5 Stocks to Buy From a Thriving Heavy Construction Industry

The Zacks Building Products - Heavy Construction industry is poised to sustain its momentum, driven by a significant infrastructure drive led by the U.S. government. This initiative aims to bolster the nation's roads, bridges and broadband connectivity. Companies in the industry are capitalizing on increased demand across various industries, including communications, power transmission and other infrastructure projects. Despite encountering challenges such as project delays, a competitive labor market and escalating costs, firms like EMCOR Group Inc. EME, Dycom Industries, Inc. DY, Granite Construction Incorporated GVA, Tutor Perini Corporation TPC and Great Lakes Dredge & Dock Corp. GLDD are well-positioned to seize opportunities in the robust market landscape. While macroeconomic factors may influence some customer plans, these companies remain poised for growth in this dynamic industry.

Industry Description

The Zacks Building Products - Heavy Construction industry consists of mechanical and electrical construction, industrial and energy infrastructure as well as building service providers. This industry comprises heavy civil construction companies that specialize in the building and reconstruction of transportation projects, including highways, roads, bridges, airfields, ports and light rail. The companies serve commercial, industrial, utility and institutional clients. The industry players are engaged in the engineering, construction and maintenance of communications infrastructure, oil and natural gas pipelines, as well as processing facilities for energy and utility industries. These firms are also engaged in mining and dredging services in the United States and internationally.

4 Trends Shaping the Future of the Heavy Construction Industry

U.S. Administration’s Infrastructural Endeavor: The announcement of the U.S. administration’s massive infrastructure plan to build modern, sustainable infrastructure and a clean future will have major implications for the U.S. economy and the construction industry over the next five years. The administration’s plan for accelerated investments in far-reaching areas, from roads and bridges to green spaces, water systems, electricity grids, as well as universal broadband, laid a new foundation for sustainable growth, withstanding the impacts of climate change and improving public health, including access to clean air and clean water. The aforesaid infrastructural expansion plan should be a boon for construction-related companies.

Strong Prospects in Telecommunication: The ramp-up of projects related to 5G has been a silver lining for the industry players. The increased demand from telecom customers for wireline networks, wireless/wireline converged networks and wireless networks using 5G technologies has been benefiting industry players. Construction work for communications is expected to pick up on huge investments in network expansion. Also, the industry is poised to gain from a significant number of project awards across multiple segments, including communications, health care, transmission and power, along with infrastructural projects in domestic and international markets.

Solid Inorganic Moves & Renewable Business Prospects: Acquisitions have been companies’ preferred mode of solidifying product portfolios and leveraging new business opportunities. Again, due to increased renewable project activity and the expansion of services in biomass and other smaller production facilities, the power generation and industrial construction market is poised to see sizable growth. The companies are well-positioned to gain from the renewable energy drive of the pro-environmental Biden administration. The development and deployment of technology solutions across the full spectrum of decarbonization efforts, comprising all facets of infrastructure for providing carbon-free energy solutions, should benefit the companies going forward.

Macroeconomic Challenges: The biggest headwinds for the industry players are centered around macroeconomic challenges and labor availability. In addition to a tight labor market, a rise in raw material costs is a concern. Meanwhile, the businesses of the industry players are susceptible to the cyclical nature of the markets in which clients operate and are dependent on the timing and funding of new awards. Hence, volatility in credits and operating risks associated with economic down cycles are pressing concerns. Macroeconomic effects may dampen the near-term execution of some customer plans.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Building Products - Heavy Construction industry is a 10-stock group within the broader Zacks Construction sector. The industry currently carries a Zacks Industry Rank #1, which places it in the top 1% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a higher earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Since March 2024, the industry’s earnings estimates for 2024 have increased to $4.01 per share from $3.64.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Sector & the S&P 500

The Zacks Building Products - Heavy Construction industry has performed better than the broader Zacks Construction sector and the Zacks S&P 500 Composite over the past year.

Stocks in this industry have collectively gained 56.8% versus the broader sector’s 31.2% rally. Meanwhile, the S&P 500 has jumped 23.2% in the said period.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is a commonly used multiple for valuing heavy construction stocks, the industry is currently trading at 21X versus the S&P 500’s 21.1X and the sector’s 16.6X.

Over the past five years, the industry has traded as high as 21.9X, as low as 7.5X and at a median of 13.7X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

5 Heavy Construction Stocks to Buy

Here, we have discussed five stocks from the industry that have solid earnings growth potential. The chosen companies currently carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR Group: Headquartered in Norwalk, CT, this company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment, comprising the U.S. Mechanical and Electrical Construction units, as well as disciplined cost control, project execution strategies and acquisition policies. The company has been gaining from resilient demand for its services, primarily in high-tech manufacturing, network and communications, manufacturing and industrial and healthcare, as well as across the EV value chain, which sparked its growth momentum. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EMCOR, currently sporting a Zacks Rank #1, has surged 117% over the past year. Also, 2024 earnings estimates have increased to $16.10 per share from $14.50 over the past 60 days. Earnings for 2024 are expected to grow 20.7%. EME surpassed earnings estimates in all the trailing four quarters, with the average surprise being 32%.

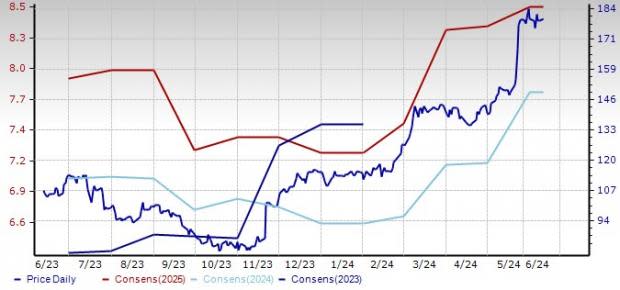

Price and Consensus: EME

Dycom: Based in Palm Beach Gardens, FL, Dycom is a specialty contracting service provider in the United States. The company is reaping the benefits of a robust mix and a steady stream of projects in expanding market sectors driven by long-term secular trends. These sectors include high-tech, traditional manufacturing, and network & communications. The company has been benefiting from the higher demand for network bandwidth and mobile broadband, extended geographic reach and proficient program management and network planning services. Yet, the increasing prices for capital equipment are causes of concern. Also, macroeconomic uncertainty may dampen its customers’ plans. Nonetheless, the prospects of the Telecommunication business look good, given the increased customer needs to expand capacity and improve the performance of existing networks, and, in certain instances, deploy new networks. Backlog ($9.18 billion) activity at the end of the fiscal first quarter reflects a solid performance, with bookings of new works and renewing existing works. Dycom expects considerable opportunities across an array of customers.

Dycom, currently sporting a Zacks Rank #1, has soared 68.1% over the past year. Also, fiscal 2025 earnings estimates have increased to $7.78 per share from $7.14 over the past 30 days. Earnings for fiscal 2025 are expected to grow 5.6%. DY surpassed earnings estimates in three of the trailing four quarters but missed on one occasion, with the average surprise being 30.2%.

Price and Consensus: DY

Granite Construction: Based in Watsonville, CA, this company is an infrastructure contractor and a construction materials producer in the United States. Granite Construction has recently restructured its operations to enhance its Construction and Materials segments, aiming to drive significant top-line and bottom-line growth. Construction segment leadership will support regional growth strategies and project execution, leveraging company-wide resources to better serve national clients. Meanwhile, the company has heavily invested in the Materials segment through acquisitions and strategic investments, positioning the segment for further growth through organic investments and M&A. Despite a flat CAP (Capital Allocation Plan) from the fourth quarter of 2023 to the first quarter of 2024, the year-over-year increase and strong market conditions in both public and private sectors, particularly in California, signal growth expectations for 2024. GVA's focus on best-value projects, representing $2.5 billion or 46% of total CAP, highlights its strategic approach to project management and risk assessment. With 87 best-value projects completed or under contract over the past 15 years, GVA's new structure is set to enhance its ability to deliver higher returns to shareholders, leveraging its longstanding regional partnerships and vertical integration strategy.

GVA, currently flaunting a Zacks Rank #1, has gained 50.8% over the past year. Also, 2024 earnings estimates have increased to $4.76 per share from $4.29 over the past 60 days. Earnings for 2024 are expected to grow 51.6%. It carries an impressive VGM Score of B.

Price and Consensus: GVA

Tutor Perini: Based in Sylmar, CA, Tutor Perini provides diverse services such as general contracting, construction management, and design-build solutions to private clients and public agencies in the United States and abroad. The company appears well-positioned to benefit from the $1.2 trillion federal infrastructure law over the next few years. Notably, its operating cash flow for the first quarter of 2024 was the second-highest since the 2008 merger of Tutor-Saliba Corporation and Perini Corporation, driven by strong collection activities, including $50 million from recent settlements and dispute resolutions. The company expects strong operating cash flow throughout the rest of 2024 and into 2025. As of Mar 31, 2024, the backlog grew to $10 billion, a 26% increase from $7.9 billion a year earlier, indicating strong growth prospects.

Tutor Perini, currently sporting a Zacks Rank #1, has surged 181.7% over the past year. Earnings estimates for 2024 have increased to $1.10 per share from 92 cents over the past 60 days. Earnings for 2024 are expected to grow 133.3%. It carries an impressive VGM Score of A.

Price and Consensus: TPC

Great Lakes Dredge & Dock: This Houston, TX-based company provides dredging services in the United States and internationally. The company is the largest provider of dredging services in the United States. Strong domestic dredging operations, high equipment utilization and solid project execution are expected to drive growth of the company. With a record $8.7 billion budget approved in the first quarter for the 2024 U.S. Army Corps of Engineers, the bid market is anticipated to be robust and remain strong, especially in its key capital and coastal protection target markets. Great Lakes remained committed to its strategic expansion into the U.S. offshore wind market, recognizing the pivotal role offshore wind will play in America's decarbonization efforts and clean energy objectives. With a focus on long-term diversification and growth opportunities, GLDD sees immense potential in offshore wind power generation. Bolstered by its extensive backlog, enhanced fleet and strategic initiatives, GLDD is optimally positioned to thrive in the flourishing dredging bid market.

Great Lakes, currently sporting a Zacks Rank #1, has rallied 22.8% over the past year. Earnings estimates for 2024 have increased to 73 cents per share from 58 cents over the past 30 days. Earnings for 2024 are expected to grow 421.4%. GLDD surpassed earnings estimates in all the trailing four quarters, with the average surprise being 184.3%. It carries an impressive VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

Price and Consensus: GLDD

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Great Lakes Dredge & Dock Corporation (GLDD) : Free Stock Analysis Report

Tutor Perini Corporation (TPC) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance