Air Canada Stock (TSX:AC): Should You Boycott it After the Bonus Scandal?

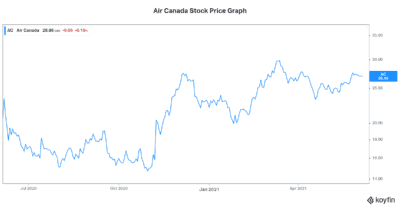

Air Canada (TSX:AC) has been quickly becoming one of the best post-pandemic buys. The airliner has suffered tremendously since the pandemic hit. But after many quarters of major losses and burning through obscene amounts of cash, there is hope in the air: hope of a sustained recovery for Air Canada’s stock price and for a return to normal.

This is why the news that came out last week was so disheartening. Air Canada executives pocketed millions of dollars in bonuses and received bailout money from the government. It’s a sad state of affairs. Should we boycott Air Canada stock in response?

Air Canada stock: The best post-pandemic stock to buy?

Air Canada stock has already rallied big in 2021. In fact, it’s up almost 20% this year. Furthermore, it’s up 125% from its 2020 lows. So, what does this mean? What does this say about Air Canada stock’s future?

As one of the hardest-hit stocks since the pandemic started, Air Canada stock is presumably one of the best stocks to buy for a post-pandemic recovery. In fact, I really do think that it is one of the best comeback stocks of the year.

The tone on Air Canada’s Q1 conference call was better than it has been since the pandemic hit. Management seems optimistic that vaccines will start to make a difference — and soon. In fact, hopes for the return of domestic travel this summer are high. As the macro environment improves, Air Canada will ride the boom every step of the way. As COVID-19 fears subside, travel will return, as consumers spend their big savings balances.

Bonus payments at Air Canada: A sign of bad corporate governance?

Moral responsibility is simply the responsibility to do the right thing. Today, investors as a whole are increasingly holding companies accountable. We want them to do the right thing.

Air Canada paying out millions of dollars in executive bonuses while asking the government for financial aid is clearly wrong. Doing so while laying off a big portion of staff is also a questionable practice. While these executives have “volunteered” to pay the money back, the question still lingers: is this just a reaction to being called out on the bonus payments? What else would they do that clearly puts their self-interest above all else?

It’s a complex question and there are no easy answers. All I know is that this doesn’t leave a good taste in my mouth. It makes me wonder if Air Canada’s motivations are as aligned with its shareholders’ as they should be.

Motley Fool: The bottom line

Air Canada stock continues to ride the wave of post-pandemic bliss. As lockdowns end and economies open up, people will begin to travel again. While the travel levels may not reach pre-pandemic levels, there’s a lot of room for Air Canada’s stock price to go higher yet. My conclusion regarding the company’s bonus payments is that I give them credit for doing the right thing in the end. It does not interfere with the recovery that is underway. But it does remind us that we have to monitor companies in order to ensure they are acting in line with shareholders’ interests.

The post Air Canada Stock (TSX:AC): Should You Boycott it After the Bonus Scandal? appeared first on The Motley Fool Canada.

Speaking of top post-pandemic stocks...

Should you invest $1,000 in Air Canada right now?

Before you consider Air Canada, you may want to hear this.

Motley Fool Canadian Chief Investment Advisor, Iain Butler, and his Stock Advisor Canada team just revealed what they believe are the 10 best stocks for investors to buy right now... and Air Canada wasn't one of them.

The online investing service they've run since 2013, Motley Fool Stock Advisor Canada, has beaten the stock market by over 3X. And right now, they think there are 10 stocks that are better buys.

More reading

Fool contributor Karen Thomas has no position in any of the companies mentioned.

2021

Yahoo Finance

Yahoo Finance