Have $500? 2 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now

Written by Brian Paradza, CFA at The Motley Fool Canada

When building wealth and investing for long-term goals, even small amounts invested in growth stocks or undervalued companies can potentially yield significant returns over several years. If you have $500 to invest and are looking for cheap stocks with high potential, you may want to consider Torex Gold Resources (TSX:TXG) and NuVista Energy (TSX:NVA) stock.

If certain scenarios play out favourably, these two TSX stocks, which are potentially undervalued, could grow your initial investment into a larger sum over the long term. Let’s take a closer look at the opportunities offered by these value stocks and their potential to grow a $500 investment over the long term.

Torex Gold Resources stock appears undervalued

Tores Gold Resources is a $1.7 billion profitable Canadian intermediate gold producer with production assets in Mexico. With the completion of its development project Media Luna, expected later this year, the company anticipates increased productivity and a return to positive free cash flow generation in 2025. The project could help extend the company’s asset life well beyond 2033.

Despite a planned one-month plant shutdown for Media Luna tie-ins later this year, the company is on track to meet its annual gold production guidance for 400,000 to 450,000 ounces of gold. Torex reported record production rates during the first quarter of 2024 and expects its all-in sustaining costs to remain stable between US$1,160 and US$1,200 an ounce of gold. This indicates sustainable profitability, particularly as gold prices print record highs above US$2,300 an ounce in 2024.

Meanwhile, TXG stock trades cheaply at a price-to-earnings multiple of 6.2 which compares favourably against an industry average PE of 67. A forward price-earnings to growth (PEG) multiple of 0.1 implies shares are grossly undervalued given the gold stock’s potential long-term earnings growth potential. According to legendary value investor Peter Lynch, a PEG ratio of 1.0 implies a fair valuation for stocks, while ratios below 1.0 imply under appreciation of future earnings growth potential.

Buy NuVista Energy stock before gas prices rebound

NuVista Energy is a $2.6 billion financially strong oil and natural gas producer operating in the Western Canadian Sedimentary Basin. The TSX energy stock has consistently increased its productivity year over year since 2018, with an expected annual production of 83,000 to 87,000 barrels of oil equivalent per day (boe/d) in 2024 compared to 50,000 boe/d in 2020.

Despite low natural gas prices caused by weather-induced low demand, NuVista Energy may achieve 10% production growth in 2024. This growth, supported by hedging activity, will contribute to increased revenue, earnings, and positive free cash flow. Management is confident that the company’s annual production will continue to grow at a rate of 10% to 15% annually, reaching 100,000 boe/d by 2026.

With a historical PE of 7.8, NuVista Energy stock is undervalued compared to the industry average PE of 12. Its forward PE is even lower at 6 as the market expects earnings per share to increase this year.

A $500 investment in NuVista stock will give you exposure to a cheap energy stock trading at 0.9 times its tangible book value, while others in the industry trade for an average of 5.1 times their tangible book value. NuVista stock’s valuation multiples may significantly expand when volatile natural gas prices rebound.

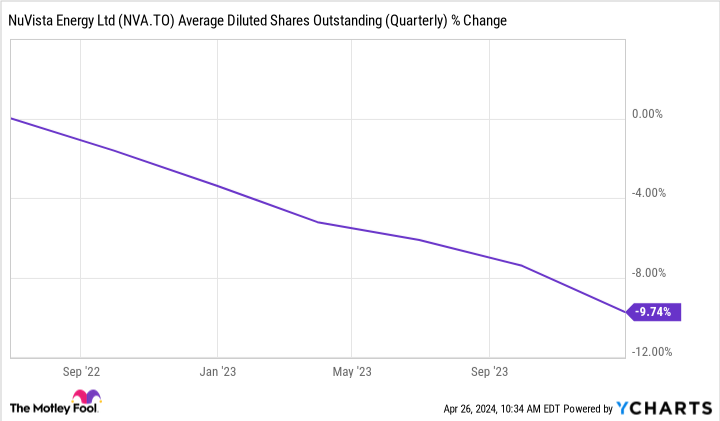

NuVista also maintains low debt levels in its capital structure and has a history of share repurchases. Since 2022, the company has repurchased 29.7 million shares – reducing its total share count by nearly 10%.

NVA Average Diluted Shares Outstanding (Quarterly) data by YCharts

The company allocates approximately 75% of its free cash flow to share repurchase programs annually. If management continues with this strategy, the company’s future earnings and cash flow claims will decrease, increasing the fair value of its remaining common stock.

Investor takeaway

Overall, Torex Gold Resources stock and NuVista Energy stock present potential opportunities for long-term investors. However, it’s important to keep conducting thorough research and consider various other opportunities to widely diversify your portfolio each time you make a new trade.

The post Have $500? 2 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now appeared first on The Motley Fool Canada.

Should you invest $1,000 in Nuvista Energy Ltd. right now?

Before you buy stock in Nuvista Energy Ltd., consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nuvista Energy Ltd. wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance