Airbnb's (NASDAQ:ABNB) Q1: Beats On Revenue But Stock Drops

Online accommodations platform Airbnb (NASDAQ:ABNB) announced better-than-expected results in Q1 CY2024, with revenue up 17.8% year on year to $2.14 billion. On the other hand, next quarter's revenue guidance of $2.71 billion was less impressive, coming in 1.1% below analysts' estimates. It made a GAAP profit of $0.41 per share, improving from its profit of $0.17 per share in the same quarter last year.

Is now the time to buy Airbnb? Find out in our full research report.

Airbnb (ABNB) Q1 CY2024 Highlights:

Revenue: $2.14 billion vs analyst estimates of $2.06 billion (3.9% beat)

Adjusted EBITDA: $424 million vs analyst estimates of $326 million (large beat)

EPS: $0.41 vs analyst estimates of $0.23 ($0.18 beat)

Revenue Guidance for Q2 CY2024 is $2.71 billion at the midpoint, below analyst estimates of $2.74 billion (guidance for adjusted EBITDA margin in Q2 2024 to be down year on year compared to Q2 of 2023)

Gross Margin (GAAP): 77.6%, up from 76.5% in the same quarter last year

Free Cash Flow of $1.9 billion, up from $46 million in the previous quarter

Nights and Experiences Booked: 132.6 million, up 11.5 million year on year

Market Capitalization: $101.5 billion

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

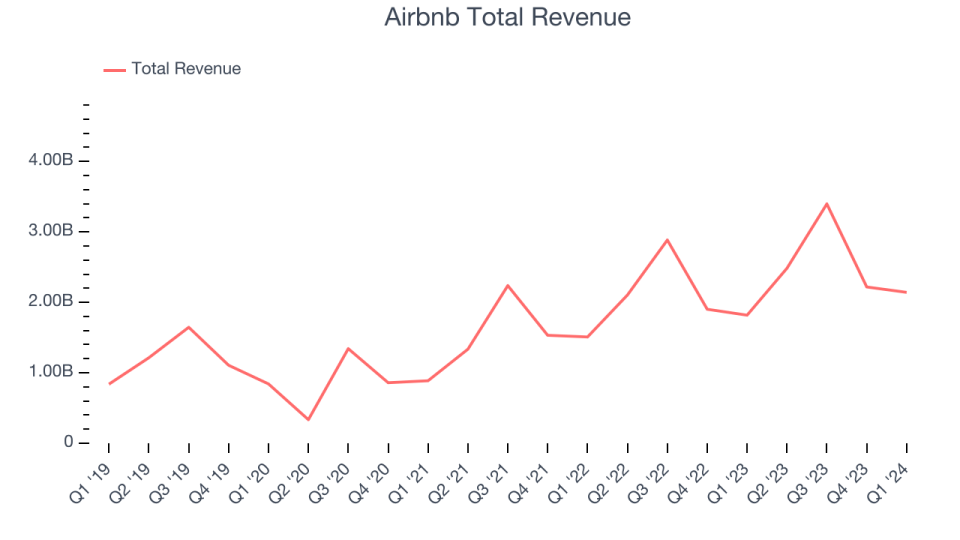

Sales Growth

Airbnb's revenue growth over the last three years has been exceptional, averaging 59.6% annually. This quarter, Airbnb beat analysts' estimates and reported 17.8% year-on-year revenue growth.

Guidance for the next quarter indicates Airbnb is expecting revenue to grow 9.1% year on year to $2.71 billion, slowing from the 18.1% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 10.8% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Usage Growth

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb's nights booked, a key performance metric for the company, grew 16.8% annually to 132.6 million. This is solid growth for a consumer internet company.

In Q1, Airbnb added 11.5 million nights booked, translating into 9.5% year-on-year growth.

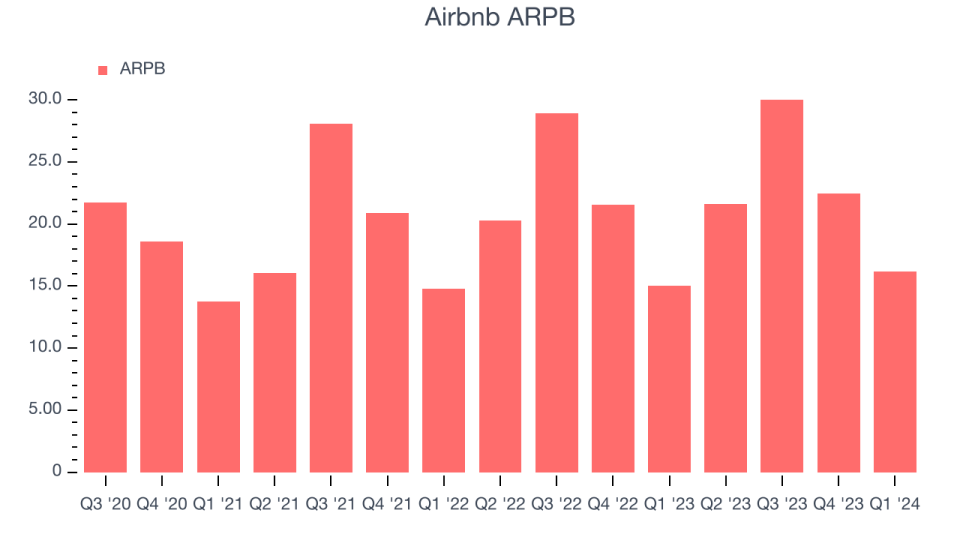

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Airbnb because it not only measures how much users book on its platform but also the commission that Airbnb can charge.

Airbnb's ARPB growth has been decent over the last two years, averaging 7%. The company's ability to increase prices while growing its nights booked demonstrates the value of its platform. This quarter, ARPB grew 7.6% year on year to $16.15 per booking.

Key Takeaways from Airbnb's Q1 Results

It was great to see Airbnb beat analysts' revenue and adjusted EBITDA expectations this quarter. We were also glad it expanded its number of bookings. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its revenue growth slowed. Overall, this was a mediocre quarter for Airbnb. The company is down 7.2% on the results and currently trades at $146.25 per share.

Airbnb may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance