Acuity Brands (AYI) Q3 Earnings Top Estimates, Revenues Lag

Acuity Brands, Inc. AYI reported mixed results in third-quarter fiscal 2024 (ended May 31, 2024), with earnings surpassing the Zacks Consensus Estimate and revenues missing the same. Earnings beat the consensus mark for the 17th consecutive quarter.

Despite a year-over-year decline in sales in the lighting business, AYI reported strong fiscal third-quarter performance driven by increased focus on margins and cash generation. This approach resulted in a higher adjusted operating profit margin and increased adjusted diluted earnings per share (EPS).

Following the results, the stock inched up 1.1% during the trading session on Jun 27, 2024. Positive investor sentiments were witnessed as the company raised its fiscal 2024 adjusted EPS guidance.

Delving Deeper

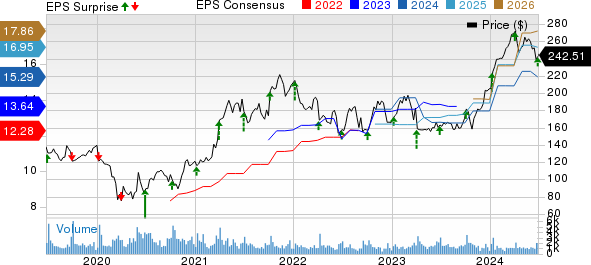

AYI reported adjusted earnings of $4.15 per share, which topped the consensus estimate of $4.10 by 1.2%. The metric also increased 10.7% from the year-ago reported figure of $3.75 per share.

Acuity Brands Inc Price, Consensus and EPS Surprise

Acuity Brands Inc price-consensus-eps-surprise-chart | Acuity Brands Inc Quote

Net sales of $968.1 million missed the consensus mark of $995.4 million by 2.7%. The metric also declined 3% from the prior-year quarter’s level. The downside was due to lower volumes.

Segment Details

Acuity Brands Lighting and Lighting Controls or ABL’s net sales declined 4.5% year over year to $898.5 million. Our estimate for the metric was $925.3 million. Net sales in the Independent Sales Network were down 7.1% year over year to $637.1 million. Sales from the Direct Sales Network were down 6.6% from the prior-year period’s level to $97 million. Retail sales of $45.7 million dropped 4.8% from the prior-year quarter’s levels. Sales in the Corporate Accounts channel increased 36.3% from the prior year’s levels to $60.5 million. The Original equipment manufacturer and other channels generated sales of $58.2 million, down 0.3% from the prior-year period’s levels.

Adjusted operating profit in the segment inched up 1.5% from the prior year’s levels to $162.1 million. The adjusted operating margin was up 100 basis points (bps) year over year to 18%.

Intelligent Spaces Group or ISG generated net sales of $75.7 million, up 15% year over year. Our estimate for the metric was $76.5 million. Adjusted operating profit was $17.3 million, up 35.2% from a year ago. Adjusted operating margin was up 340 bps year over year to 22.9%.

Operating Highlights

Adjusted operating profit increased 2.6% to $167.1 million. Adjusted operating margin of 17.3% was up 100 bps year over year. Adjusted EBITDA rose 2.5% to $180 million from a year ago. Adjusted EBITDA margin expanded 100 bps to 18.6% from a year ago.

Financials

At the fiscal third-quarter end, Acuity Brands had cash and cash equivalents of $699 million compared with $397.9 million at the fiscal 2023-end. Long-term debt was $496 million, slightly up from $495.6 million in the fiscal 2023-end.

During the first nine months of fiscal 2024, cash provided by operating activities totaled $445.1 million, down from $471.5 million in the prior-year period. Free cash flow was down 4.6% year over year to $404.1 million in the first nine months of fiscal 2024.

During the first nine months of fiscal 2024, the company repurchased nearly 454,000 shares of its common stock for $89 million.

Raised Fiscal 2024 Outlook

For the fiscal 2024, AYI still expects net sales in the range of $3.7-$4 billion compared with the reported figure of $3.95 billion in the fiscal 2023.

For the year, the adjusted earnings per shares are projected within the range of $14.75-$15.50, up from a prior projection of $13-$14.50. The estimated figure is up from $14.05 reported in fiscal 2023.

Zacks Rank & Key Picks

Acuity Brands currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Zacks Construction sector are:

Howmet Aerospace Inc. HWM carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

HWM has a trailing four-quarter earnings surprise of 8.5%, on average. Shares of HWM have gained 63.2% in the past year. The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 10.6% and 29.9%, respectively, from prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2 (Buy). It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 26.7%. Shares of MPTI have risen 216.4% in the past year.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 8.8% and 58.6%, respectively, from prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average. Shares of GTES have gained 18.3% in the past year.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance