5 Reasons to Add Regency Centers (REG) to Your Portfolio Now

The increase in consumers’ preference for in-person shopping experiences following the pandemic downtime has been driving the recovery in the retail real estate industry.

Given this backdrop, Regency Centers Corp.’s REG portfolio of premium shopping centers in the affluent suburban areas and near urban trade areas of the United States, having strong growth drivers, positions it well for growth. Also, an encouraging development pipeline and balance-sheet strength bode well.

Regency’s fourth-quarter 2022 results reflected healthy leasing activity and a year-over-year improvement in the base rent. Management expects 2023 NAREIT funds from operations (FFO) per share in the range of $4.03-$4.11.

Analysts seem bullish on this Jacksonville, FL-based Zacks Rank #2 (Buy) company. The Zacks Consensus Estimate for this retail real estate investment trust’s (REIT) 2023 funds from operations (FFO) per share indicates a favorable outlook as it has moved marginally upward over the past month to $4.08.

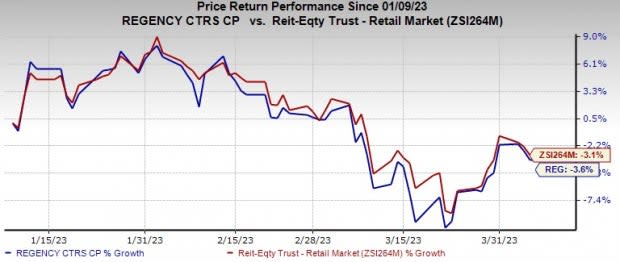

Shares of REG have lost 3.6% in the past three months compared with its industry's fall of 3.1%. Nonetheless, given its robust fundamentals and positive estimate revisions, the stock is likely to keep performing well in the quarters ahead. Hence the dip offers a good entry point.

Image Source: Zacks Investment Research

What Makes Regency Centers a Solid Pick?

Solid Industry Fundamentals: Regency’s premium shopping centers are situated in affluent suburban areas and near the urban trade areas where consumers have high spending power. With more people moving into the suburbs due to post-pandemic migration and the hybrid work setup, Regency’s suburban-shopping-center portfolio is likely to benefit as the best-in-class operators are opening new locations in high-quality centers.

Focus on Grocery-Anchored Shopping Centers: REG’s focus on necessity, service, convenience and value retailers serving the essential needs of the communities provides it with an unequaled strategic advantage. Its portfolio comprises 80% of the grocery-anchored neighborhood and community centers, which are necessity-driven by nature. This ensures dependable traffic and allows the company to bank on its grocery centers during uncertain times.

Also, its portfolio has a good tenant mix with several industry-leading grocers. Of the top 10 tenants, six are high-performing grocers. This assures a stable revenue generation for the company.

Acquisitions & Development: To enhance its portfolio, REG has been making acquisitions and developments in key markets of the United States. In 2022, the company’s acquisitions totaled $210 million (at Regency’s share), encompassing 1.15 million gross leasable area.

Moreover, REG has an encouraging development pipeline. As of Dec 31, 2022, its in-process development and redevelopment projects had estimated net project costs of $301 million (at the company’s share). So far, it has incurred 51% of the costs. Management anticipates incurring $130 million of development and redevelopment spend for 2023. Such efforts bode well for the company’s long-term growth.

Balance Sheet & Cash Flow Strength: Regency maintains a healthy balance-sheet position with ample liquidity and a low leverage level. As of Dec 31, 2022, it had full capacity under its $1.2-billion revolving credit facility, a pro-rata net debt-to-operating EBITDAre ratio of 5.0 and a fixed charge coverage ratio of 4.7.

Also, its investment grade credit ratings of BBB+/Baa1 with stable outlooks from S&P Global and Moody's, respectively, render it favorable access to the debt market. With strong financial footing and enough financial flexibility, REG is well-positioned to capitalize on growth opportunities.

REG’s current cash flow growth is projected at 21.54% compared with the 14.01% estimated for the industry. Moreover, its trailing 12-month return on equity (ROE) is 7.59% compared with the industry’s average of 5.65%. This reflects that the company is more efficient in using shareholders’ funds than its peers.

Dividend: Solid dividend payouts are arguably the biggest attraction for REIT investors, and Regency remains committed to that. Since 2014, this retail REIT has steadily increased its dividend payments and continued with its payments even during the pandemic.

In November 2022, concurrent with its third-quarter earnings release, Regency Centers increased the quarterly cash dividend payment on its common stock from 62.50 cents per share to 65 cents, marking a 4% rise.

Given the company’s solid operating platform, the scope for growth and a decent financial position compared to the industry, this dividend rate is expected to be sustainable.

Other Stocks to Consider

Some other top-ranked stocks from the retail REIT sector are Federal Realty Investment Trust FRT, Essential Properties Realty Trust EPRT and Urstadt Biddle Properties UBA, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Federal Realty’s ongoing year’s FFO per share is pegged at $6.47.

The Zacks Consensus Estimate for Essential Properties Realty Trust’s 2023 FFO per share is pegged at $1.64.

The Zacks Consensus Estimate for Urstadt Biddle Properties’ current-year FFO per share is pegged at $1.60.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Urstadt Biddle Properties Inc. (UBA) : Free Stock Analysis Report

Essential Properties Realty Trust, Inc. (EPRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance