Admiral Group And Two Additional Stocks Possibly Valued Below Market On UK Exchange

Amid a landscape of cautious trading and modest movements in the FTSE 100, investors are keeping a close watch on market dynamics as they unfold. In such an environment, identifying stocks that may be undervalued could offer potential opportunities for those looking to diversify or enhance their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kier Group (LSE:KIE) | £1.484 | £2.84 | 47.7% |

LSL Property Services (LSE:LSL) | £3.33 | £6.53 | 49% |

Auction Technology Group (LSE:ATG) | £4.70 | £9.19 | 48.8% |

Loungers (AIM:LGRS) | £2.84 | £5.63 | 49.5% |

Ricardo (LSE:RCDO) | £4.85 | £9.47 | 48.8% |

Entain (LSE:ENT) | £6.318 | £12.26 | 48.5% |

Franchise Brands (AIM:FRAN) | £1.63 | £3.15 | 48.2% |

Accsys Technologies (AIM:AXS) | £0.56 | £1.07 | 47.7% |

Nexxen International (AIM:NEXN) | £2.385 | £4.76 | 49.9% |

M&C Saatchi (AIM:SAA) | £2.02 | £3.98 | 49.3% |

Here's a peek at a few of the choices from the screener

Admiral Group

Overview: Admiral Group plc is a financial services company offering insurance and personal lending products across the United Kingdom, France, Italy, Spain, and the United States, with a market capitalization of approximately £7.84 billion.

Operations: The company generates £2.73 billion from its UK Insurance operations and £818.10 million from its International Insurance segment.

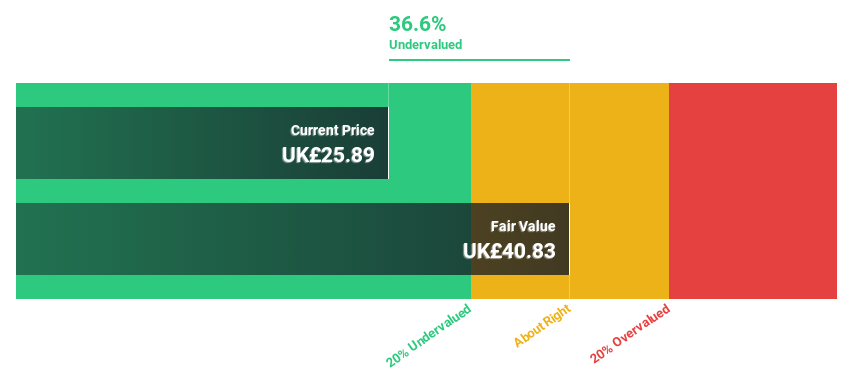

Estimated Discount To Fair Value: 37.3%

Admiral Group, valued at £26.09, trades significantly below our fair value estimate of £41.61, marking it as undervalued based on discounted cash flow analysis. While its dividend yield of 3.95% isn't well supported by cash flows, the company demonstrates robust financial health with expected revenue growth at 8.1% per year—outpacing the UK market's 3.5%. Moreover, Admiral's earnings are projected to rise by 12.79% annually and its return on equity is anticipated to be very high at 46.8% in three years, suggesting strong future profitability despite recent executive changes enhancing governance structures.

Babcock International Group

Overview: Babcock International Group PLC operates globally, offering value-added services in aerospace, defense, and security sectors with a market capitalization of approximately £2.68 billion.

Operations: The company's revenue is divided into four main segments: Land (£1.08 billion), Marine (£1.52 billion), Nuclear (£1.33 billion), and Aviation (£0.53 billion).

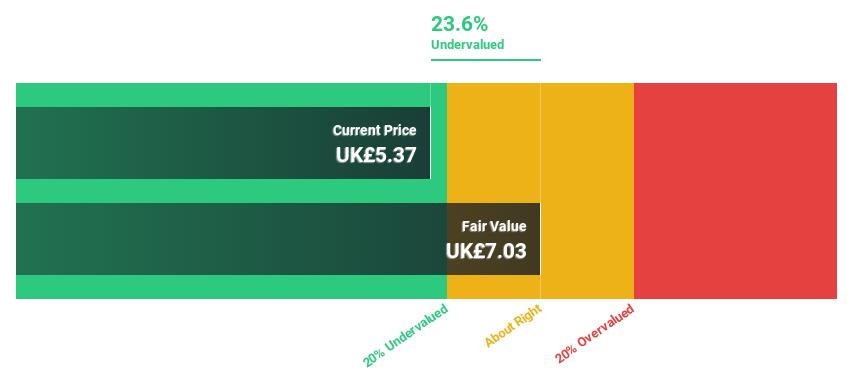

Estimated Discount To Fair Value: 28.9%

Babcock International Group, priced at £5.31, is trading 28.9% below our calculated fair value of £7.46, suggesting significant undervaluation based on discounted cash flows. Despite a high debt level and lower-than-market forecasted revenue growth at 2.4% per year, Babcock's earnings are expected to surge by 29.7% annually, outperforming the UK market prediction of 12.6%. However, its profit margins have declined from last year's 3.6% to just 0.7%, impacted by substantial one-off items.

Smith & Nephew

Overview: Smith & Nephew plc is a global medical technology company that develops, manufactures, markets, and sells medical devices and services, with a market capitalization of approximately £9.26 billion.

Operations: The company generates revenue from three primary segments: Orthopaedics ($2.21 billion), Sports Medicine & ENT ($1.73 billion), and Advanced Wound Management (AWM) ($1.61 billion).

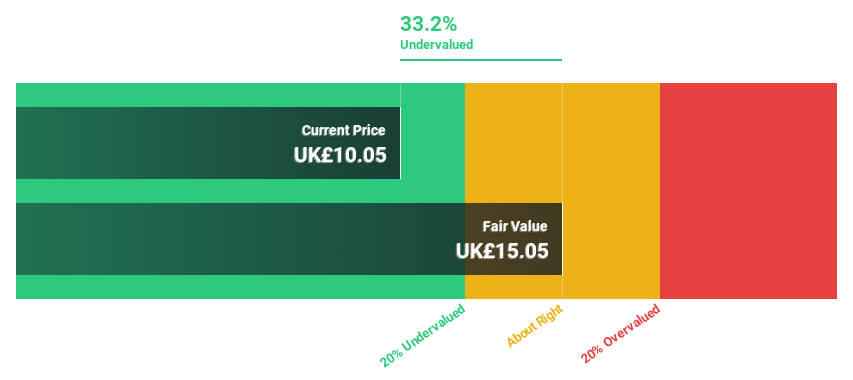

Estimated Discount To Fair Value: 32.9%

Smith & Nephew, valued at £10.62, is considered significantly undervalued with a fair value estimate of £15.83, reflecting a potential underpricing based on cash flows. Despite this, the firm faces challenges like high debt and dividends not well covered by earnings or cash flows. Recent involvement by Cevian Capital highlights opportunities for operational improvements to unlock value, emphasizing the company's attractive market positions yet historical underperformance in shareholder value creation.

Taking Advantage

Unlock our comprehensive list of 57 Undervalued UK Stocks Based On Cash Flows by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:ADM LSE:BAB and LSE:SN..

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance