6 Reasons to Add Farmers National (FMNB) to Your Portfolio

Farmers National Banc Corporation FMNB is well-positioned for growth on the back of a solid loan balance and strategic acquisitions. Hence, adding the stock to your portfolio seems a wise idea now.

The Zacks Consensus Estimate for Farmers National’s 2024 and 2025 earnings has been revised 4% and 7.2% upward, respectively, over the past 60 days. This indicates that analysts are optimistic regarding its earnings growth potential. The company currently carries a Zacks Rank #2 (Buy).

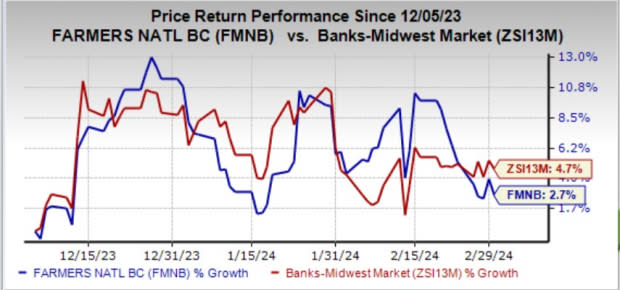

Over the past three months, the company’s shares have gained 2.7% compared with the industry’s growth of 4.7%

Image Source: Zacks Investment Research

Revenue Strength: Farmers National has experienced a consistency in revenue growth, with a compound annual growth rate (CAGR) of 10.1% over the last five years ended 2023. This was driven by robust loan growth, with net loans witnessing a CAGR of 12.9% over the last five years (2018-2023). The solid loan growth was majorly driven by the successful acquisitions of the bank in the past.

The steady growth in loan balance, efforts to bolster fee income and higher interest rates are expected to continue supporting the top line in the upcoming quarters. Revenues are expected to decline 4.8% in 2024, however, it will rebound and grow at the rate of 3.5% in 2025.

Strategic Acquisitions: FMNB has been focused on its inorganic growth. The company has been an active acquirer and has successfully bought seven companies in the last decade. The most recent buyout of Emclair Financial Corp. was completed in January 2023, with a deal value of up to $105 million. This transaction helped the bank to expand its footprint in Pennsylvania markets. Farmers National’s efforts to grow inorganically will continue to support its financials and help the company create market dominance in the long run.

Earnings Growth: FMNB’s earnings have witnessed growth of 10.5% over the past three to five years, higher than the industry’s 9.9%. Though the company’s earnings are projected to decline 21.2% in 2024, it will rebound and grow 3.9% in 2025. The company has an impressive earnings surprise history, surpassing the Zacks Consensus Estimate in three of the four trailing quarters, with an average surprise of 9.07%.

Impressive Capital Distribution: Farmers National has an impressive capital distribution plan. The company has been paying out dividend to its shareholders regularly. In November 2022, the bank announced a 6.3% hike in its quarterly dividend to 17 cents per share and has maintained the payout ever since. The company has five-year annualized dividend growth of 16.62% and a payout ratio of 41% of earnings.

The company has a share repurchase program in place. In March 2023, the bank authorized a share repurchase plan of $1 million of its common shares. As of Dec 31, 2023, approximately 0.5 million shares remained available under the authorization.

On the back of decent liquidity and a strong balance sheet position, FMNB is expected to sustain efficient capital distribution.

Stock Seems Undervalued: The company has price/cash flow (P/CF) and price/earnings (P/E) (F1) of 6.15 and 8.02 compared with the industry’s P/CF and P/E (F1) of 6.84 and 10.88, respectively.

The stock has a Value Score of B. Our research suggests that stocks with a Value Score of A or B, when combined with Zacks Rank #1 (Strong Buy) or 2, offer the highest upside potential.

Superior Return on Equity (ROE): Farmers National’s ROE of 17.53% is higher than the industry average of 12.51%. This highlights the company’s commendable position over its peers in using shareholders’ funds.

Other Bank Stocks to Consider

Earnings estimates for 1st Source Corporation SRCE for 2024 have increased 7.1% over the past 60 days. Shares of SRCE have gained 8.1% over the past six months. At present, SRCE sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for First Busey Corporation BUSE for 2024 have been revised slightly upward over the past 30 days. Shares of BUSE have climbed 12.8% in the past six months. Currently, BUSE sports a Zack Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Busey Corporation (BUSE) : Free Stock Analysis Report

1st Source Corporation (SRCE) : Free Stock Analysis Report

Farmers National Banc Corp. (FMNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance