5 Reasons Why Adobe Stock is Worth Adding to Your Portfolio

Adobe Systems Incorporated ADBE is currently one of the top-performing stocks in the technology sector, and an increase in share price and strong fundamentals signal its bull run.Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed extremely well in the past few months and has the potential to carry on the momentum in the near term as well.

What Makes it an Attractive Pick?

Share Price Appreciation: A glimpse of the company’s price trend shows that the stock has had an impressive run on the bourses over the past three months. Adobe has returned 76.39%, comparing favorably with the industry’s rally of 22.79%.

Solid Rank & VGM Score: Currently, Adobe sports a Zacks Rank #1 (Strong Buy) and has a Momentum Score of B. Our research shows that stocks with a Momentum Score of A or B, when combined with a Zacks Rank #1 or #2 (Buy) offer the best investment opportunities for investors. Thus, the company appears to be a convincing investment proposition at the moment.

Northward Estimate Revisions: For the current year, 12 estimates have moved north over the past 60 days against no southward revision, reflecting analysts’ confidence in the stock. Over the same period, the Zacks Consensus Estimate for the current year has increased 4%. Also, for fiscal 2019, the Zacks Consensus Estimate has moved up 4% over the same time frame to $7.49.

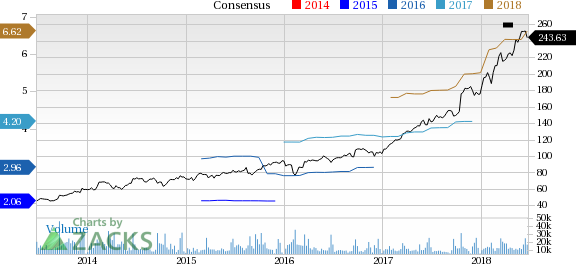

Strong Growth Prospects: The Zacks Consensus Estimate for fiscal 2018 earnings of $6.62 reflects year-over-year growth of 53.60%. Moreover, earnings are expected to grow 13.12% in fiscal 2019. The stock has a long-term expected earnings per share growth rate of 16.20%.

Growth Drivers: Adobe has been making great efforts toward establishing its presence in cloud-related software areas such as documents and marketing.

Adobe’s Creative Cloud software is witnessing strong demand, which is adding to its subscriber base. Continued growth of Adobe Document Cloud subscriptions and Adobe Experience Cloud is aiding the company.Adobe Experience Manager is also growing robustly, enabling brands to offer a personalized experience.

In the last reported quarter, revenues increased 6% sequentially and 23.9% year over year to $2.20 billion, beating the Zacks Consensus Estimate of $2.15 billion. Also, non-GAAP earnings of $1.66 per share also surpassed the Zacks Consensus Estimate of $1.54.

We believe that this growth momentum will continue to be driven by strong demand for the company’s innovative solutions and products, strength across geographies, and growing subscriptions for its cloud application.

We remain optimistic about Adobe’s market position, compelling product lines, continued innovation, strong cash-flow generation and solid balance sheet. Also, the company’s expansion in growing markets such as artificial intelligence and machine-learning framework is a big positive.

Adobe Systems Incorporated Price and Consensus

Adobe Systems Incorporated Price and Consensus | Adobe Systems Incorporated Quote

Other Stocks to Consider

Other top-ranked stocks in the same industry include Groupon GRPN, PetMed Express PETS and Expedia EXPE. While Groupon sports a Zacks Rank #1, PetMed and Expedia both carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Groupon, PetMed and Expedia is currently projected to be 6.5%, 10% and 14.5%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PetMed Express, Inc. (PETS) : Free Stock Analysis Report

Expedia, Inc. (EXPE) : Free Stock Analysis Report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

Adobe Systems Incorporated (ADBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance