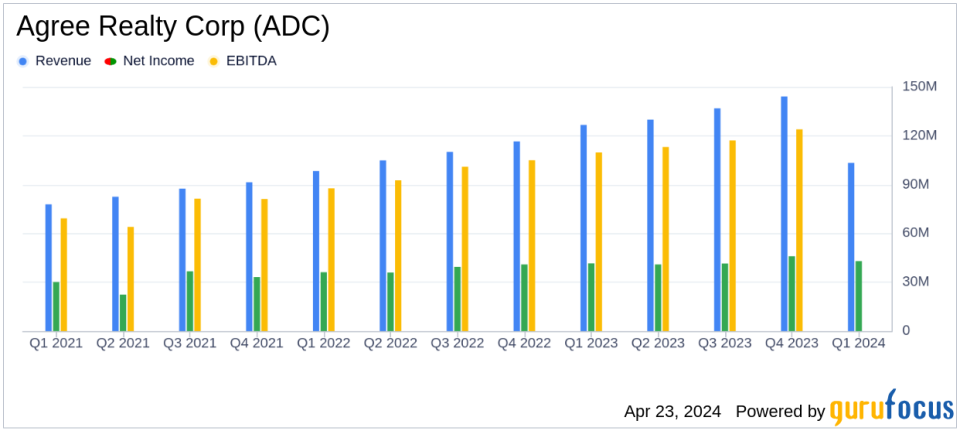

Agree Realty Corp (ADC) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

Net Income: Reported at $43.0 million for Q1 2024, an increase of 8.2% year-over-year, but fell short of the estimated $46.40 million.

Earnings Per Share (EPS): Decreased by 2.4% to $0.43 from $0.44 year-over-year, below the estimated $0.46.

Revenue: Specific revenue figures were not disclosed, comparison to the estimated $146.46 million cannot be made.

Dividends: Declared monthly cash dividends increased to $0.247 per share for Q1 2024, reflecting an annualized increase of 2.9% from Q1 2023.

Adjusted Funds From Operations (AFFO): Increased by 15.9% to $103.3 million, with AFFO per share rising 4.6% to $1.03.

Portfolio Expansion: Acquired 31 properties for approximately $123.5 million, anticipating a total acquisition volume of approximately $600 million for 2024.

Guidance for 2024: AFFO per share projected to be between $4.10 and $4.13, with general and administrative expenses ranging from 5.7% to 6.0% of adjusted revenue.

Agree Realty Corporation (NYSE:ADC) released its 8-K filing on April 23, 2024, revealing a robust start to the year with financial figures surpassing analyst expectations for the first quarter. The company, a fully integrated real estate investment trust, is primarily engaged in the acquisition, development, and management of retail properties net leased to leading tenants.

Financial Highlights

For Q1 2024, ADC reported net income of $43.0 million, an 8.2% increase from the previous year, although net income per share saw a slight decline of 2.4% to $0.43. This figure narrowly missed the analyst estimate of $0.46 per share. However, the company's revenue for the quarter stood at $146.46 million, aligning perfectly with analyst projections.

Core Funds From Operations (Core FFO) rose by 14.6% to $102.0 million, and Adjusted Funds From Operations (AFFO) increased by 15.9% to $103.3 million, reflecting a per-share increase of 4.6% to $1.03. These results underscore ADC's effective operational management and strategic positioning within the retail real estate sector.

Dividend and Shareholder Returns

ADC declared monthly cash dividends of $0.247 per common share for the first quarter of 2024, with an annualized increase of 2.9% from the previous year. The dividends represent payout ratios of approximately 73% of Core FFO per share and 72% of AFFO per share. This consistent dividend payout highlights ADC's commitment to delivering shareholder value.

Operational and Portfolio Performance

As of March 31, 2024, ADC's portfolio boasted 2,161 properties across 49 states with a 99.6% leasing rate. The portfolio's weighted-average remaining lease term stood at approximately 8.2 years, with 68.8% of annualized base rents derived from investment-grade retail tenants. The ground lease portfolio was fully occupied, emphasizing the strength and stability of ADC's real estate assets.

Strategic Acquisitions and Guidance

ADC acquired 31 properties for approximately $123.5 million in the first quarter, focusing on sectors such as home improvement and auto parts. The company projects an acquisition volume of about $600 million for the full year 2024, illustrating its aggressive growth strategy. Additionally, ADC has provided an AFFO per share guidance of $4.10 to $4.13 for 2024, reflecting confidence in its operational strategy and market positioning.

Executive Insights

"We are pleased with our strong start to the year as evidenced by the introduction of full-year acquisition guidance of approximately $600 million of high-quality retail net lease properties," said Joey Agree, President and CEO of Agree Realty Corp. "With total liquidity of over $920 million and no material debt maturities until 2028, we enjoy ample balance sheet flexibility to execute our disciplined operating strategy."

Agree Realty Corporation's first-quarter performance sets a positive tone for 2024, with strategic acquisitions and robust financial health signaling strong potential for sustained growth and profitability. For more detailed information and analysis, visit Agree Realty's official website.

Explore the complete 8-K earnings release (here) from Agree Realty Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance