Should You Be Adding Science Applications International (NYSE:SAIC) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Science Applications International (NYSE:SAIC). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Science Applications International

How Fast Is Science Applications International Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, Science Applications International's EPS soared from US$3.54 to US$5.20, in just one year. That's a commendable gain of 47%.

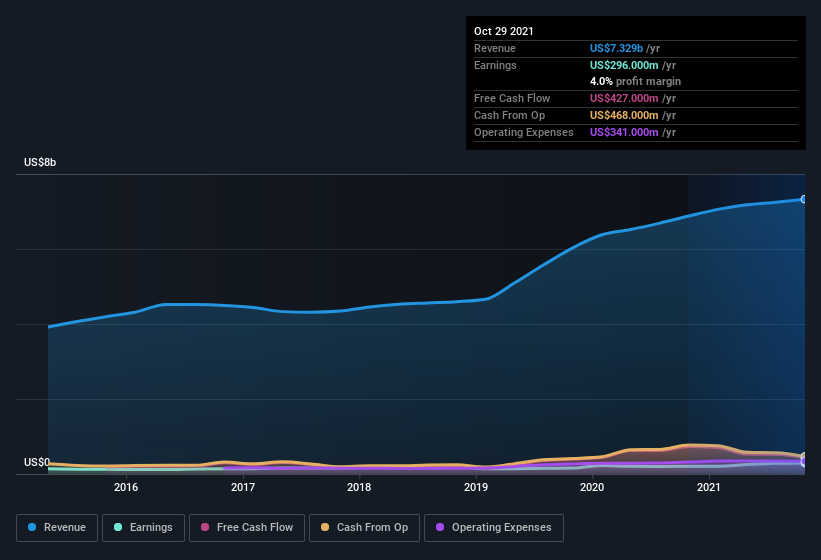

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Science Applications International maintained stable EBIT margins over the last year, all while growing revenue 6.6% to US$7.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Science Applications International's future profits.

Are Science Applications International Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Science Applications International shares in the last year. But the really good news is that Executive VP & CFO Prabu Natarajan spent US$500k buying stock stock, at an average price of around US$83.33. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, it's good to see that Science Applications International insiders have a valuable investment in the business. Indeed, they hold US$36m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Science Applications International Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Science Applications International's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 2 warning signs for Science Applications International (1 is concerning!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Science Applications International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance