Abbott (ABT) Tops Q2 Earnings Estimates, Lifts EPS Guidance

Abbott Laboratories ABT reported second-quarter 2019 adjusted earnings from continuing operations of 82 cents per share, beating the Zacks Consensus Estimate by 2.5%. The bottom line improved 12.3% year over year and remained above the company’s guided range of 79-81 cents. Reported earnings from continuing operation in the quarter came in at 56 cents, a 36.6% surge from the year-ago quarter.

Second-quarter worldwide sales came in at $7.98 billion, up 2.7% year over year on a reported basis. The top line missed the Zacks Consensus Estimate by 0.1%.

On an organic basis (adjusting for the impact of foreign exchange as well as certain acquisitions and divestments), sales increased 7.5% year over year in the reported quarter.

Quarter in Detail

Abbott operates through four segments, namely Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition and Diagnostics.

In the second quarter, EPD sales dropped 1.8% on a reported basis (improved 6.1% on an organic basis) to $1.11 billion. This included a 7.9% adverse impact from currency fluctuations. Sales in the key emerging markets declined 1.4% year over year on a 9.3% adverse impact of foreign exchange. Organically, sales improved 7.9% in this market.

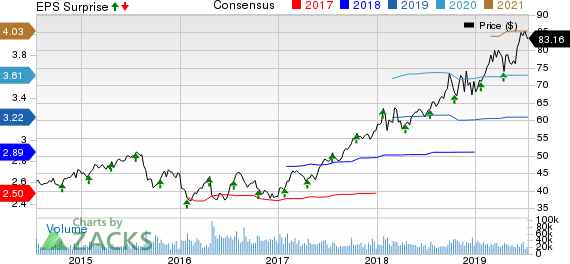

Abbott Laboratories Price, Consensus and EPS Surprise

Abbott Laboratories price-consensus-eps-surprise-chart | Abbott Laboratories Quote

The Medical Devices business sales increased 6.4% on a reported basis to $3.08 billion. On an organic basis, sales grew 10.5%.

Cardiovascular and Neuromodulation sales reportedly (up 5.6% on an organic basis) rose 2.1% on double-digit growth in Electrophysiology, Heart Failure and Structural Heart. In Electrophysiology, growth was led by strong performance in cardiac diagnostic and ablation catheters.

Heart Failure sales growth was 24.6% organically, driven by strong market adoption of Abbott's HeartMate 3 left ventricular assist device following its FDA approval as a destination therapy in late 2018.

Within Structural Heart, the company registered 16.6% organic growth on a year-over-year basis driven by strong performance in several product areas across Abbott's broad portfolio, including MitraClip device.

Diabetes Care sales improved 23.9% (up 35.3% organically), buoyed consistent consumer uptake of FreeStyle Libre, the revolutionary continuous glucose monitoring system of Abbott.

Nutrition sales were up a marginal 0.9% year over year on a reported basis (up 5.1% on an organic basis) to $1.88 billion. Pediatric Nutrition sales increased 2.9% on an organic basis. Adult Nutrition sales were up 7.9% organically.

Diagnostics sales were up 1.7% year over year on a reported basis (up 6.2% on a comparable operational basis) to $1.91 billion. Core Laboratory Diagnostics sales grew 9.4% while Molecular Diagnostics slipped 9.3%, on an organic basis. Point of Care Diagnostics sales were up 5.7%. Rapid Diagnostics sales improved 2.8% on an organic basis in the second quarter led by infectious disease testing in developed markets and cardio-metabolic testing globally.

2019 Guidance

For the full year, adjusted earnings from continuing operations have been raised to a new band of $3.21-$3.27 from the earlier-provided range of $3.15-$3.25. The Zacks Consensus Estimate of $3.22 remains within this projected range. The company also projects 2019 organic sales growth of 7-8%.

The company has also provided third-quarter 2019 adjusted earnings per share outlook. It expects to report adjusted earnings from continuing operations in the range of 83-85 cents. The consensus mark of 85 cents falls at the upper end the predicted range.

Our Take

Abbott exited the second quarter of 2019 on a mixed note with better-than-expected earnings and revenues lagging the estimate.

Overall, we are optimistic about Abbott’s strong and consistent EPD and Medical Devices performance organically. Particularly, Abbott has been riding high on a healthy growth within its Diabetes Care business. The company has been hogging the limelight for developments in the flagship, sensor-based continuous glucose monitoring (CGM) system — FreeStyle Libre System. Also, solid contributions from the company’s other two businesses encourage us.

Meanwhile, the company’s emerging market performance has been promising on several strategic developments. Consequently, Abbott has raised its full-year guidance.

On the flip side, increasing currency headwinds significantly dented the company’s international performance.

Zacks Rank & Key Picks

Abbott currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Thermo Fisher Scientific, Inc. TMO and Teleflex Inc. TFX.

Hologic is scheduled to release second-quarter 2019 results on Jul 31. The Zacks Consensus Estimate for the quarter’s adjusted EPS is pegged at 61 cents and for revenues stands at $834.6 million. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher is scheduled to release second-quarter 2019 results on Jul 24. The Zacks Consensus Estimate for the period’s adjusted EPS is $3.01 and for revenues, $6.23 billion. The stock carries a Zacks Rank #2 (Buy).

Teleflex is expected to release second-quarter 2019 results on Aug 1. The Zacks Consensus Estimate for adjusted EPS for the to-be-reported quarter is $2.59 and for the top line, $636.7 million. The stock has a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%. This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance