6 Top Internet Software Bets Amid the Coronavirus Crisis

Internet has been instrumental in fundamentally changing the way one works, and this has significantly transformed workspace. The ubiquitous nature of Internet essentially renders physical presence null and void to a large extent, and thus has turned out to be a blessing amid the coronavirus pandemic.

Precautionary measures are being undertaken globally to deal with the pandemic. Companies are urging employees to work from home. Schools, colleges, other education institutions, have been shut down. Theaters, malls, public recreation places have been closed to minimize the risk of spread.

This is expected to benefit Internet software companies providing enterprise workspace solutions, enterprise communication platforms, online education portals, to mention a few.

Internet Software Stocks Poised to Benefit

Solid adoption of cloud-based services, increasing proliferation of IoT, AR/VR devices and accelerated deployment of 5G are expected to aid Internet software users to deal with the coronavirus-induced situation.

Further, Internet software providers are well poised to gain from growing demand for their services as enterprises continue to shift from on-premise to cloud environments — both public and hybrid.

Enterprises have been increasingly adopting digital transformation techniques to automate and accelerate business processes, with an aim to boost productivity. Advancements in AI, machine learning (ML), deep learning (DL), natural language processing (NLP), and neural networks, has transformed enterprise processes with robust team collaboration tools, virtual assistants and chat bots.

This is also the primary reason behind SaaS-based (or Software as a Service) application and infrastructure monitoring gaining importance. Demand for cloud infrastructure monitoring, web-based application performance management, human capital management (HCM), and cyber security software are increasing rapidly.

Moreover, secular growth in the e-commerce space, increasing popularity of social-media platforms and digital ad-spending are major growth drivers. Increasing popularity of programmatic ad-buying is a key catalyst, in this regard. Further, growing allegiance to online gaming, music, payment portals, education and video streaming services enhances growth opportunities for Internet software companies amid coronavirus-induced shut down.

Notably, the Zacks Internet - Software Industry carries a Zacks Industry Rank #108 that places it at the top 43% of more than 250 Zacks industries.

6 Stocks Worth a Bet

Given the current backdrop, investors can take a look at these five Internet software stocks with promising fundamentals that are poised to grow.

Arco Platform Limited ARCE offers technology-enabled features with an aim to enhance educational content in private schools based out of Brazil.

The company’s expanding network, comprising enrolled students and partner schools, is anticipated to boost ACV bookings, consequently enhancing financial performance.

Arco Platform Limited Price and Consensus

Arco Platform Limited price-consensus-chart | Arco Platform Limited Quote

This Zacks Rank #1 (Strong Buy) stock has long-term earnings growth rate of 49.07%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Digital Turbine, Inc. APPS has been exhibiting impressive performance driven by increasing advertiser demand and incremental adoption of innovative offerings, including SingleTap, Notifications and Folders.

This Zacks Rank #2 (Buy) company recently concluded acquisition of Mobile Posse with an aim to strengthen its comprehensive mobile content delivery platform, which is anticipated to boost adoption further.

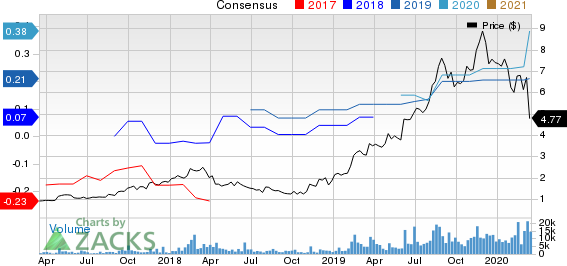

Digital Turbine, Inc. Price and Consensus

Digital Turbine, Inc. price-consensus-chart | Digital Turbine, Inc. Quote

The Zacks Consensus Estimate for fiscal 2021 earnings has been revised upward by 52% in the past 30 days to 38 cents.

Model N, Inc. MODN is riding on rapid adoption of its Revenue Cloud offering for med-tech, pharma, semiconductor, manufacturing and high-tech companies.

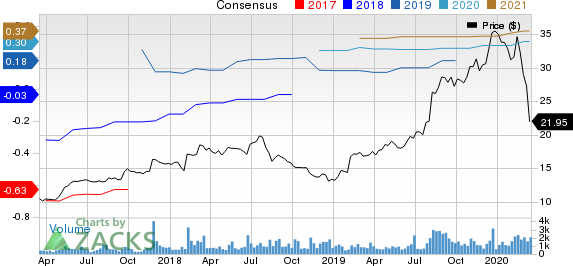

The Zacks Consensus Estimate for fiscal 2020 earnings has been revised upward by 7.1% in the past 60 days to 30 cents.

Model N, Inc. Price and Consensus

Model N, Inc. price-consensus-chart | Model N, Inc. Quote

This Zacks Rank #2 stock has a long-term earnings growth rate of 13%.

eGain Corporation EGAN is benefiting from robust adoption of SaaS and on-premise business-to-consumer (B2C) customer engagement solutions. In fact, the company’s solutions have been adopted by notable enterprise customers that include Avon, Comcast, Fiserv and Vodafone.

The Zacks Consensus Estimate for fiscal 2020 earnings has been revised 225% upward in the past 60 days to 13 cents.

eGain Corporation Price and Consensus

eGain Corporation price-consensus-chart | eGain Corporation Quote

This Zacks Rank #2 stock has long-term earnings growth rate of 20%.

Zoom Video Communications, Inc. ZM is well poised to capitalize on evolving workspace demands for seamless enterprise communication tools. Ongoing workspace trends of Bring Your Own Device (BYOD), rise in smartphone penetration and increasing number of mobile workers, are expected to bolster adoption of the company’s enterprise communication solutions.

This Zacks Rank #2 stock has long-term earnings growth rate of 26.56%.

Zoom Video Communications, Inc. Price and Consensus

Zoom Video Communications, Inc. price-consensus-chart | Zoom Video Communications, Inc. Quote

The Zacks Consensus Estimate for fiscal 2021 earnings has been revised 51.9% upward to 41 cents in the past 30 days.

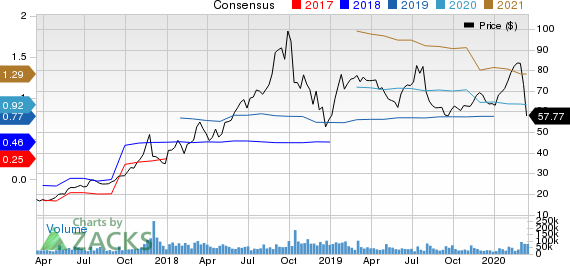

Square, Inc. SQ is expected to gain from robust performance by product lines such as Square Terminal, Cash Card, Square Register and Square Capital. Moreover, the company’s seller ecosystem, which helps in strengthening relationship with sellers, is likely to contribute to the payment volume and the top line. Additionally, growing adoption of Cash App in the bitcoin space is a tailwind.

This Zacks Rank #2 stock has a long-term earnings growth rate of 30.8%.

Square, Inc. Price and Consensus

Square, Inc. price-consensus-chart | Square, Inc. Quote

The Zacks Consensus Estimate for 2020 earnings has been revised upward by 1.1% to 92 cents in the past 30 days.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Click to get this free report

eGain Corporation (EGAN) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

Arco Platform Limited (ARCE) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance