5 Stocks With Recent Dividend Hike in a Volatile September

Wall Street has seen an impressive bull run in the first seven months of 2023. However, U.S. stock markets lost momentum over the past one-and-a half months. Market participants are uncertain about the Fed’s future move on monetary policies. Last week, the S&P 500 and the Nasdaq Composite posted two consecutive weeks of decline.

At present, the CME FedWatch is showing a 99% probability that the central bank will keep the interest rate unchanged at the existing rate of 5.25-5.5% in its FOMC meeting, which started on Sep 19. Notably, this is the highest Fed fund rate since March 2001.

However, there exists a 29% probability that the benchmark interest rate will be hiked by another 25 basis points or more in the November FOMC meeting. In this regard, the post-FOMC meeting statement of Fed Chairman Jerome Powell, to be delivered at 2 PM on Sep 20, will have immense importance.

Stocks to Watch

September is historically known as the worst-performing month on Wall Street. At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe that one should consider stocks that have recently raised their dividend payments.

Five such companies are — Phillips Edison & Co. Inc. PECO, Verizon Communications Inc. VZ Fifth Third Bancorp FITB, Everest Group Ltd. EG, and InterDigital Inc. IDCC.

Phillips Edison & Co. is one of the largest owners and operators of omni-channel grocery-anchored neighborhood shopping centers in the United States. PECO owns equity interests in real estate properties, including wholly-owned real estate properties and shopping center properties. PECO currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

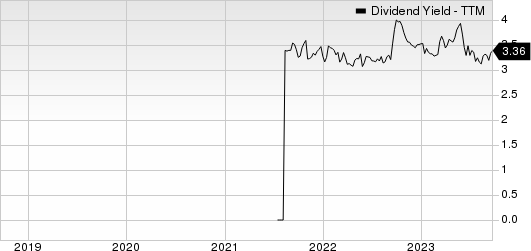

On Sep 5, 2023, Phillips Edison & Co. declared that its shareholders would receive a dividend of $0.0975 per share on Nov 1, 2023. It has a dividend yield of 3.2%. Over the past five years, PECO has increased its dividend three times, and its payout ratio presently stays at 48% of earnings. Check PECO’s dividend history here.

Phillips Edison & Company, Inc. Dividend Yield (TTM)

Phillips Edison & Company, Inc. dividend-yield-ttm | Phillips Edison & Company, Inc. Quote

Verizon Communications provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. VZ operates in two segments, namely, Verizon Consumer Group (Consumer) and Verizon Business Group (Business). VZ offers communication services in the form of local phone service, long distance, wireless and data services. VZ currently carries a Zacks Rank #2.

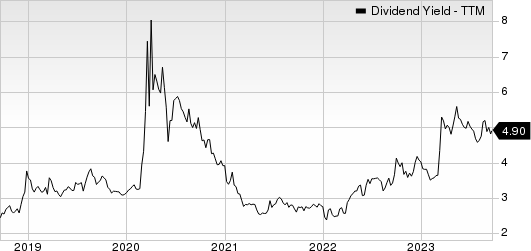

On Sep 7, 2023, Verizon Communications declared that its shareholders would receive a dividend of $0.665 per share on Nov 1, 2023. It has a dividend yield of 7.7%. Over the past five years, VZ has increased its dividend six times, and its payout ratio presently stays at 53% of earnings. Check VZ’s dividend history here.

Verizon Communications Inc. Dividend Yield (TTM)

Verizon Communications Inc. dividend-yield-ttm | Verizon Communications Inc. Quote

Fifth Third Bancorp operates as a diversified financial services company in the United States. FITB operates through four segments: Branch Banking provides deposit and loan products, and credit cards to individuals and small businesses. Consumer Lending includes residential mortgage, automobile, and other indirect lending activities.

The Commercial Banking unit provides credit intermediation, cash management and financial services to large and middle-market businesses, governments and professional customers. The Wealth and Asset Management division offers a full range of wealth management services to individuals, companies and non-profit organizations. FITB currently carries a Zacks Rank #3 (Hold).

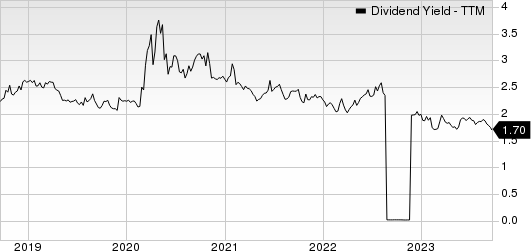

On Sep 11, 2023, Fifth Third Bancorp declared that its shareholders would receive a dividend of $0.35 per share on Oct 16, 2023. It has a dividend yield of 5.3%. Over the past five years, FITB has increased its dividend six times, and its payout ratio presently stays at 36% of earnings. Check FITB’s dividend history here.

Fifth Third Bancorp Dividend Yield (TTM)

Fifth Third Bancorp dividend-yield-ttm | Fifth Third Bancorp Quote

Everest Group provides reinsurance and insurance products in the United States, Bermuda, and internationally. EG operates through Reinsurance Operations and Insurance Operations segments. EG’s business strategy is to sustain its leadership position within targeted reinsurance and insurance markets, and provide effective management throughout the property and casualty underwriting cycle. EG currently carries a Zacks Rank #2.

On Sep 11, 2023, Everest Group declared that its shareholders would receive a dividend of $1.75 per share on Sep 29, 2023. It has a dividend yield of 1.9%. Over the past five years, EG has increased its dividend five times, and its payout ratio presently stays at 20% of earnings. Check EG’s dividend history here.

Everest Group, Ltd. Dividend Yield (TTM)

Everest Group, Ltd. dividend-yield-ttm | Everest Group, Ltd. Quote

InterDigital is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. IDCC is engaged in designing and developing a wide range of advanced technology solutions, which are used in digital cellular, wireless 3G, 4G and IEEE 802-related products and networks. IDCC currently carries a Zacks Rank #3.

On Sep 13, 2023, InterDigital declared that its shareholders would receive a dividend of $0.40 per share on Oct 25, 2023. It has a dividend yield of 1.9%. Over the past five years, EG has increased its dividend once, and its payout ratio presently stays at 20% of earnings. Check IDCC’s dividend history here.

InterDigital, Inc. Dividend Yield (TTM)

InterDigital, Inc. dividend-yield-ttm | InterDigital, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Phillips Edison & Company, Inc. (PECO) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance