Air Products to Exhibit Industrial Gas Solutions Portfolio

Air Products and Chemicals, Inc APD will display its industrial gas solutions portfolio, including the latest smart furnace atmosphere monitoring and control solutions, at Heat Treat 2019 in Detroit, MI, from Oct 15-17. The company's smart systems feature its process intelligence, IIoT (Industrial Internet of Things)-backed process optimization approach, with the application of Air Products’ expertise in gas supply, applications knowledge and safety.

Air Products will showcase its gas blend panel, which offers precise blending and control of metal processors for optimum gas mixture, at the event. It will also highlight its gas density sensor — an atmospheric measurement innovation that optimizes furnace performance by measuring gas levels. The company will also demonstrate its tank monitoring system which tracks storage tank levels remotely to allow compliance with NFPA. In addition to helping customers maintain their industrial gas supply, this system helps identify excessive gas usage, and monitor the temperature of the liquid tank and gas vaporizer.

System experts will be deployed at the Air Products booth to discuss the challenges faced by them in conducting daily operations with metal processors. The company provides industrial gas services and technical support that can help improve product quality, minimize operating costs, boost production and maximize gas usage.

Air Products will also present “Troubleshooting and Optimization of Nitrogen-Hydrogen Furnace Atmospheres for Annealing" on Oct 15. This apart, it will review years of field experience with nitrogen-hydrogen based atmosphere systems, and share case studies of the company’s innovative atmosphere monitoring and control solutions.

Air Products’ shares have declined around 6.5% in the past three months compared with the roughly 7.3% fall recorded by the industry.

The company remains focused on deploying capital in high-return industrial gas projects. It has a total available capacity to deploy (over fiscal 2018-2022) nearly $17 billion in high-return investments, aimed at creating significant shareholder value. Air Products has already spent or committed more than half of this capacity.

Air Products also remains committed to maximize returns to shareholders, leveraging strong cash flows. It generated more than $2.5 billion of distributable cash flow during the 12-month period ending third-quarter fiscal 2019. This distributable cash flow enabled it to pay roughly $1 billion or around 40% as dividends to shareholders.

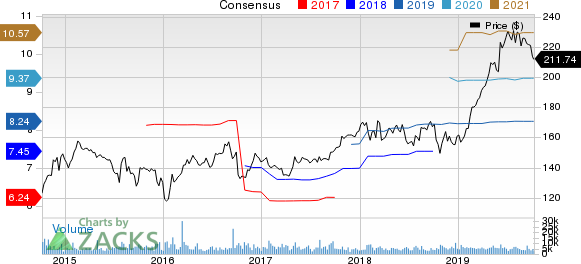

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Other Key picks

Air Products currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the basic materials space are Kinross Gold Corporation KGC, AngloGold Ashanti Limited AU and Alamos Gold Inc AGI, each sporting a Zacks Rank #1 (Strong Buy) currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an estimated earnings growth rate of 170% for the current year. The company’s shares have rallied nearly 62.2% in a year’s time.

AngloGold has a projected earnings growth rate of 154.7% for 2019. Its shares have surged around 120% over the past year.

Alamos Gold has an estimated earnings growth rate of a whopping 340% for the ongoing year. The company’s shares have rallied 17.2% in a year’s time.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance