5 Packaging Stocks to Watch in a Challenging Industry

The Zacks Containers - Paper and Packaging industry has been facing weak demand due to lower consumer spending amid an inflationary backdrop and high interest rates. Pricing actions implemented by the industry players will help offset the impacts of supply-chain disruptions and elevated costs. The industry will gain support from rising e-commerce activities, and solid demand for sustainable and eco-friendly packaging options due to increasing environmental concerns.

Companies like Packaging Corporation of America PKG, Amcor plc AMCR, AptarGroup ATR, Sealed Air SEE and Greif, Inc. GEF are set to gain from their efforts to capitalize on these trends.

About the Industry

The Zacks Containers - Paper and Packaging industry comprises companies that manufacture paper and plastic packaging products. The packaging solutions provided by the industry help protect and preserve products, extend the shelf life, and cut down on wastage and loss across the wide and lengthy range of distribution channels. The products range from containerboard and corrugated packaging to flexible and rigid plastic packaging. Some companies manufacture dispensing pumps, closures, aerosol valves and applicators for the beauty, personal, home care and healthcare markets. The industry serves a wide array of markets, including food, beverage, food services and other consumer products, such as beauty, personal care and home care. They also cater to the chemical, agribusiness, medical, pharmaceutical, electronics and industrial markets, to name a few.

What's Shaping the Future of the Containers - Paper and Packaging Industry

Persisting Low Volumes & High Costs Pose Challenges: Industry participants have been witnessing declines in volumes due to lower consumer spending on goods, which mainly reflected the persisting inflationary scenario. Also, customers have been lowering their inventory, which had built up in response to high demand and supply-chain issues. This had an impact on the top-line performances of packaging companies. They also encountered supply-chain disruptions, and higher material, labor and transportation costs. The companies have been implementing cost-reduction actions for a while in this situation to sustain margins. They have also been streamlining their operations and taken steps to realign with high-growth key markets to bolster their performances. There are also signs that supply-chain issues are easing and customer destocking seems to be over, which could bring some relief in the near future.

E-commerce Acts as a Key Catalyst: With rising e-commerce activities over the past few years and the pandemic accelerating it further, the importance of packaging has increased manifold as it maintains the integrity and durability of a product. Packaging also helps withstand the complex product delivery process. Per Statista, global revenues in the eCommerce market are projected at $4.117 trillion in 2024. This is expected to accelerate and reach $6.478 trillion by 2029, seeing a compound annual growth rate (CAGR) of 9.49%. The user base is expected to reach 3.6 billion in 2029. These solid projections bode well for the Containers - Paper and Packaging industry. Also, the industry has significant exposure (more than 60%) to consumer-oriented end markets, such as food and beverages, and healthcare. Demand for packaging applications remains fairly stable for these sectors across economic cycles, thus ensuring consistent demand for packaging solutions.

Demand for Eco-Friendly Packaging to Aid Industry: The preference for environmentally friendly biodegradable packaging materials is witnessing a steady rise globally, courtesy of customers’ increasing awareness of environmental issues. The industry is constantly striving to meet the same by adopting the latest technology and bringing innovative products. Industry players have begun incorporating recycled content into production methods. By maximizing recycling, the industry can implement environmentally and economically sustainable production methods.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Containers - Paper and Packaging industry is an 11-stock group within the broader Zacks Industrial Products sector. The industry currently carries a Zacks Industry Rank #144, which places it at the bottom 42% of the 248 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates weak prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. Over the past 12 months, the industry's earnings estimates for 2024 and 2025 have both moved down 7%.

Despite the dim near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it is worth taking a look at the industry’s shareholder returns and current valuation first.

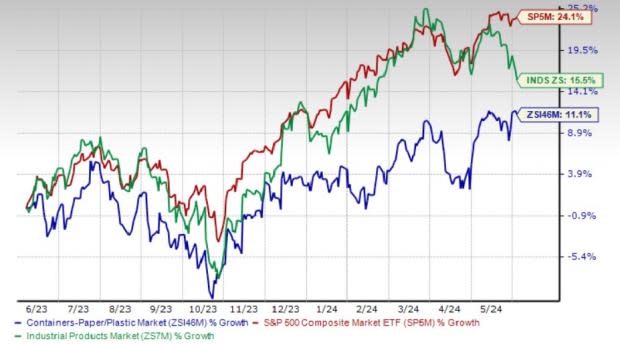

Industry Versus Broader Market

The Containers - Paper and Packaging industry has underperformed the S&P 500 and the sector over the past year. The industry has gained 11.1% compared with the S&P 500’s growth of 24.1%. The Industrial Products sector has meanwhile risen 15.5%.

One-Year Price Performance

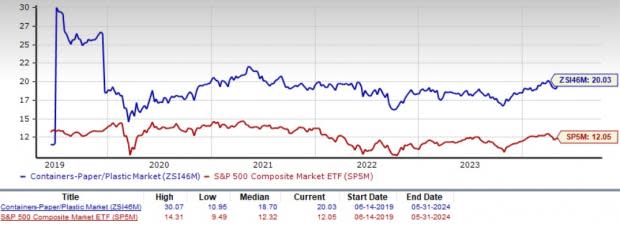

Industry's Current Valuation

On the basis of the forward 12-month EV/EBITDA ratio, a commonly used multiple for valuing Containers - Paper and Packaging companies, we see that the industry is currently trading at 20.03 compared with the S&P 500’s 12.05X and the Industrial Products sector’s forward 12-month EV/EBITDA of 13.68X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Over the last five years, the industry traded as high as 30.07X and as low as 10.95X, the median being 18.70X.

5 Containers - Paper and Packaging Stocks to Keep an Eye on

AptarGroup: The company’s Beauty segment will continue to gain from increased demand for beauty and personal care markets. The Pharma segment is benefitting from steady demand growth for prescription and consumer healthcare. Given the ongoing sales momentum in elastomer components and active material solutions, AptarGroup is expanding its capacity to produce elastomer components for injected medicines and active material science solutions, which will drive near-term growth. The company’s ongoing business transformation plan is expected to drive top-line growth, boost operational excellence and improve organizational effectiveness. Backed by its efforts to bring innovative products into the market, the company remains the preferred choice for renowned brands worldwide. Focus on acquisitions to expand the scope of technologies, geographic presence and product offerings will also aid growth.

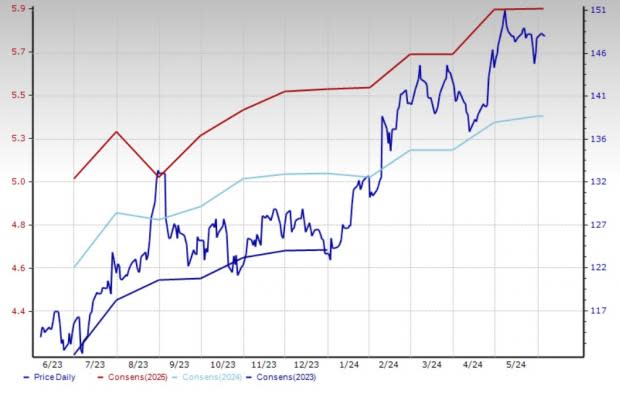

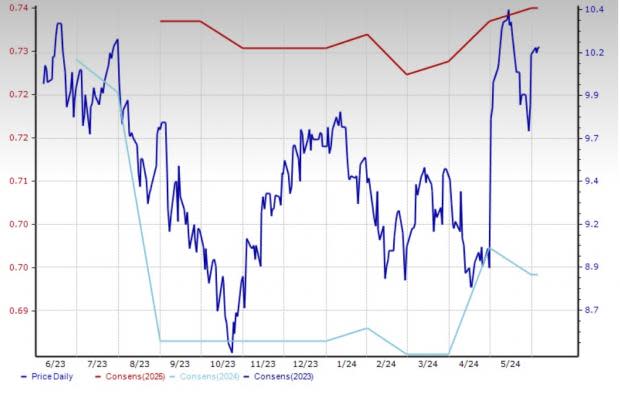

The Zacks Consensus Estimate for AptarGroup’s fiscal 2024 earnings has moved 3.3% north in the past 90 days. The figure indicates year-over-year growth of 12.1%. This Crystal Lake, IL-based company has a trailing four-quarter earnings surprise of 9.3%, on average. The company has an estimated long-term earnings growth rate of 8.8% and a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: ATR

Packaging Corp: The company’s packaging business, which accounts for around 91% of its revenues, is poised to gain from strong demand in e-commerce and stable demand for the packaging of meat, fruit and vegetables, processed food, beverages, and medicines. The conversion of the No. 3 paper machine at its Jackson, AL-based mill to linerboard in a phased manner over the next three years will help it meet the strong packaging demand. The company maintains a balanced approach toward capital allocation to boost growth and maximize returns for shareholders.

The Zacks Consensus Estimate for Packaging Corp’s ongoing year’s earnings has been revised upward by 1.1% in the past 90 days. PKG has a trailing four-quarter earnings surprise of 12.3%, on average. The Lake Forest, IL-based company has an estimated long-term earnings growth rate of 2.8%. The company currently carries a Zacks Rank #3 (Hold).

Price & Consensus: PKG

Amcor: Backed by its strong balance sheet and annual free cash flow in excess of $1 billion, the company continues to invest actively in various areas to drive growth. Particularly, its strategy to expand capacity in higher-growth, higher value-added, more packaging-intensive segments like healthcare, protein, pet food, premium coffee and hot fill beverage containers will bear fruit. Efforts taken to increase market share in emerging markets, wherein the demand for packaging products is being fueled by urbanization and rising incomes, will be a significant growth driver. Focus on innovative products and sustainable packaging offerings will be key catalysts.

The Zacks Consensus Estimate for Amcor’s ongoing year’s earnings has been revised upward by 3% in the past 90 days. Amcor has a trailing four-quarter earnings surprise of 8.1%, on average. The Switzerland-based company has an estimated long-term earnings growth rate of 2.6%. AMCR currently carries a Zacks Rank #3.

Price & Consensus: AMCR

Sealed Air: Strong demand for automated equipment and sustainable packaging solutions will drive Sealed Air’s growth. The acquisition of Liquibox is highly complementary to the Cryovac Fluids & Liquids business and will further drive the company’s vision to become a leader in fluids and liquid packaging. Notably, Fluids and Liquids is the highest-margin, fastest-growing product line for SEE. Its protein automation pipeline continues to grow across all regions, with major food producers committing to its SEE Touchless Automation future. With an estimated addressable market of $15 billion for Automated Protective Solutions, the company has immense potential to grow this business. Sealed Air recently initiated a three-year CTO2Grow Program, designed to drive annualized savings of around $140-$160 million by the end of 2025. Per the program, the company seeks to optimize its portfolio with a focus on automation, digital and sustainable solutions, streamline its supply-chain footprint, and drive SG&A productivity.

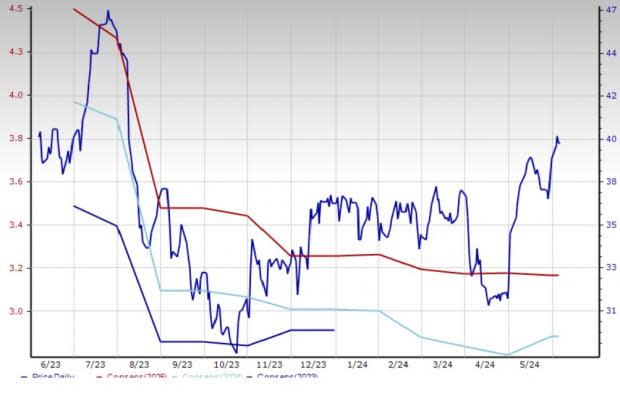

The Zacks Consensus Estimate for Sealed Air’s 2024 earnings has moved up 1% over the past 90 days. SEE has a trailing four-quarter earnings surprise of 32.2%, on average. The Charlotte, NC-based company carries a Zacks Rank #3 at present.

Price & Consensus: SEE

Greif: Greif continues to make strategic acquisitions to expand its geographic reach and its product portfolio. In March 2024, the company closed the acquisition of IPACKCHEM, which is a global leader in premium barrier and non-barrier jerry cans and small plastic containers. This is in sync with Greif’s strategic objective to grow its product offerings in high-performance jerry cans and small plastics globally. The IPACKCHEM acquisition, along with the previous additions of Reliance Products, Colepack and an 80% stake in Centurion Container, will aid GEF’s growth. The company’s M&A pipeline remains solid. It plans to continue to deploy capital toward value-accretive targets in the coming quarters. Greif has been implementing cost rationalization measures and undertaken efforts to improve operating efficiency within its system, which have been aiding its earnings performance.

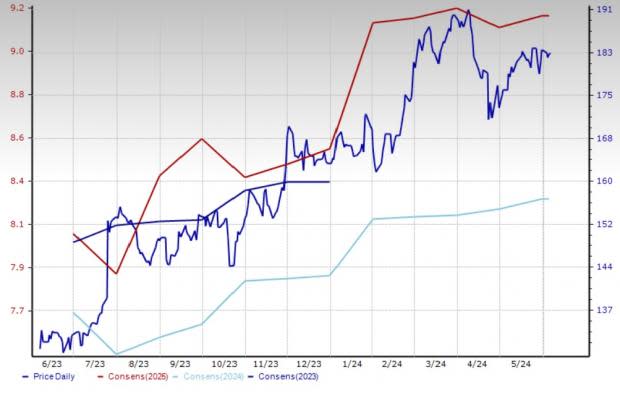

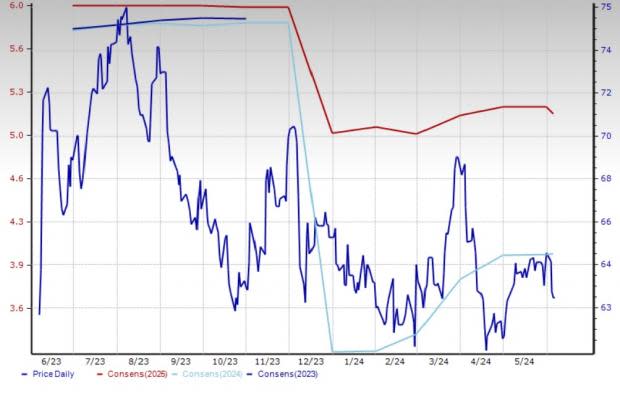

The Zacks Consensus Estimate for Greif’s 2024 earnings has been revised 1% upward over the past 60 days. Greif has a trailing four-quarter earnings surprise of 150.6%, on average. The Delaware, OH-based player currently has an estimated long-term earnings growth rate of 10% and a Zacks Rank #3.

Price & Consensus: GEF

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Sealed Air Corporation (SEE) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Amcor PLC (AMCR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance