AECOM (ACM) Secures US Army Environmental Command Contract

AECOM ACM has won a five-year, multiple-award contract from the U.S. Army Environmental Command.

Per the contract, ACM will provide environmental remediation services, including investigation and remediation services for hazardous and toxic waste, including persistent compounds, such as per- and polyfluoroalkyl substances (PFAS).

The work will take place at different locations across the contiguous United States, Puerto Rico, Hawaii and Alaska.

AECOM has more than two decades of PFAS experience at over 600 sites globally. It holds some important environmental remediation contracts from various U.S. government clients, which include the U.S. Army, Navy, FEMA and NASA.

Backlog Growth Signals Positive Outlook

AECOM has been witnessing robust prospects in each of its segments. Currently, it has a good visibility of a strong backlog and pipelines for the upcoming quarters. Owing to the improving global scenario, which is fostering infrastructural demand around the globe, there has been an increase in demand for ACM’s services. This improving trend is reflected in the company’s backlog levels.

As of the fiscal second-quarter end, the total backlog was $23.74 billion compared with $22.98 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth. The design business backlog grew 6.3% to $22.29 billion. The metric was driven by a near-record win rate and continued strong end-market trends.

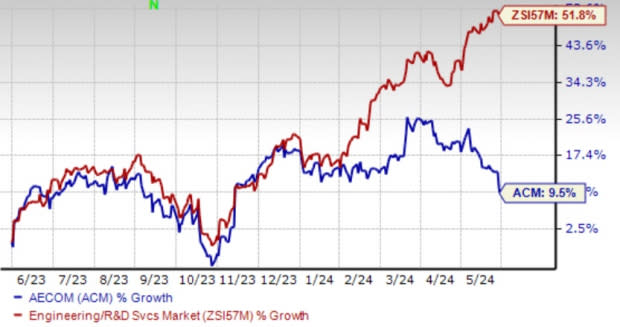

Image Source: Zacks Investment Research

Shares of AECOM have gained 9.5% in the past year compared with the Zacks Engineering - R and D Services industry’s growth of 51.8%. Although shares of the company have underperformed the industry in the past year, the ongoing contract wins are likely to boost its prospects in the forthcoming quarters. Also, increasing infrastructural spending trends across the world is encouraging for ACM.

Zacks Rank & Key Picks

ACM currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space are:

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 10.6% and 29.9%, respectively, from the prior-year levels.

Sterling Infrastructure, Inc. STRL presently carries a Zacks Rank #2. Sterling Infrastructure has a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 14.8%, respectively, from the prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance