Should You Be Adding WestBond Enterprises (CVE:WBE) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like WestBond Enterprises (CVE:WBE), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for WestBond Enterprises

WestBond Enterprises's Improving Profits

In the last three years WestBond Enterprises's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, WestBond Enterprises's EPS shot from CA$0.013 to CA$0.025, over the last year. You don't see 84% year-on-year growth like that, very often.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). WestBond Enterprises's EBIT margins have actually improved by 3.7 percentage points in the last year, to reach 11%, but, on the flip side, revenue was down 3.4%. That falls short of ideal.

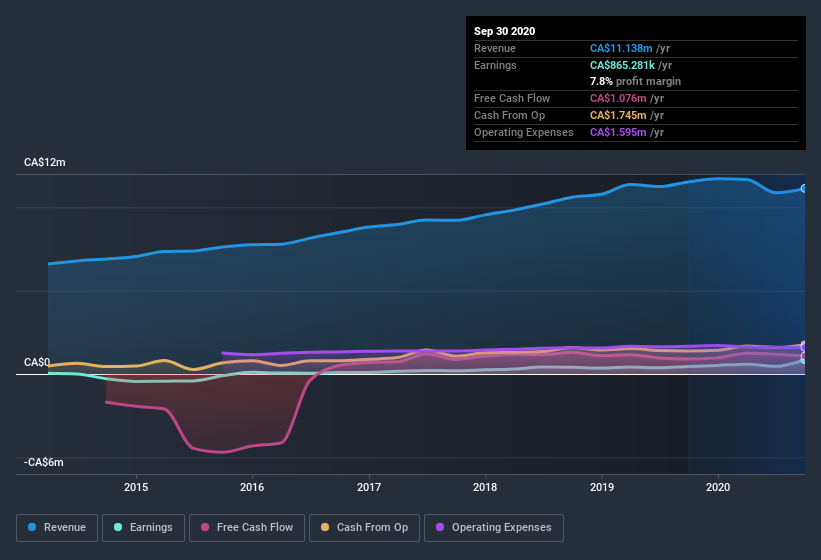

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

WestBond Enterprises isn't a huge company, given its market capitalization of CA$32m. That makes it extra important to check on its balance sheet strength.

Are WestBond Enterprises Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling WestBond Enterprises shares, in the last year. So it's definitely nice that Independent Director Peter Toigo bought CA$32k worth of shares at an average price of around CA$0.32.

And the insider buying isn't the only sign of alignment between shareholders and the board, since WestBond Enterprises insiders own more than a third of the company. Indeed, with a collective holding of 52%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only CA$32m WestBond Enterprises is really small for a listed company. That means insiders only have CA$16m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is WestBond Enterprises Worth Keeping An Eye On?

WestBond Enterprises's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe WestBond Enterprises deserves timely attention. Still, you should learn about the 3 warning signs we've spotted with WestBond Enterprises .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of WestBond Enterprises, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance