Air Products & Chemicals Inc (APD) Reports Mixed Fiscal Q2 2024 Results, Aligns with EPS ...

GAAP EPS: Reported at $2.57, up 30% year-over-year, falling short of estimates of $2.69.

Adjusted EPS: Reported at $2.85, up 4% from the previous year, surpassing the estimated $2.69.

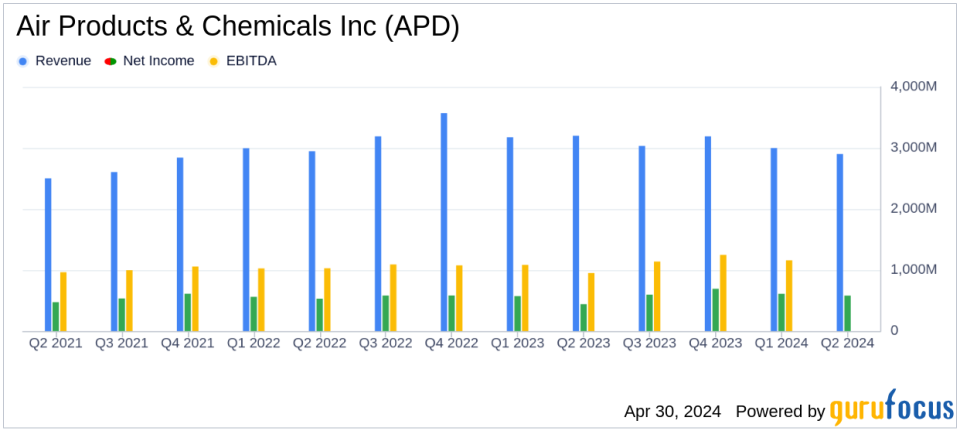

Net Income: GAAP net income reached $581 million, a 29% increase year-over-year, falling slightly below the estimated $604.94 million.

Revenue: Totalled $2.93 billion, down 8% from the previous year, falling short of estimates of $3.047 billion.

Adjusted EBITDA: Increased by 4% to $1.2 billion, with an adjusted EBITDA margin expansion of 490 basis points to 40.9%.

Dividend Increase: Quarterly dividend raised to $1.77 per share, marking the 42nd consecutive year of dividend increases.

Full-Year Guidance: Maintains adjusted EPS guidance for fiscal 2024 in the range of $12.20 to $12.50, reflecting a 6-9% increase over the previous year.

Air Products & Chemicals Inc (NYSE:APD) released its 8-K filing on April 30, 2024, detailing its financial performance for the second quarter of fiscal year 2024. The company reported a GAAP EPS of $2.57, marking a significant 30% increase from the previous year, and an adjusted EPS of $2.85, which aligns closely with analyst expectations of $2.69 for the quarter. Despite a challenging economic landscape, APD maintained its full-year adjusted EPS guidance of $12.20 to $12.50.

Founded in 1940, Air Products has grown to become a leading supplier of industrial gases globally, operating in 50 countries and employing 19,000 people. The company is recognized for its extensive portfolio serving various industries and its leadership in hydrogen and helium supply. In fiscal 2023, Air Products generated $12.6 billion in revenue.

Financial Performance Overview

For Q2 FY24, Air Products reported net income of $581 million, a 29% increase year-over-year, with net income margins expanding by 570 basis points to 19.8%. This improvement was primarily driven by lower business and asset action charges, favorable pricing, and reduced other costs, though partially offset by lower volumes and higher interest expenses. The company's sales for the quarter stood at $2.9 billion, a decrease of 8% from the previous year, influenced by lower energy cost pass-through and unfavorable currency impacts.

Segment Performance and Challenges

The Americas segment saw a 9% decrease in sales, primarily due to lower energy cost pass-through and unfavorable currency impacts, partially mitigated by higher pricing and volumes. In contrast, the Asia segment experienced a 4% decrease in sales due to unfavorable currency and lower volumes. Europe's sales decreased by 11%, impacted by lower volumes and energy cost pass-through, alongside a slight decrease in pricing.

Despite these challenges, the company's adjusted EBITDA of $1.2 billion increased by 4% compared to the prior year, with an adjusted EBITDA margin of 40.9%, reflecting a 490 basis point improvement. This performance underscores APD's effective cost management and pricing strategies amid fluctuating market conditions.

Strategic Initiatives and Outlook

APD's Chairman, President, and CEO, Seifi Ghasemi, highlighted the company's focus on pricing and cost reduction, which has supported its performance despite economic and geopolitical challenges. The company continues to lead in safety and adjusted EBITDA margin, demonstrating robust operational execution and strategic focus on shareholder value through its portfolio of low- and zero-carbon hydrogen projects.

Looking ahead, Air Products reaffirms its commitment to significant capital expenditures, projecting $5.0 billion to $5.5 billion for FY24, aimed at bolstering its position in sustainable and clean energy solutions.

In conclusion, Air Products & Chemicals Inc's fiscal Q2 2024 results reflect a resilient business model capable of navigating economic uncertainties while aligning closely with market expectations for EPS. The company's maintained guidance and strategic focus on sustainable growth initiatives position it well for continued success in the industrial gases sector.

Explore the complete 8-K earnings release (here) from Air Products & Chemicals Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance