Acer (ACER) to Report Q4 Earnings: What's in the Cards?

We expect investors to focus on updates of Acer Therapeutics’ ACER pipeline and revenue guidance for the company’s recently approved drug, when it reports fourth-quarter 2022 results.

ACER’s surprise record has been mixed so far, as its earnings beat expectations in two of the last four quarters, while missing the mark on other two occasions. It has a trailing four-quarter negative earnings surprise of 95.82%, on average. In the last reported quarter, Acer’s earnings beat estimates by 59.21%.

Acer Therapeutics Inc. Price and EPS Surprise

Acer Therapeutics Inc. price-eps-surprise | Acer Therapeutics Inc. Quote

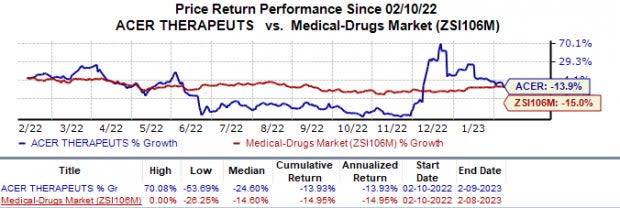

Since the past year, shares of Acer Therapeutics have declined 13.9% compared with the industry’s 15.0% decline.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for the quarter to be reported.

Factors to Note

On Dec 27, Acer Therapeutics announced that the FDA approved Olpruva, a formulation of sodium phenylbutyrate for oral suspension for the treatment of certain patients with urea cycle disorders (“UCDs”). The drug has been developed in collaboration with Relief Therapeutics Holdings SA. The approval also marks the first FDA nod to the company for any of its pipeline candidates. We do not expect the company to record any product revenues from the sale of Olpruva in the to-be-reported quarter. Investor focus would likely be on any revenue guidance and management’s commercialization activities on Olpruva.

As a result of the above approval, Acer Therapeutics is also eligible for a $42.5 million term loan, which management is most likely to avail as it will boost the company’s existing cash runway to second-half 2023.

Apart from UCD, Acer intends to develop Olpruva to treat various other disorders, including maple syrup urine disease, pyruvate dehydrogenase complex deficiency, rare pediatric epilepsies and various liver disorders.

Other than Olpruva, ACER is also evaluating other candidates in active clinical development.

A novel NK3R antagonist, ACER-801 (osanetant) is being developed across three indications – induced vasomotor symptoms (“VMS”), post-traumatic stress disorder (“PTSD”) and prostate cancer across multiple mid-stage studies. Topline data from the ongoing phase IIa study on ACER-801 as a potential treatment for moderate to severe VMS in post-menopausal women is expected in first-quarter 2023.

Acer Therapeutics is also evaluating Edsivo (celiprolol) for the treatment of vascular Ehlers-Danlos syndrome (vEDS) in patients with a confirmed type III collagen (COL3A1) mutation in the ongoing pivotal phase III DiSCOVER study. Management is currently enrolling participants in the study and expects to complete the same by this year’s end. The successful development of these two pipeline candidates will be a big boost for the company.

Activities related to the development of pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Whispers

Our proven model does not predict an earnings beat for Acer Therapeutics this time around. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Acer’s Earnings ESP is 0.00% as both the Most Accurate Estimate and Zacks Consensus Estimate stand at a loss of 39 cents per share.

Zacks Rank: Acer Therapeutics currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few other stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Syndax Pharmaceuticals SNDX has an Earnings ESP of +4.39% and a Zacks Rank #1.

Syndax Pharmaceuticals’ stock has surged 68.6% in the past year. Syndax Pharmaceuticals beat estimates in three of the last four quarters while meeting the mark on one occasion. Syndax Pharmaceuticals has delivered an earnings surprise of 95.39%, on average. In the last reported quarter, SNDX reported an earnings surprise of 10.77%.

Alkermes ALKS has an Earnings ESP of +49.57% and a Zacks Rank #2.

Alkermes’ stock has risen 15.1% in the past year. Earnings of ALKS beat estimates in three of the last four quarters while meeting the mark on another. On average, Alkermes witnessed a trailing four-quarter positive earnings surprise of 306.73%, on average. In the last reported quarter, Alkermes’ earnings met estimates. ALKS is scheduled to release its fourth-quarter 2022 results on Feb 16, before market opens.

Bayer BAYRY has an Earnings ESP of +6.70% and a Zacks Rank #3.

Bayer’s stock has risen 4.5% this year so far. Bayer beat earnings estimates in three of the last four quarters while missing the mark on one occasion. Bayer has a four-quarter earnings surprise of 18.23%, on average. In the last reported quarter, Bayer’s earnings missed estimates by 3.33%. BAYRY is scheduled to release its fourth-quarter 2022 results on Feb 28.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Acer Therapeutics Inc. (ACER) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance