Air Products (APD) to Display Technologies at ADIPEC in UAE

Air Products and Chemicals, Inc. APD recently announced that along with Air Products Qudra it will display their world-leading technologies and global capabilities at ADIPEC— the world's largest oil, gas and energy event. The exhibition will take place from Nov 15-18 at the Abu Dhabi National Exhibition Centre, United Arab Emirates.

Industry specialists from Air Products and Air Products Qudra will share the latest innovation, technology and projects and offerings in hydrogen, carbon capture, liquefied natural gas heat exchanger technology as well asRotoflow turbomachinery equipment at the event.

Air Products stated that it intends to bring people together to collaborate and innovate solutions to the world's most significant energy and environmental sustainability challenges. Its technologies and solutions enable its customers globally to attain their sustainability goals. The company is proud to showcase these at ADIPEC along with mega projects such as the NEOM Green Hydrogen project, which are likely to help make the world's dream of carbon-free hydrogen a reality.

In 2021, Air Products Qudra is also a sponsor at the Middle East Energy Club. Its mission is to bring world-class technology, onsite solutions and leading project execution and operational leadership for large-scale energy environmental projects throughout the Middle East.

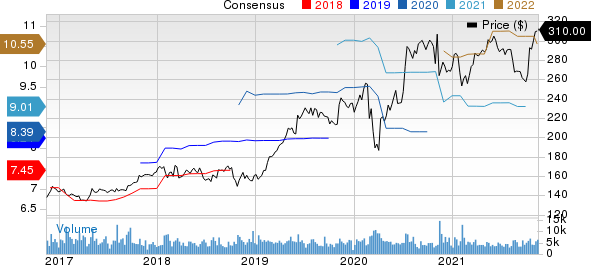

Shares of Air Products have gained 16.3% in the past year against a 25.1% rally of the industry.

Image Source: Zacks Investment Research

Air Products, in its last earnings call, expects adjusted earnings per share (EPS) of $10.20-$10.40 for fiscal 2022, up 13-15% from prior year’s adjusted earnings per share. For the first quarter of fiscal 2022, it sees adjusted EPS of $2.45-$2.55, up 16-20% year over year. The company also expects capital expenditures of $4.5-$5 billion for fiscal 2022.

Air Products and Chemicals Price and Consensus

Air Products and Chemicals price-consensus-chart | Air Products and Chemicals Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Dow Inc. DOW.

Nucor has an expected earnings growth rate of 583.5% for the current year. The Zacks Consensus Estimate for earnings for the current year has been revised 18.1% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. Its shares have also rallied around 106.7% over a year. NUE currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. CC has a trailing four-quarter earnings surprise of roughly 34.2%, on average. Its shares have also rallied around 43.3% over a year. It currently carries a Zacks Rank #2 (Buy).

Dow has a projected earnings growth rate of 447% for the current year. The consensus estimate for the current year has been revised 7.2% upward in the past 60 days.

Dow beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 14.1%. The company’s shares have gained around 11.3% in a year. DOW currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance