5 Stocks With Recent Dividend Hikes to Watch

Wall Street’s popular adages are not matching this year. April is historically known as being favorable to investors. But this year, April ended on a disappointing note. For May, the popular adage is “Sell and Go Away.” However, May 2024 turned out highly successful for U.S. stock markets.

The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — were up 2.3%, 4.8% and 6.9%, respectively. The tech-heavy Nasdaq Composite recorded its best month since November 2023. On May 31, the blue-chip Dow soared 1.5% or 574.84 points, marking its best daily performance in 2024.

On Jun 5, the tech-heavy Nasdaq Composite closed at 17,187.92, marking a fresh all-time high. Wall Street’s broad-market benchmark — the S&P 500 Index —finished at a new closing high of 5,354.03. This was the 25th record closing high for the S&P 500 in 2024.

However, we are not out of the woods. The inflation rate is still elevated. In the May FOMC meeting, almost all Fed officials wanted the existing Fed fund rate to prevail. Notably, the market interest rate has been kept static in the range of 5.25-5.5% since July 2023. Currently, the range is at its 23-year high.

More importantly, some policymakers argued that rates should be increased if needed. "Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate,” according to the minutes of the last FOMC meeting.

Stocks in Focus

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — Enact Holdings Inc. ACT, SEI Investments Co. SEIC, NetApp Inc. NTAP, Royal Bank of Canada RY and Donaldson Co. Inc. DCI.

Enact Holdings operates as a private mortgage insurance company in the United States. ACT engages in writing and assuming residential mortgage guaranty insurance. ACT primarily serves originators of residential mortgage loans.

Enact Holdings also offers private mortgage insurance products primarily insuring prime-based, individually underwritten residential mortgage loans, contract underwriting services for mortgage lenders, and mortgage-related reinsurance products. ACT currently carries a Zacks Rank #3 (Hold).

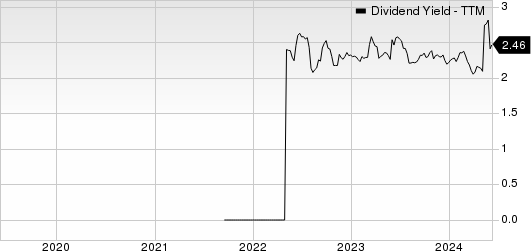

On May 29, 2024, Enact Holdings declared that its shareholders would receive a dividend of $0.185 per share on Jun 13, 2024. It has a dividend yield of 2.5%. Over the past five years, ACT has increased its dividend five times, and its payout ratio presently stays at 21% of earnings. Check ACT’s dividend history here.

Enact Holdings, Inc. Dividend Yield (TTM)

Enact Holdings, Inc. dividend-yield-ttm | Enact Holdings, Inc. Quote

SEI Investments has been benefiting from its global presence, diverse product offerings, solid balance sheet, strategic buyouts and robust assets under management balance. SEIC’s plans of continuing to expand inorganically will help in accelerating growth in the long run.

Further, SEI Investments’ technological innovations, along with the rising demand for the SEI Wealth Platform across financial institutions, are likely to aid financials. SEIC currently carries a Zacks Rank #3.

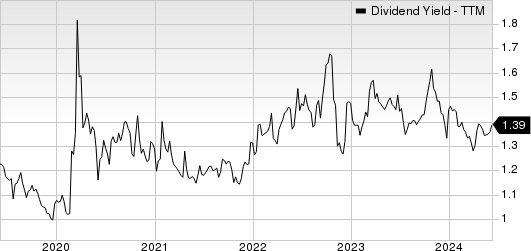

On May 29, 2024, SEI Investments declared that its shareholders would receive a dividend of $0.46 per share on Jun 18, 2024. It has a dividend yield of 2.8%. Over the past five years, SEIC has increased its dividend five times, and its payout ratio presently stays at 25% of earnings. Check SEIC’s dividend history here.

SEI Investments Company Dividend Yield (TTM)

SEI Investments Company dividend-yield-ttm | SEI Investments Company Quote

NetApp is benefiting from steady traction across its expanded all-flash product portfolio and improved operational discipline. In the fiscal third quarter, NTAP’s All-Flash Array Business’s annualized revenue run rate was $3.4 billion, up 21% year over year. We expect the metric to increase 3.7% for fiscal 2024.

NetApp’s advanced portfolio of ransomware protection solutions is likely to gain momentum amid rising cybersecurity risks. NTAP’s hyper-scaler partnerships and natively integrated storage services will help tap the ongoing demand for generative AI. Frequent product launch initiatives are tailwinds. NTAP currently carries a Zacks Rank #3.

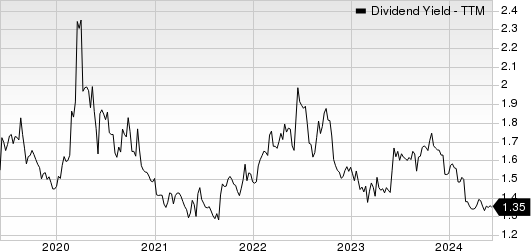

On May 30, 2024, NetApp declared that its shareholders would receive a dividend of $0.52 per share on Jul 24, 2024. It has a dividend yield of 1.8%. Over the past five years, NTAP has increased its dividend three times, and its payout ratio presently stays at 39% of earnings. Check NTAP’s dividend history here.

NetApp, Inc. Dividend Yield (TTM)

NetApp, Inc. dividend-yield-ttm | NetApp, Inc. Quote

Royal Bank of Canada operates as a diversified financial service company worldwide. Royal Bank of Canada operates in four segments — Personal & Commercial Banking, Wealth Management, Capital Markets and Insurance. RY currently carries a Zacks Rank #3.

RY operates under the master brand name of RBC. RY is Canada's largest bank as measured by assets and market capitalization, and one of North America's leading diversified financial services companies.

On May 30, 2024, Royal Bank of Canada declared that its shareholders would receive a dividend of $1.03 per share on Aug 23, 2024. It has a dividend yield of 3.8%. Over the past five years, RY has increased its dividend 16 times, and its payout ratio presently stays at 48% of earnings. Check RY’s dividend history here.

Royal Bank Of Canada Dividend Yield (TTM)

Royal Bank Of Canada dividend-yield-ttm | Royal Bank Of Canada Quote

Donaldson is well-positioned to benefit from its focus on innovation, growth investments and a healthy demand scenario in the quarters ahead. Continued strength in DCI’s dust collection sales and power generation project timing within the industrial filtration solutions business is driving the Industrial Solutions segment.

Recovery in Disk Drive demand is boosting DCI’s Life Sciences segment. Synergies from the Univercells acquisition bolster Donaldson’s growth. DCI currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

On May 31, 2024, Donaldson declared that its shareholders would receive a dividend of $0.27 per share on Jun 28, 2024. It has a dividend yield of 1.5%. Over the past five years, DCI has increased its dividend five times, and its payout ratio presently stays at 32% of earnings. Check DCI’s dividend history here.

Donaldson Company, Inc. Dividend Yield (TTM)

Donaldson Company, Inc. dividend-yield-ttm | Donaldson Company, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance