Should You Be Adding Sandstorm Gold (TSE:SSL) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sandstorm Gold (TSE:SSL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Sandstorm Gold with the means to add long-term value to shareholders.

See our latest analysis for Sandstorm Gold

How Fast Is Sandstorm Gold Growing Its Earnings Per Share?

In the last three years Sandstorm Gold's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Sandstorm Gold's EPS catapulted from US$0.16 to US$0.28, over the last year. It's not often a company can achieve year-on-year growth of 73%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

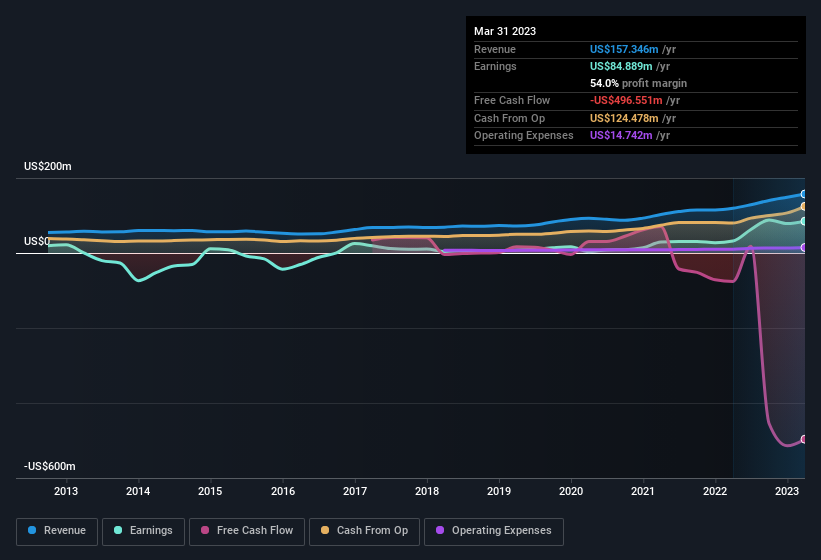

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Sandstorm Gold did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Sandstorm Gold.

Are Sandstorm Gold Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insider selling of Sandstorm Gold shares was insignificant compared to the one buyer, over the last twelve months. To be exact, Co-Founder Nolan Watson put their money where their mouth is, paying US$1.3m at an average of price of US$6.89 per share It's hard to ignore news like that.

The good news, alongside the insider buying, for Sandstorm Gold bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$26m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 1.2% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Sandstorm Gold To Your Watchlist?

Sandstorm Gold's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Sandstorm Gold belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Sandstorm Gold (of which 2 make us uncomfortable!) you should know about.

The good news is that Sandstorm Gold is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance