Adobe (ADBE) Boosts Generative AI Solutions With Content Hub

Adobe ADBE is benefiting from strong positioning in the generative AI space, driven by its family of creative, generative AI models, Firefly. The company’s expanding generative AI-backed solutions portfolio is expected to drive its customer momentum in this fast-paced world.

ADBE recently made Adobe Content Hub with Adobe Experience Manager (“AEM”) Assets generally available. This will enable various brands to manage several creative assets seamlessly with the power of generative AI-backed Content Hub.

Integration with AEM offers a new destination wherein extended teams can easily find, edit and distribute brand-approved assets. Users can remix assets directly in the flow of work be leveraging Adobe Express with Firefly. They can also boost the production of fresh content for channels, including websites, mobile and social media on the back of Adobe Express.

Companies can execute end-to-end business processes easily, and deliver content required for marketing campaigns and personalized customer experience with the help of Content Hub.

Move to Benefit

The latest move is expected to aid Adobe in gaining solid traction among various companies and marketers.

It has added strength to Adobe Experience Cloud offerings, which will likely contribute well to the Digital Experience segment’s performance in the near term.

In second-quarter fiscal 2024, the Digital Experience segment generated revenues of $1.33 billion, which improved 9% on a year-over-year basis.

For third-quarter fiscal 2024, Adobe expects Digital Experience revenues between $1.325 billion and $1.345 billion.

The strengthening of the Digital Experience segment will, in turn, aid Adobe’s overall financial performance.

The company projects total revenues between $5.33 billion and $5.38 billion for third-quarter fiscal 2024. The Zacks Consensus Estimate for the same is pegged at $5.37 billion, indicating year-over-year growth of 9.8%.

Adobe expects non-GAAP earnings per share between $4.50 and $4.55. The consensus mark for the same is pegged at $4.52, suggesting year-over-year growth of 10.5%. The EPS estimate has been revised upward by 1.3% in the past 30 days.

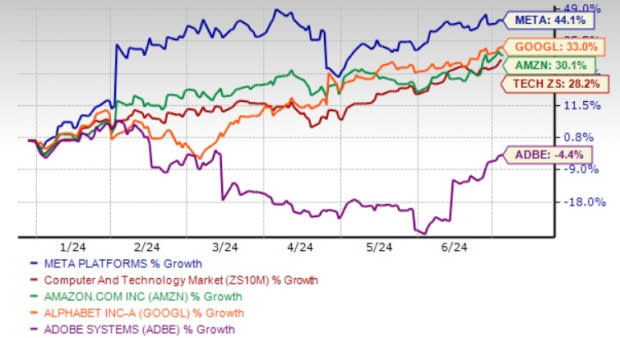

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Strong Generative AI Solutions Aid Prospects

Per a Grand View Research report, the generative AI market size is expected to witness a CAGR of 36.5% between 2024 and 2030.

The Zacks Rank #3 (Hold) company is well-poised to capitalize on this growth prospect on the back of its strengthening generative AI-powered portfolio of solutions. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Adobe’s unveiling of the Firefly Image 2 Model, Firefly Vector Model and Firefly Design Model to mark a significant advancement in its creative generative AI model family is noteworthy.

The company recently integrated Firefly-powered Generative Fill, Remove Background, Erase and Crop features into Acrobat, which are designed to allow customers to edit images directly in PDFs. The company also integrated the Firefly Image 3 Model into Acrobat in order to aid customers in generating images and adding those to their PDFs.

The unveiling of Generative Remove in Adobe Lightroom, which is a powerful Firefly-backed tool that helps remove unwanted objects from any photo in a single click in a non-destructive manner, is a plus.

The launch of Adobe Express for Enterprise, which is powered by Firefly Image Model 3, is a positive.

Intensifying Competition: A Risk

Adobe has lost 4.4% year to date against the Zacks Computer & Technology sector’s growth of 26.7%. In the same time frame, the company has underperformed Meta Platforms META, Amazon AMZN and Alphabet GOOGL, from which it faces stiff competition in the generative AI space.

Meta Platforms, which has returned 44.1% year to date, recently introduced generative AI features to assist businesses in creating and editing ad content, making the process quicker and more efficient.

Amazon, which has gained 30.1% year to date, is benefiting significantly from the solid adoption of Amazon Bedrock, which has provided it with a breakthrough in the generative AI space.

Meanwhile, Alphabet’s Google is capitalizing on the increasing demand for large language models with its most powerful AI model, Gemini. Solid momentum in Google’s Vertex AI, which enables developers to train, tune, augment and deploy applications using generative AI models, is another positive.

Alphabet shares have rallied 33.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Adobe Inc. (ADBE): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance