6 Reasons to Add Clean Harbors (CLH) Stock to Your Portfolio

Clean Harbors, Inc. CLH is a waste removal services provider that has performed significantly well in the past three months and has the potential to sustain momentum in the near term. Consequently, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

What Makes Clean Harbors an Attractive Pick?

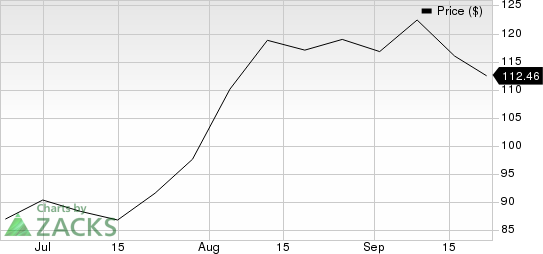

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run in the past three months. Shares of Clean Harbors have appreciated 34.8%, significantly outperforming the 13.9% rise of the industry it belongs to.

Clean Harbors, Inc. Price

Clean Harbors, Inc. price | Clean Harbors, Inc. Quote

Solid Rank & VGM Score:Clean Harbors currently carries a Zacks Rank #1 (Strong Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Four estimates for 2022 have moved north over the past 60 days versus no southward revision for Clean Harbors, reflecting analysts’ confidence in the stock. During the same period, the Zacks Consensus Estimate for 2022 earnings has moved up 52.7%.

Positive Earnings Surprise History: Clean Harbors has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering an average earnings surprise of 37.5%.

Strong Growth Prospects: The Zacks Consensus Estimate for CLH’s 2022 earnings of $6.78 reflects year-over-year growth of 86.3%.

Growth Factors: Clean Harbors continues to make capital investments to enhance its quality and comply with government and local regulations. The current regulatory requirements are cost-intensive and complicated for in-house disposal facilities, which, in turn, compel most companies to outsource their hazardous waste disposal needs. This is where Clean Harbors steps in with its suitable disposal firms in Canada and the United States.

Moreover, Clean Harbors has a diversified customer base, ranging from Fortune 500 companies to midsize and small public and private entities, which provides it with a stable and recurring source of revenue. The company has been chosen as an authorized vendor by large and small generators of waste as it has comprehensive waste disposal and waste tracking capabilities.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are Avis Budget Group, Inc. CAR, Automatic Data Processing, Inc. ADP and CRA International, Inc. CRAI.

Avis Budget sports a Zacks Rank #1 at present. CAR has an earnings growth rate of 109.1% for 2022.

Avis Budget delivered a trailing four-quarter earnings surprise of 69.5%, on average.

ADP carries a Zacks Rank #2 at present. ADP has a long-term earnings growth expectation of 12%.

ADP delivered a trailing four-quarter earnings surprise of 5%, on average.

CRA International carries a Zacks Rank of 2, currently. CRAI has a long-term earnings growth expectation of 14.3%.

CRAI delivered a trailing four-quarter earnings surprise of 26%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance