AB Sagax Leads Trio Of Swedish Growth Stocks With High Insider Stakes On The Swedish Exchange

As global markets navigate through fluctuating economic indicators and geopolitical shifts, the Swedish stock exchange presents a unique landscape for investors interested in growth companies with high insider ownership. Such stocks often signal strong confidence from those closest to the company, potentially aligning well with current market conditions that favor informed, strategic investments in stable environments.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Sileon (OM:SILEON) | 14.1% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's review some notable picks from our screened stocks.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

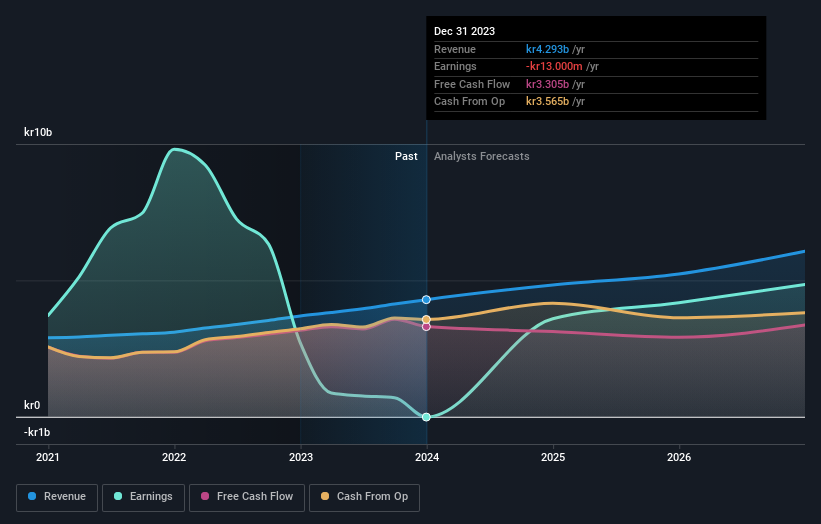

Overview: AB Sagax (ticker: OM:SAGA A) is a property company operating across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 105.39 billion.

Operations: The company generates revenue primarily through real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish property investment firm, has demonstrated robust growth with its recent financial maneuvers and dividend strategies. The company successfully issued a €500 million green bond and maintained attractive dividends, declaring SEK 3.10 per share for series A and B, reflecting strong fiscal health. Despite challenges in covering debt with operating cash flow, Sagax's earnings are expected to significantly outpace the market with a projected annual increase of 33.5%. This performance is underpinned by high insider ownership which aligns management’s interests with shareholders', although there has been some shareholder dilution over the past year.

Take a closer look at AB Sagax's potential here in our earnings growth report.

The valuation report we've compiled suggests that AB Sagax's current price could be inflated.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

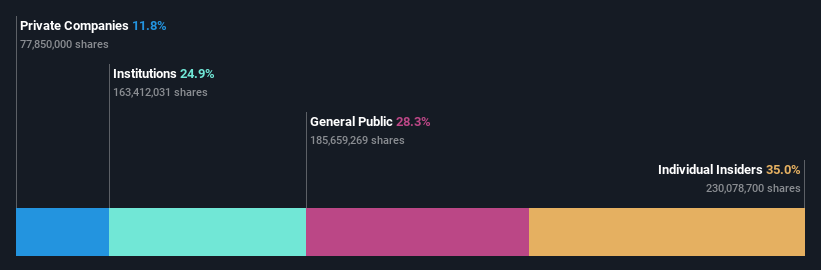

Overview: Wallenstam AB (publ) is a property company based in Sweden, with a market capitalization of approximately SEK 37.12 billion.

Operations: The company generates revenue primarily from its operations in Gothenburg and Stockholm, with SEK 1.94 billion and SEK 0.94 billion respectively.

Insider Ownership: 35%

Wallenstam AB has shown a promising turnaround in its recent financial performance, reporting a substantial increase in net income to SEK 408 million for the first half of 2024 from a net loss last year. The company's earnings are expected to grow by 55.3% annually over the next three years, outpacing the Swedish market forecast of 14.7%. Despite this growth, concerns remain about its ability to cover interest payments effectively with earnings. Insider transactions have been balanced, with more purchases than sales but not in significant volumes.

Yubico

Simply Wall St Growth Rating: ★★★★★★

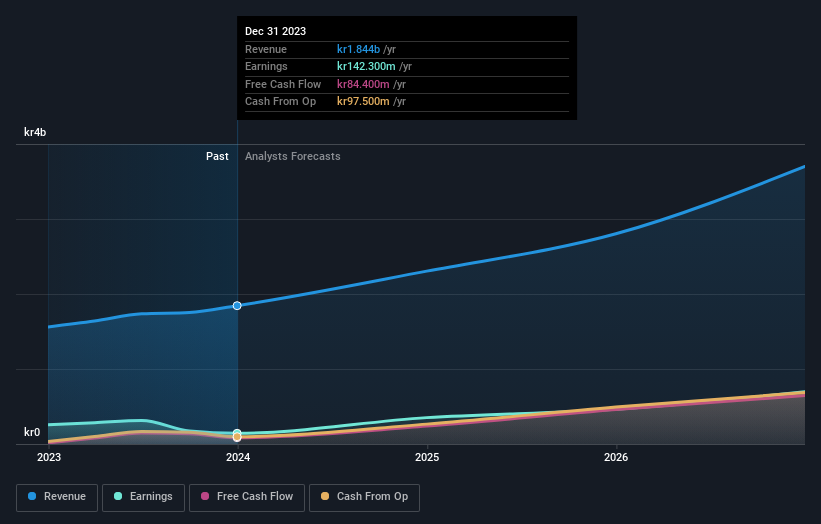

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.75 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Yubico AB, a Swedish growth company with high insider ownership, has demonstrated robust financial performance with first-quarter sales rising to SEK 504.4 million and net income increasing to SEK 77.5 million. Despite a slight dip in earnings per share, the company's revenue growth is expected to outpace the market significantly at 22.9% annually. However, recent substantial insider selling and shareholder dilution over the past year raise concerns about its future stock stability and commitment from insiders.

Get an in-depth perspective on Yubico's performance by reading our analyst estimates report here.

Upon reviewing our latest valuation report, Yubico's share price might be too optimistic.

Where To Now?

Click through to start exploring the rest of the 81 Fast Growing Swedish Companies With High Insider Ownership now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:SAGA AOM:WALL B and OM:YUBICO

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance