AI-Driven Growth, Strategic Investments Propel Meta Platforms' Potential

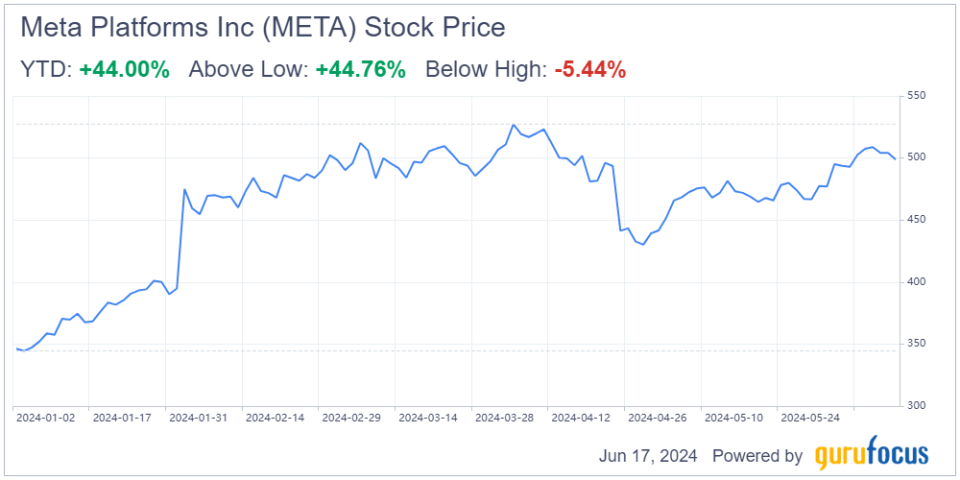

Meta Platforms Inc. (NASDAQ:META) has experienced a significant surge so far this year, pushing the stock to nearly a 40% premium over its previous peak set in 2021, primarily due to its comeback in the social media advertising space after Apple's (NASDAQ:AAPL) App Tracking Transparency update, which had severely impacted its targeting capabilities.

Figure 1: Meta Platforms' shares up 44% year to date

Despite this recovery, the first-quarter earnings season has generally been disappointing, and investors have found few reasons to chase market highs, resulting in Meta's stock plummeting by over 13% post-earnings report. The social media giant's decision to increase its capital expenditure outlook for the year without a corresponding uptick in growth led to investor skepticism about the efficiency of its spending. Meta's operational expenses are now projected to be between $96 billion and $99 billion, a $2 billion increase at the low end of the previous range of $94 billion to $99 billion. This new range represents a 9% year-over-year increase in operating expenses compared to $88.20 billion in 2023.

Regardless of these challenges, I believe Meta's updated fundamentals and its position as a leader in adopting artificial intelligence transformation support a positive long-term growth and margin expansion trajectory. This outlook underpins its valuation prospects and maintains a robust outlook for the company, even with the unexpected capital expenditure increase. Although Meta's earnings dropped by double digits, the stock is still up more than 40% year to date. This recent dip presents a substantial opportunity for investors to buy into the Meta rally if they have not already.

Advertising business recovery fueled by AI investments

Much of Meta's $70 billion capital expenditure over the past two years, in addition to its research and development efforts, has been directed toward the development and deployment of AI technologies. These investments have paid off significantly. The recovery Meta experienced following Apple's ATT update in 2022 can be largely attributed to its AI initiatives, which helped restore its targeting capabilities and sustain its advertising business. As one of the tech giants with a market cap exceeding $1 trillion, Meta continues to grow its revenue at an impressive rate of over 20% annually. As a growth stock, it is logical for Meta to continue channeling resources into further growth initiatives.

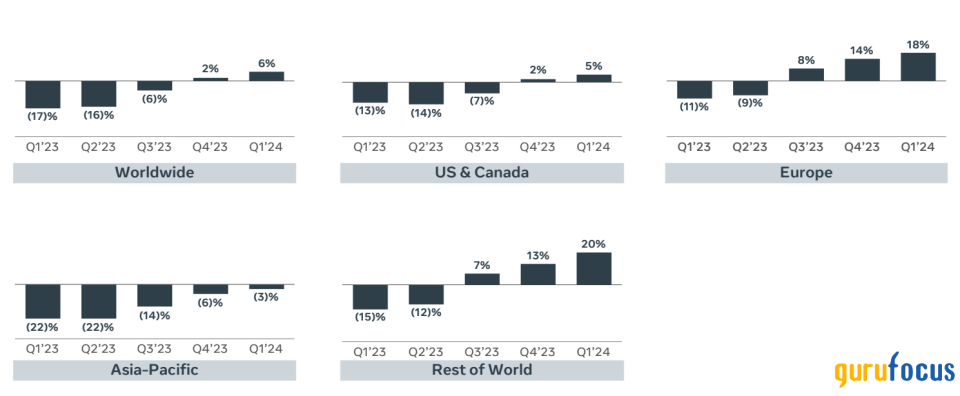

Recent industry data highlights the impact of Meta's AI investments. More than half of the content viewed by Instagram users is now recommended by AI algorithms. A survey revealed that 53% of Facebook and Instagram users spent more time on these apps compared to last year, whereas TikTok reported a 25% increase in user engagement over the same period. This underscores the effectiveness of Meta's AI in enhancing user engagement. Additionally, the company has consistently improved return on ad spend (ROAS) for advertisers through AI-enabled tools. The number of ad impressions served increased by 20% year over year and the average price per ad rose by 6%, reversing previous downward trends.

Figure 2: Ad impressions growth year over year

Source: Meta Investor Relations

Figure 3: Average price per ad growth year over year

Source: Meta Investor Relations

Looking forward, Meta's ongoing commitment to AI developments is expected to bolster its strategy for monetizing its extensive user and merchant base. The company is also advancing its next-generation Meta Training and Inference Accelerator (MTIA), following in the footsteps of other tech giants who are enhancing their in-house silicon capabilities to reduce dependency on third-party hardware essential for AI advancements. This development complements Meta's AI investment cycle, which includes acquiring up to 350,000 Nvidia (NASDAQ:NVDA) H100 GPUs. Continued vertical integration and diversified hardware reliance are anticipated to support the long-term success of its AI strategy and drive margin expansion at scale.

Competitive advantage

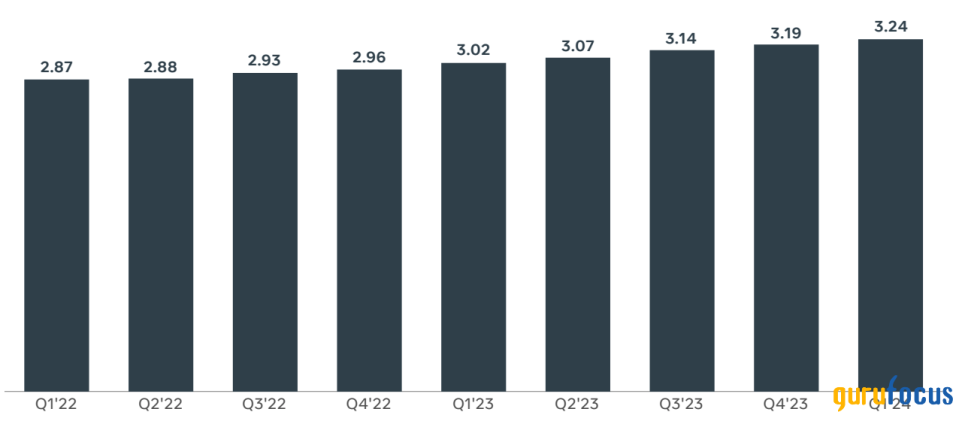

Meta continues to see an increase in daily active users across its platforms, including WhatsApp, Facebook, Messenger and Instagram. With 3.24 billion daily users, the social media giant boasts one of the strongest network effects in the industry. The company has not only rebounded in user activity, but has also achieved robust growth. From first-quarter 2022 to first-quarter 2023, Meta's monthly active users grew by 15 million. From the first quarter of 2023 to the first quarter of 2024, this number increased by 22 million, marking almost a 50% rise in growth. This is particularly impressive considering the company already engages 40% of the global population as monthly active users, underscoring how integral its platforms are to daily life.

Figure 4: Meta daily active people

Source: Meta Investor Relations

No competitor has been able to challenge Meta's dominance effectively. While companies like Microsoft (NASDAQ:MSFT) could develop their own social networks, the established user base of Facebook and Instagram creates a substantial barrier to entry. Google might integrate AI features into Bing and Apple might impose privacy settings to hinder Meta, but its investment in AI has allowed it to overcome these obstacles and continue to deliver personalized advertising. Even TikTok, Meta's closest competitor, faces significant operational challenges in the West with potential bans looming.

Diversification potential

Meta also has significant potential for diversification beyond its traditional revenue streams, particularly in the augmented reality and virtual reality markets. These efforts are encapsulated in the Reality Labs segment, which, despite being loss-making, represents a long-term investment.

In the most recent quarter, Reality Labs reported $3.8 billion in losses, a slight improvement year over year. Mark Zuckerberg has acknowledged the business will not be profitable until 2030, so immediate substantial cash flows are not expected. The Metaverse project, still in its early stages, requires years for consumer habits to adapt. Despite its current unprofitability, Meta holds a significant share of the AR and VR market. Few other companies are willing or able to invest as heavily in this space. Even Apple's entry with the Vision Pro has not made the expected impact, leaving Meta as a dominant player in the long-term development of these technologies.

Financial performance and outlook

Meta has consistently demonstrated robust revenue growth, except in 2022 when its advertising business faced challenges due to Apple's ATT. The resurgence of Chinese e-commerce companies like Temu and Shein, which have heavily invested in Meta's ad solutions, has significantly boosted ad revenue over the past several quarters. The company's free cash flow margin currently stands at 35%, with the potential to exceed 40% if the capital expenditure is reduced in the coming years.

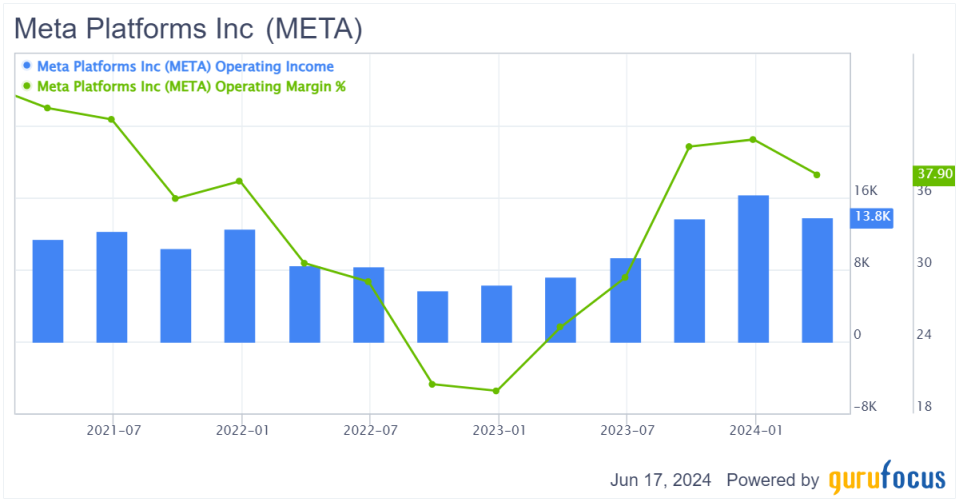

Figure 5: Meta's financials recovery following slump in 2022

Source: Meta Investor Relations

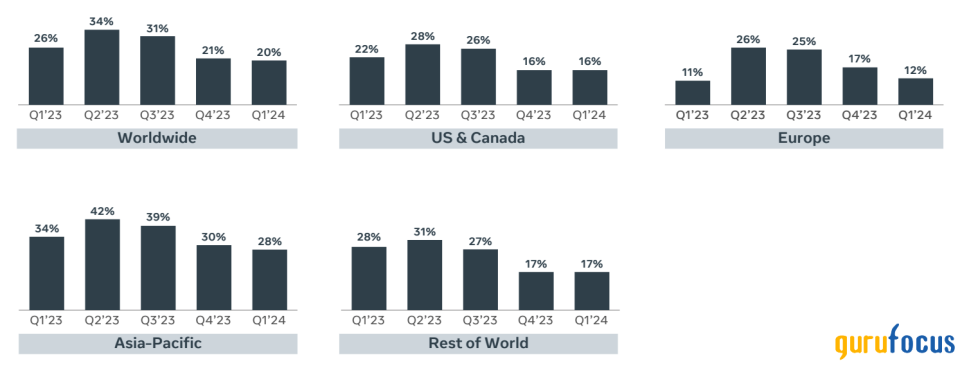

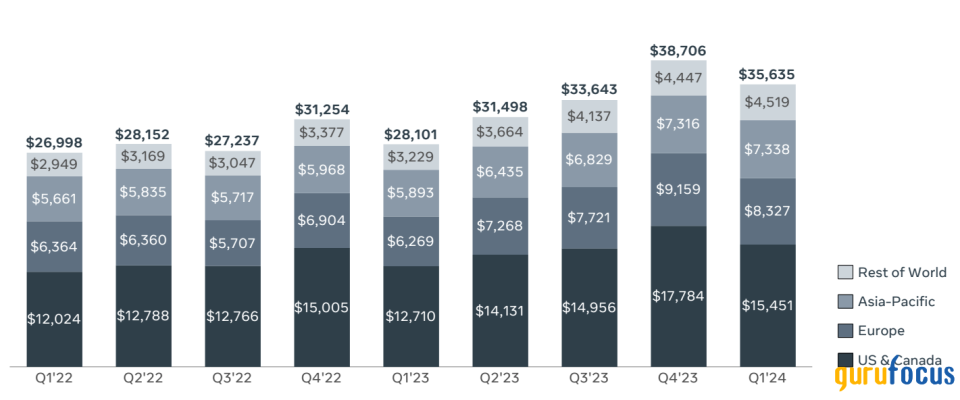

Meta's core social media business continues to perform well, particularly outside its primary markets, with revenue reaching $36.50 billion, up nearly 20% year over year. Notably, there was an almost 50% increase in revenue from the "Rest of World" segment. For 2024, I anticipate 16% year-over-year revenue growth to $156.60 billion, driven by sustained demand for advertising across the Family of Apps and the expansion of business messaging opportunities. Advertising will remain central to Meta's business as online ad demand grows and Facebook maintains its significant market share.

Figure 6: Meta ad revenue by geography

Source: Meta Investor Relations

Despite increased spending, Meta has significantly improved its operating margins. In the first quarter, the company reported $13.80 billion in operating profit, nearly doubling year over year, with operating margin rising from 25% in the prior year to 38% in the most recent quarter. However, the overall operating margin fell quarter over quarter, impacted by widening losses in the Reality Labs segment and a decline in the Family of Apps segment's operating margin, which constitutes 98.90% of total revenue. The decrease in operating margin is attributed to substantial investments in AI infrastructure.

For 2024, I expect profit margins to remain relatively flat compared to 2023, as margin expansion driven by strong ad demand will likely be offset by increased losses in Reality Labs and additional short-term investments in the AI roadmap.

Figure 7: Meta's operating margin

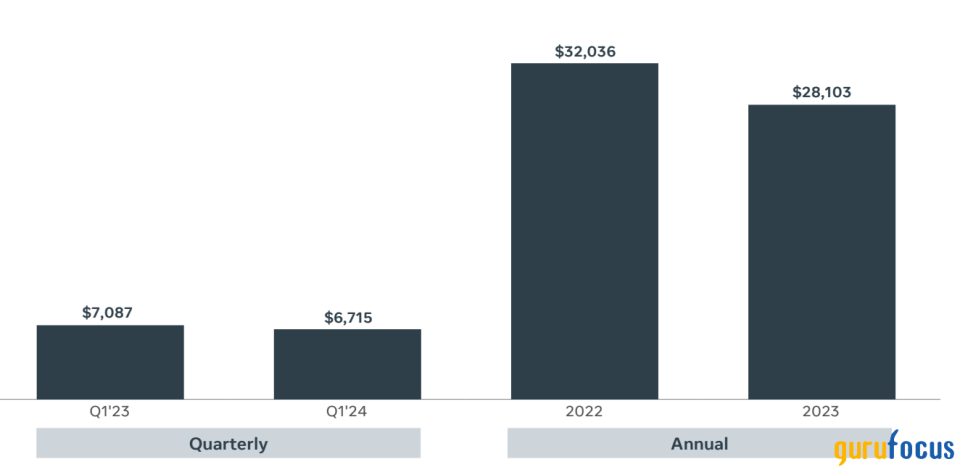

Meta's cash flow remains robust despite continued losses from Reality Labs. The company's annualized free cash flow has surpassed $50 billion, an impressive figure for a company with a market capitalization of nearly $1.20 trillion, equating to an almost 5% FCF yield. This is despite significant capital investments, which amounted to nearly $30 billion in 2023. Meta now projects capital expenditures of $35 billion to $40 billion, up from an earlier estimate of $30 billion to $37 billion. This is considerably higher than the average capex over the previous two years.

In the long term, I anticipate a reduction in these capital expenditures as the majority of these investments are one-time expenses aimed at building out AI infrastructure. Consequently, Meta's ability to generate cash flows is expected to strengthen significantly once these investments are completed.

Figure 8: Meta's capex

Source: Meta Investor Relations

Meta's financial performance underscores its resilience and growth potential, driven by strategic investments in AI and robust revenue growth from its core social media platforms. While current expenditures are high, they are largely one-off investments that will position Meta for stronger cash flow generation and sustained profitability in the long term. Despite some short-term margin pressures, the company's long-term outlook remains positive, making it a compelling investment opportunity.

Valuation perspective: Assessing Meta's growth potential

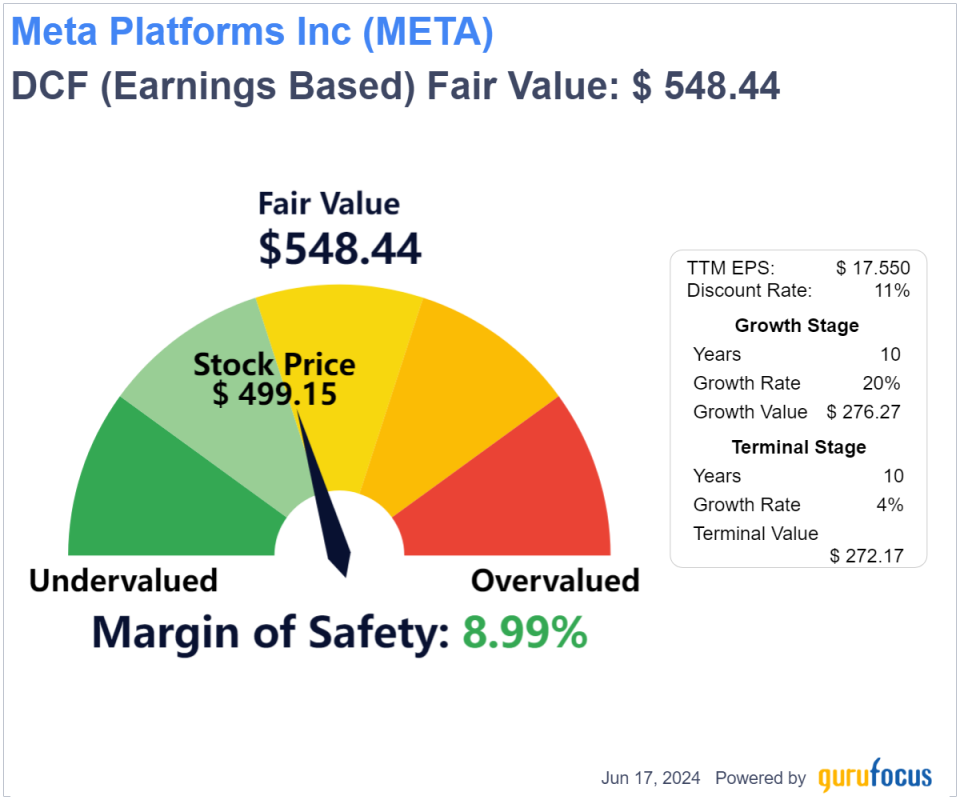

I remain confident that Meta is well-positioned for an upside scenario, supported by its leadership in social media advertising and the 6% increase in average price per ad during the first quarter, despite the seasonal slowdown. Additionally, given its significant advancements with large language models, I believe Meta has a promising future in the AI market. The market seems to agree with this outlook, even after the post-earnings drop. Although current metrics suggest the market already values the stock at a premium for its robust business model, I believe the shares are still undervalued. Trading at about 8 times estimated sales and 24 times estimated earnings, Meta's valuation is lower than its mega-cap rivals by wide margins, yet remains consistent with its peers relative to their growth profiles.

Figure 9: DCF Calculation

Considering upside scenario cash flows while maintaining base case valuation assumptionsan 11.10% weighted average cost of capital and an expected earnings per share growth rate of 18.41% (achievable given that the expected 10-year earing per share without NRI growth rate is less than the historical 10-year earnings growth rate of 35.70%)I calculate Meta's margin of safety or upside potential at around 9%, with an intrinsic value of approximately $548.44 per share. This would take the stock to new record levels, which seems likely by year-end considering the upcoming cyclical tailwinds. Additionally, this model does not account for Meta's significant share buyback program. The company is spending tens of billions on share repurchases, which will positively impact the fair value per share. The company has a $50 billion authorized buyback program, enough to cover almost 5% of outstanding shares, potentially completing it in just one and a half years.

Conclusion

Meta Platforms is well-positioned for substantial growth, supported by its leadership in social media advertising and strategic investments in AI. Despite some short-term challenges and increased expenditures, the company's long-term outlook remains positive. With robust revenue growth, strong cash flow generation and a significant share buyback program, Meta presents a compelling investment opportunity. The potential upside, driven by AI advancements and cyclical tailwinds, reinforces the company's promising future.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance