Affirm (AFRM) Chosen to Bring Flexible Hotel Booking Payments

Affirm Holdings, Inc. AFRM recently joined forces with the hospitality management company, Brittain Resorts & Hotels, to enable approved guests to book stays at more than 15 hotels and resorts and make payments over time.

By choosing to pay through Affirm’s flexible payment solutions at checkout, approved guests can divide the total cost of any purchase exceeding $150 into monthly payments for a period of up to 18 months. Customers will be aware of their total purchase cost and will not have to pay anything more than the agreed amount. Affirm does not charge any late or hidden fees, including compounding or deferred interest.

The latest partnership is likely to expand the retail partner network of the company, constant additions to which imply increased utilization of AFRM’s financing solutions. This, in turn, may fetch higher fees to Affirm from merchants in return for increased sales generated through the usage of its financing products.

The direct application programming interface enables developers to seamlessly integrate Affirm into payment and product pages for merchants.

Affirm boasts 292,000 retail partners, with the latest addition being Brittain Resorts & Hotels. Other major names include Amazon AMZN, Casper, Newegg, SeatGeek, Royal Caribbean, Priceline and American Airlines AAL. Moreover, partnerships similar to the latest one also deliver certain benefits, such as higher sales, improved average order value and new customer gains for the retail partners, in addition to being of significant use to Affirm.

The management of Brittain Resorts & Hotels has found that the spend per guest remains higher with the usage of AFRM’s solutions. This makes the company optimistic about extending this option to its call center in the next few months.

Additionally, the facility to make installment payments infuses greater peace of mind as it alleviates the strain on the finances of a consumer, thereby paving the way for the widespread adoption of AFRM’s financing product suite. Affirm witnessed a 35% rise in travel and ticketing on a year-over-year basis in third-quarter fiscal 2024, further substantiating its prudence in partnering with a hospitality management company.

Affirm continues to undertake partnerships to capitalize on the increasing travel trend worldwide. A few days before the recent partnership, it expanded ties with Alterra Mountain Company to provide flexible and transparent payment options to customers looking to book Ikon and mountain passes, lessons and lodging at Alterra’s destinations. In May 2024, the company teamed up with a Canadian travel agency, FlightHub, to offer flexible and transparent payment options to eligible consumers for travel bookings.

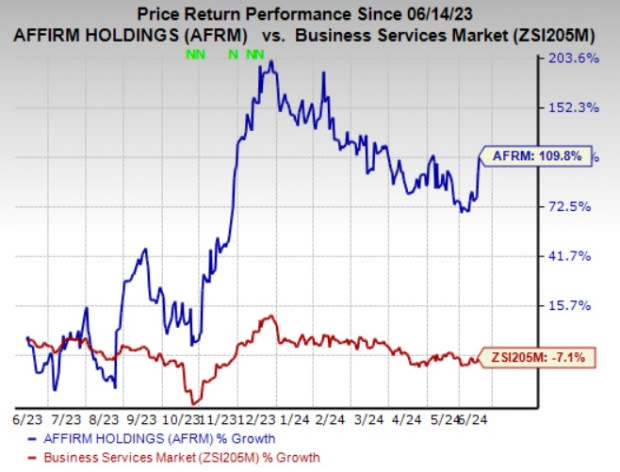

Shares of Affirm have surged 109.8% in the past year against the industry’s 7.1% decline. AFRM currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Another Stock to Consider

Another top-ranked stock in the Business Services space is The Western Union Company WU, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Western Union outpaced estimates in each of the last four quarters, the average surprise being 15.66%. The Zacks Consensus Estimate for WU’s 2024 earnings indicates an improvement of 1.2% from the year-ago reported figure. The consensus estimate for WU's earnings has moved 4.8% north in the past 60 days. Its shares have gained 7.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance