ABN AMRO Bank And Two More Leading Dividend Stocks From Euronext Amsterdam

Amidst a backdrop of political uncertainty and fluctuating market sentiments across Europe, the Dutch stock market presents a unique landscape for investors interested in stable income through dividend stocks. In this context, understanding the characteristics that define resilient and attractive dividend stocks is crucial, especially in an environment where economic indicators and investor confidence can be volatile.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.62% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.74% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.95% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.60% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.33% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.16% | ★★★★☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

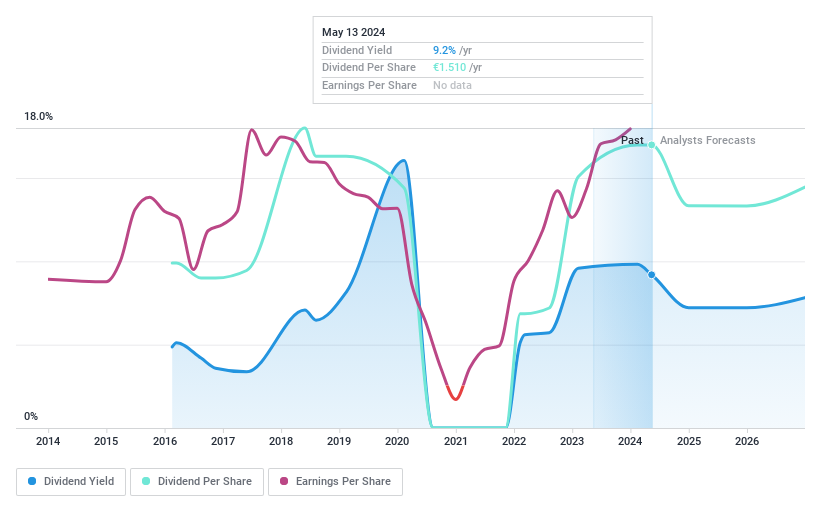

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €12.92 billion.

Operations: ABN AMRO Bank N.V. generates revenue through its Corporate Banking (€3.50 billion), Wealth Management (€1.59 billion), and Personal & Business Banking (€4.07 billion) segments.

Dividend Yield: 9.7%

ABN AMRO Bank's dividend track record is inconsistent, with volatile payments over the past 8 years and a less than 10-year history of dividend distribution. Despite this, the bank's dividends are currently well-covered by earnings, with a payout ratio of 47.9%. However, earnings are expected to decline by an average of 11.1% annually over the next three years, which could challenge future dividend sustainability. Recent strategic moves include discussions for selling its stake in Neuflize Vie and related partnerships potentially impacting its financial positioning slightly positively.

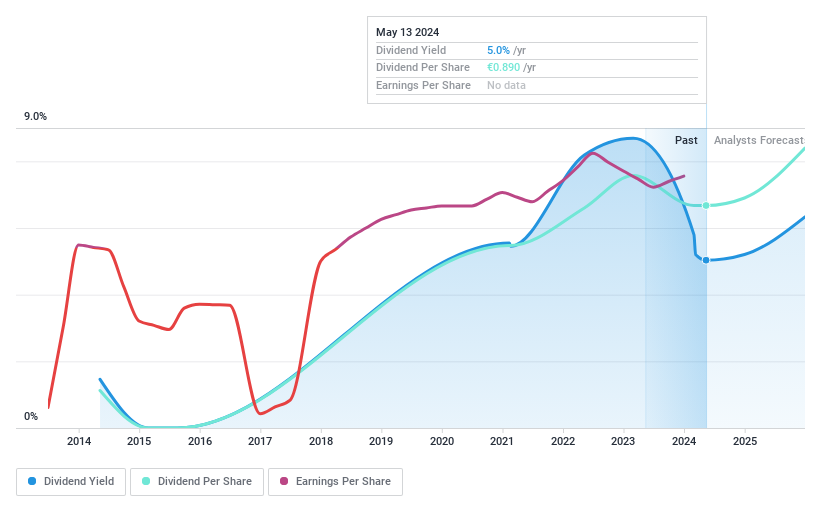

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company that operates in property development, construction, and infrastructure sectors both domestically and internationally, with a market capitalization of approximately €551.27 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate segment (€411.79 million), Van Wanrooij division (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

Dividend Yield: 4.3%

Koninklijke Heijmans has a fluctuating history of dividend payments, making its reliability questionable for consistent income. Despite this, dividends have grown over the last decade and are currently supported by both earnings and cash flows, with payout ratios of 37.1% and 59% respectively. However, the current yield of 4.33% trails behind the top quartile in the Dutch market at 5.69%. The stock is also trading slightly below its estimated fair value, indicating potential undervaluation.

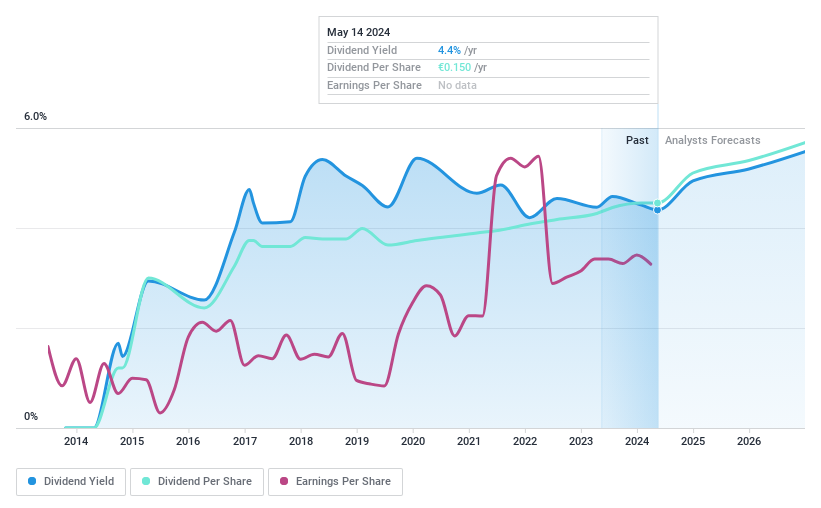

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €14.19 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Consumer (€2.93 billion), Business (€1.84 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.2%

Koninklijke KPN has shown a pattern of unstable dividend payments over the past decade, with significant fluctuations including annual drops exceeding 20%. Despite this, dividends have grown in the last 10 years and are currently supported by earnings and cash flows, with payout ratios at 78.4% and 59.6% respectively. However, its dividend yield of 4.16% is below the top quartile average in the Dutch market (5.69%). Additionally, KPN's financial position is burdened by high debt levels but it trades at a significant discount to estimated fair value (57.6% below), suggesting potential undervaluation.

Where To Now?

Embark on your investment journey to our 6 Top Euronext Amsterdam Dividend Stocks selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:HEIJM and ENXTAM:KPN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance