The Access Intelligence (LON:ACC) Share Price Is Up 78% And Shareholders Are Holding On

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Access Intelligence Plc (LON:ACC) shareholders have enjoyed a 78% share price rise over the last half decade, well in excess of the market decline of around 16% (not including dividends).

View our latest analysis for Access Intelligence

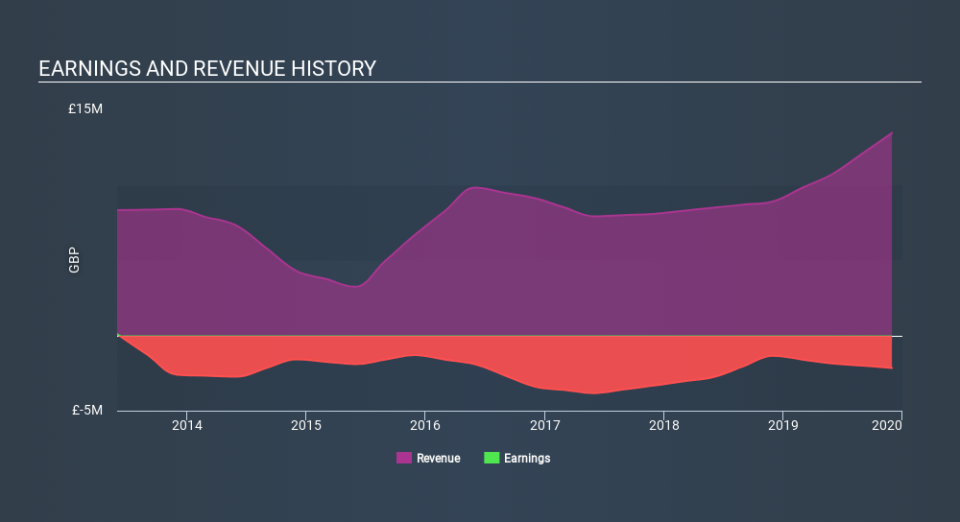

Given that Access Intelligence didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Access Intelligence saw its revenue grow at 17% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 12%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Access Intelligence's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Access Intelligence shareholders can take comfort that their trailing twelve month loss of 5.5% wasn't as bad as the market loss of around 11%. Longer term investors wouldn't be so upset, since they would have made 12%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Access Intelligence better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Access Intelligence .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance