Air Products (APD) to Build Nitrogen Infrastructure in Penang

Air Products and Chemicals, Inc. APD has announced that it will construct and operate two nitrogen plants in the Bayan Lepas Free Industrial Zone and Batu Kawan Industrial Park in Penang, Malaysia. The company has been a prominent provider of industrial gases globally and has been serving Malaysia for almost five decades. Additionally, the company intends to expand its pipeline network in these regions. This investment in increased capacity and infrastructure will reinforce Air Products' strong position in Northern Malaysia and its ability to fulfill the demands of the market.

The company has established two cutting-edge air separation units in Prai Industrial Area, which has enabled it to maintain a strong presence in Northern Malaysia. Its comprehensive pipeline network is present across several key industrial areas, including Bukit Minyak Industrial Area, Penang Science Park, Batu Kawan Industrial Park and Valdor Industrial Area. In response to increasing customer demand, the company will construct a new nitrogen plant at its greenfield site in the Batu Kawan Industrial Park, where it will be integrated into its existing pipeline infrastructure.

To meet the rising demand from the electrical, electronics and other manufacturing sectors, the company will construct a new nitrogen plant in the Bayan Lepas Free Industrial Zone. This will be in addition to the nitrogen plant that Air Products brought online in the zone in 2021.

The company provides a more cost-effective solution for customers, particularly those with high-volume requirements, by transforming hauled-in liquefied nitrogen into gaseous nitrogen supply through pipelines. This conversion not only enhances sustainability but also enables customers to lessen their carbon emissions.

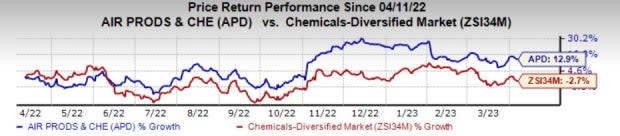

Shares of Air Products have gained 12.9% over a year against a 2.7% fall recorded by its industry.

Image Source: Zacks Investment Research

Air Products, on its first-quarter call, said that it expects its adjusted earnings to be in the range of $11.20-$11.50 per share for fiscal 2023. The company sees its adjusted earnings for the fiscal second quarter to be between $2.50 and $2.70. For fiscal 2023, the company expects its capital expenditures to be in the range of $5-$5.5 billion.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Olympic Steel, Inc. ZEUS, Steel Dynamics, Inc. STLD and Linde plc LIN. ZEUS and STLD sport a Zacks Rank #1(Strong Buy), while LIN carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s shares have gained 30.3% in the past year. The Zacks Consensus Estimate for ZEUS’ current-year earnings has been revised 33.1% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

Steel Dynamic’s shares have gained 23.7% in the past year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 33% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 11.3% on average.

Linde’s shares have gained 12.4% in the past year. The company has an expected earnings growth rate of 8.1% for the current year. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

LIN topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 6% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance