The 50 Worst Housing Markets in the US for Growth

When buying a home — be it to live in or to rent out to generate passive income — it’s important to know your local housing market conditions. Is it strong, stable and growing? Are mortgage rates decent? Or is it in an irreversible slump?

Find Out: 7 Worst States To Buy Property in the Next 5 Years, According to Real Estate Agents

Try This: How To Get Rich in Real Estate Starting With Just $1,000

GOBankingRates determined the 50 worst housing markets in the U.S. for growth. To do this, we looked at the 200 largest metro statistical areas (MSAs) according to the real estate market and found the one-year percentage change in home value, the two-year percentage change in home value, the mean days from pending to close, the share of listings with a price cut and the mean price cut.

Here are some key findings:

Austin ranks as the worst housing market in America. Most notably, two-year home values have dropped nearly 18%.

The second-worst housing market for growth is New Orleans.

Other Texas markets are also struggling, including, but not limited to, Longview, Laredo and Dallas.

Five of the 10 worst housing markets are in Florida. Among these are North Port, Cape Coral and Crestview.

Read on for details on the 50 U.S. housing markets that are the worst for growth.

50. Salinas, California

June 2024 home value: $844,402

One-year home value change (percentage): 6%

Two-year home value change (percentage): 1.6%

Mean price cut: $80,737

Share of listings with price cut: 20.4%

Mean days to close: 29

Read Next: 10 Countries To Live Outside the US That Are So Cheap You Could Quit Your Job

Be Aware: 20 Best Cities Where You Can Buy a House for Under $100K

It's Going Viral: Want to Retire Rich? Suze Orman Says You're Missing This Key Money Move

49. Orlando, Florida

June 2024 home value: $399,253

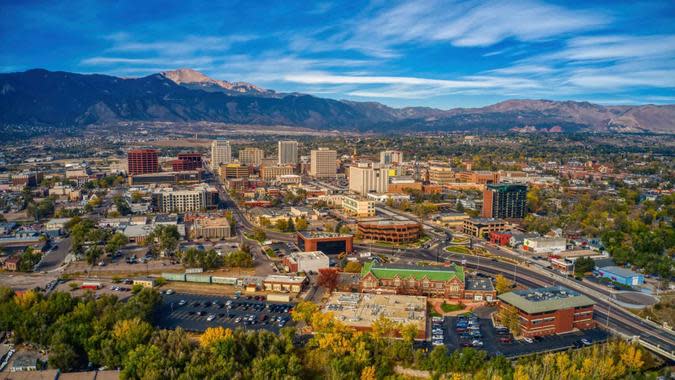

One-year home value change (percentage): 3.2%

Two-year home value change (percentage): 5.3%

Mean price cut: $14,907

Share of listings with price cut: 29.3%

Mean days to close: 34

Check Out: 5 Types of Homes That Will Plummet in Value in 2024

48. Baton Rouge, Louisiana

June 2024 home value: $240,017

One-year home value change (percentage): 1.7%

Two-year home value change (percentage): 3.6%

Mean price cut: $11,512

Share of listings with price cut: 26%

Mean days to close: 34

47. Eugene, Oregon

June 2024 home value: $455,582

One-year home value change (percentage): 1.3%

Two-year home value change (percentage): -0.71%

Mean price cut: $20,297

Share of listings with price cut: 24.3%

Mean days to close: 30

46. Shreveport, Louisiana

June 2024 home value: $174,384

One-year home value change (percentage): 4.1%

Two-year home value change (percentage): 0.15%

Mean price cut: $11,597

Share of listings with price cut: 26%

Mean days to close: 34

45. Reno, Nevada

June 2024 home value: $548,869

One-year home value change (percentage): 4.6%

Two-year home value change (percentage): -5.5%

Mean price cut: $26,683

Share of listings with price cut: 23.2%

Mean days to close: 32

Trending Now: 5 Cities Where Homes Will Be a Total Steal In Two Years

44. Salisbury, Maryland

June 2024 home value: $423,739

One-year home value change (percentage): 2.3%

Two-year home value change (percentage): 3.4%

Mean price cut: $21,070

Share of listings with price cut: 26.5%

Mean days to close: 37

43. Jackson, Mississippi

June 2024 home value: $197,464

One-year home value change (percentage): 0.78%

Two-year home value change (percentage): 3.1%

Mean price cut: $11,977

Share of listings with price cut: 25%

Mean days to close: 36

42. Longview, Texas

June 2024 home value: $218,205

One-year home value change (percentage): 0.3%

Two-year home value change (percentage): 5.6%

Mean price cut: $12,216

Share of listings with price cut: 24.5%

Mean days to close: 26

41. Greeley, Colorado

June 2024 home value: $500,073

One-year home value change (percentage): 0.72%

Two-year home value change (percentage): -4.4%

Mean price cut: $16,690

Share of listings with price cut: 22.9%

Mean days to close: 31

Try This: 5 Worst Florida Cities To Buy Property in the Next 5 Years, According to Real Estate Agents

40. San Francisco

June 2024 home value: $1,180,321

One-year home value change (percentage): 5%

Two-year home value change (percentage): -7.3%

Mean price cut: $69,905

Share of listings with price cut: 17.6%

Mean days to close: 23

39. Laredo, Texas

June 2024 home value: $206,726

One-year home value change (percentage): -3.4%

Two-year home value change (percentage): 0.6%

Mean price cut: $10,330

Share of listings with price cut: 16.1%

Mean days to close: 28

38. Ogden, Utah

June 2024 home value: $498,019

One-year home value change (percentage): 2.6%

Two-year home value change (percentage): -4.4%

Mean price cut: $13,821

Share of listings with price cut: 29.1%

Mean days to close: 28

37. Huntsville, Alabama

June 2024 home value: $309,499

One-year home value change (percentage): 0.48%

Two-year home value change (percentage): 0.48%

Mean price cut: $10,268

Share of listings with price cut: 28.2%

Mean days to close: 32

Explore More: I’m an Economist — Here’s My Prediction for the Housing Market If Trump Wins the Election

36. Myrtle Beach, South Carolina

June 2024 home value: $338,481

One-year home value change (percentage): 1.8%

Two-year home value change (percentage): 4.4%

Mean price cut: $11,694

Share of listings with price cut: 28.2%

Mean days to close: 37

35. Spokane, Washington

June 2024 home value: $417,086

One-year home value change (percentage): 1.5%

Two-year home value change (percentage): -3.8%

Mean price cut: $17,579

Share of listings with price cut: 27.1%

Mean days to close: 29

34. Portland, Oregon

June 2024 home value: $554,847

One-year home value change (percentage): 1.6%

Two-year home value change (percentage): -4.1%

Mean price cut: $23,109

Share of listings with price cut: 24.9%

Mean days to close: 29

33. Pensacola, Florida

June 2024 home value: $309,736

One-year home value change (percentage): 1.8%

Two-year home value change (percentage): 3.6%

Mean price cut: $12,737

Share of listings with price cut: 31.3%

Mean days to close: 34

Read More: 6 Best Florida Suburbs to Buy Property in the Next 5 Years, According to Real Estate Agents

32. Salt Lake City

June 2024 home value: $548,835

One-year home value change (percentage): 2.6%

Two-year home value change (percentage): -4.9%

Mean price cut: $18,638

Share of listings with price cut: 30.2%

Mean days to close: 27

31. Lubbock, Texas

June 2024 home value: $209,214

One-year home value change (percentage): -0.14%

Two-year home value change (percentage): 1.7%

Mean price cut: $9,877

Share of listings with price cut: 29%

Mean days to close: 33

30. Corpus Christi, Texas

June 2024 home value: $224,512

One-year home value change (percentage): 0.33%

Two-year home value change (percentage): 0.05%

Mean price cut: $17,191

Share of listings with price cut: 23%

Mean days to close: 30

29. Waco, Texas

June 2024 home value: $261,013

One-year home value change (percentage): 0.81%

Two-year home value change (percentage): 1.7%

Mean price cut: $13,464

Share of listings with price cut: 28.9%

Mean days to close: 31

Discover More: 5 Southern Cities Where You Can Buy a House for Under $100K

28. Lakeland, Florida

June 2024 home value: $315,149

One-year home value change (percentage): 1.4%

Two-year home value change (percentage): 1.5%

Mean price cut: $10,537

Share of listings with price cut: 30.2%

Mean days to close: 34

27. Killeen, Texas

June 2024 home value: $258,289

One-year home value change (percentage): -1%

Two-year home value change (percentage): -0.94%

Mean price cut: $12,284

Share of listings with price cut: 23.3%

Mean days to close: 32

26. Port St. Lucie, Florida

June 2024 home value: $401,971

One-year home value change (percentage): 2.5%

Two-year home value change (percentage): 2.9%

Mean price cut: $19,065

Share of listings with price cut: 29.6%

Mean days to close: 34

25. Houston

June 2024 home value: $312,052

One-year home value change (percentage): 1.4%

Two-year home value change (percentage): 0.7%

Mean price cut: $15,072

Share of listings with price cut: 28.8%

Mean days to close: 29

For You: 8 Places Where Houses Are Suddenly Major Bargains

24. Nashville, Tennessee

June 2024 home value: $447,170

One-year home value change (percentage): 2%

Two-year home value change (percentage): -0.38%

Mean price cut: $21,392

Share of listings with price cut: 32.2%

Mean days to close: 32

23. Colorado Springs, Colorado

June 2024 home value: $464,036

One-year home value change (percentage): 1.5%

Two-year home value change (percentage): -4.6%

Mean price cut: $13,065

Share of listings with price cut: 31.6%

Mean days to close: 32

22. Denver

June 2024 home value: $592,720

One-year home value change (percentage): 2%

Two-year home value change (percentage): -4.4%

Mean price cut: $19,067

Share of listings with price cut: 32.1%

Mean days to close: 28

21. Honolulu (Urban)

June 2024 home value: $867,057

One-year home value change (percentage): 0.74%

Two-year home value change (percentage): -3.3%

Mean price cut: $34,693

Share of listings with price cut: 18.3%

Mean days to close: 39

Read Next: 6 Best Cities To Buy Property in the Next 5 Years, According to Real Estate Agents

20. Ocala, Florida

June 2024 home value: $279,895

One-year home value change (percentage): 0.4%

Two-year home value change (percentage): 2.6%

Mean price cut: $12,281

Share of listings with price cut: 29.4%

Mean days to close: 34

19. Provo, Utah

June 2024 home value: $533,482

One-year home value change (percentage): 2%

Two-year home value change (percentage): -7%

Mean price cut: $16,036

Share of listings with price cut: 30.1%

Mean days to close: 28

18. Palm Bay, Florida

June 2024 home value: $357,251

One-year home value change (percentage): 1.4%

Two-year home value change (percentage): 1.9%

Mean price cut: $13,739

Share of listings with price cut: 33%

Mean days to close: 32

17. Beaumont, Texas

June 2024 home value: $168,201

One-year home value change (percentage): -1.3%

Two-year home value change (percentage): -3.7%

Mean price cut: $11,861

Share of listings with price cut: 23.6%

Mean days to close: 29

Check Out: Mortgage Rates Are Dropping — 20 Housing Markets With the Most Affordable Home Prices

16. Boise City, Idaho

June 2024 home value: $482,228

One-year home value change (percentage): 4%

Two-year home value change (percentage): -9.5%

Mean price cut: $18,615

Share of listings with price cut: 31%

Mean days to close: 29

15. Jacksonville, Florida

June 2024 home value: $361,530

One-year home value change (percentage): 1.3%

Two-year home value change (percentage): 0.5%

Mean price cut: $13,749

Share of listings with price cut: 31.8%

Mean days to close: 30

14. Lafayette, Louisiana

June 2024 home value: $193,479

One-year home value change (percentage): -2.1%

Two-year home value change (percentage): -2.9%

Mean price cut: $9,305

Share of listings with price cut: 26.3%

Mean days to close: 31

13. Deltona, Florida

June 2024 home value: $346,653

One-year home value change (percentage): 1%

Two-year home value change (percentage): 1%

Mean price cut: $14,388

Share of listings with price cut: 30%

Mean days to close: 33

Try This: You’ll Need at Least $50K Saved To Buy a Home in These 13 Affordable Housing Markets

12. Dallas

June 2024 home value: $381,600

One-year home value change (percentage): 1.1%

Two-year home value change (percentage): -1.2%

Mean price cut: $15,721

Share of listings with price cut: 32%

Mean days to close: 28

11. Boulder, Colorado

June 2024 home value: $747,586

One-year home value change (percentage): 1.2%

Two-year home value change (percentage): -5.7%

Mean price cut: $40,990

Share of listings with price cut: 24.1%

Mean days to close: 27

10. Tampa, Florida

June 2024 home value: $381,941

One-year home value change (percentage): 2.7%

Two-year home value change (percentage): 2.4%

Mean price cut: $16,110

Share of listings with price cut: 35.3%

Mean days to close: 34

9. Phoenix

June 2024 home value: $460,513

One-year home value change (percentage): 4%

Two-year home value change (percentage): -5.6%

Mean price cut: $16,577

Share of listings with price cut: 34.3%

Mean days to close: 31

Learn More: 4 Best International Cities to Buy a House in the Next 5 Years, According to Real Estate Experts

8. Santa Cruz, California

June 2024 home value: $1,181,192

One-year home value change (percentage): 3.9%

Two-year home value change (percentage): -5.7%

Mean price cut: $89,350

Share of listings with price cut: 20%

Mean days to close: 26

7. Naples, Florida

June 2024 home value: $604,606

One-year home value change (percentage): 1.2%

Two-year home value change (percentage): 1.9%

Mean price cut: $46,104

Share of listings with price cut: 25.4%

Mean days to close: 38

6. Crestview, Florida

June 2024 home value: $445,687

One-year home value change (percentage): -0.69%

Two-year home value change (percentage): -0.96%

Mean price cut: $30,520

Share of listings with price cut: 28%

Mean days to close: 33

5. Cape Coral, Florida

June 2024 home value: $390,185

One-year home value change (percentage): -2.3%

Two-year home value change (percentage): -1.9%

Mean price cut: $19,759

Share of listings with price cut: 23.7%

Mean days to close: 33

Consider This: 5 Housing Markets That Will Plummet in Value Before the End of 2025

4. San Antonio

June 2024 home value: $290,483

One-year home value change (percentage): -2.2%

Two-year home value change (percentage): -3.8%

Mean price cut: $12,408

Share of listings with price cut: 31.4%

Mean days to close: 30

3. North Port, Florida

June 2024 home value: $450,116

One-year home value change (percentage): -1.6%

Two-year home value change (percentage): -2.2%

Mean price cut: $24,603

Share of listings with price cut: 33.2%

Mean days to close: 37

2. New Orleans

June 2024 home value: $243,729

One-year home value change (percentage): -6.4%

Two-year home value change (percentage): -11.8%

Mean price cut: $15,512

Share of listings with price cut: 26.8%

Mean days to close: 33

1. Austin, Texas

June 2024 home value: $466,103

One-year home value change (percentage): -4.3%

Two-year home value change (percentage): -17.7%

Mean price cut: $25,088

Share of listings with price cut: 29.5%

Mean days to close: 23

Methodology: For this piece, GOBankingRates looked at the 200 largest metro statistical areas (MSA) according to the real estate market and found the following 10 factors. For each MSA, GOBankingRates found (1) a one-year percentage change in home value, (2) a one-year change in home value in USD, (3) a two-year percentage change in home value, (4) a two-year change in home value in USD, (5) for-sale inventory, (6) mean days from listing to pending, (7) mean list-to-sale ratio, (8) mean days from pending to close, (9) share of listings with a price cut, and (10) mean price cut. All data was sourced from Zillow’s June 2024 data. All 10 factors were then scored and combined with the highest score being the worst housing markets. In final calculations, factors (1), (2), (9) and (10) were weighted 2x and factor (5) was weighted 0.5x. All data was collected and is up to date as of Jul. 29, 2024.

More From GOBankingRates

5 Low-Risk Accounts Financially Savvy People Trust for Reliable Returns (And How You Can Use Them)

6 Subtly Genius Moves All Wealthy People Make With Their Money

This Free Money Move Could Nearly Double Your Lifetime Investment Returns

This article originally appeared on GOBankingRates.com: The 50 Worst Housing Markets in the US for Growth

Yahoo Finance

Yahoo Finance