5 Big Plays As Gold Markets Heat Up

Growing geopolitical tensions and ''Trumpflation'' have spurred a dramatic increase in safe haven demand...and the ongoing Bitcoin craze clearly proves it.

Bitcoin prices have more than doubled in the year-to-date, while those of its closest peer, Ethereum, are up an eye-popping 4,500 percent.

Yet, extreme volatility by digital currencies makes them a poor hedge against future uncertainties. Bitcoin has a downward deviation SIX times greater than gold's, making it extremely risky for use as currency.

Gold remains the pre-eminent and time-tested safe haven asset for hedging against macroeconomic upheavals.

Evidence keeps piling up: Future supply of the world's most important precious metal is now under threat. After years of falling gold prices, major miners everywhere have been forced to slash their exploration budgets, with many downsizing operations or completely shutting down.

Prior to the gold rally of 2017, gold prices had been falling since 2008 as economies around the world gradually improved in the post-financial crisis period, forcing producers to fold up operations. Even today, no new big mines are being developed across the world.

The spectacular collapse of South Africa's gold industry, formerly the world's largest, was the classic canary in a coal mine. At just 140 metric tonnes per year, the country's current production is a far cry of what it was a couple of decades ago.

Source: Zero Hedge

The situation in South Africa foreshadowed a coming decline in global production.

Last year marked the first time that global gold output declined since 2008, with all major producers except China recording significant declines.

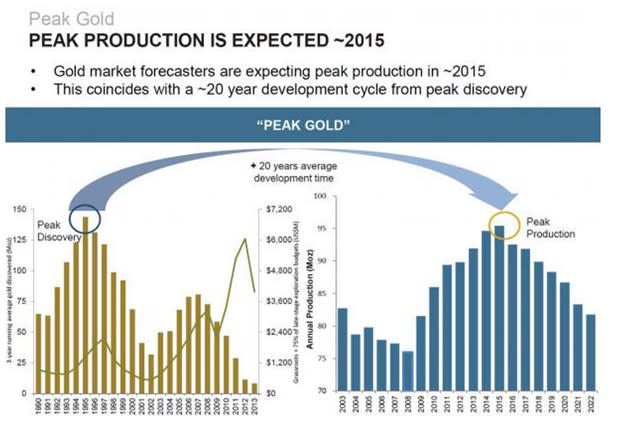

The fact that we are now past "peak gold" is a criminally underreported phenomenon--and the situation is expected to worsen as the years roll on.

Source: ZeroHedge

The sad fact of the matter is that we live on a small, finite planet, and it's just a matter of time before the gold market has to climb a major wall of worry in the form of small and dwindling supply.

Against this backdrop, here are our 5 picks to get into gold right now, whether you're looking for an entry point that offers outsized gains or a consistent dividend safe house …

#1 Tahoe Resources (NYSE:TAHO)

For Tahoe, the main attraction right now is dividend yield. This company is paying double its peers, and blows pretty much everyone else away. That's unusual in gold. But it's not that black and white. This stock hasn't done well over the past few years, and the declining price of silver has taken its toll. It's also had trouble in Guatemala, and it's suffering from high production costs due to a string of acquisitions. But still, even though some of its peers' stocks are doing better, Tahoe still has the highest dividend yield. So why is that?

Tahoe is trading at 9 times its cash flow—way below its closest rivals. If it were trading higher, its dividend yield would fall. But that's not the only reason. It's also simply got a better dividend policy from a shareholder perspective. It's fixed at $0.02 per share (per month) or $0.024 per share per year. So, the dividend isn't based on cash flow. You might think this would be a problem for Tahoe, but it's not. The company actually has a strong cash balance sheet.

So while you might look at all of Tahoe's problems and be put off—or you might not like what's going on in Guatemala, or all the expensive acquisitions, from a purely dividend perspective, this is our number one pick right now. At the end of the day, it's all about dividends after all.

#2 Osprey Gold (TSX:OS.V; OTC:OSSPF)

This small-cap company isn't likely on your radar—yet. But it should be. That's because not only is it a good time to start getting back into gold, but it's a good time to start looking at different ways to get back in … and it might be best to think out of the box. What stands out here is the cheap open-pit mining, new technology that is making it even cheaper, and a return to one of the most prolific gold rush venues in the world—Canada's Nova Scotia.

Nova Scotia has already supported three major gold rushes, and we're looking at a fourth in the making. Miners with new technology are rushing back here to scoop up the easy pickings, and Osprey is the only real entry point here.

Osprey has moved into Nova Scotia's Goldenville—and it's a gold miner's dream.

Here, the technology is the key because it's making expensive underground mining operations obsolete. Geologists have recently developed a technology that allows miners to assess mineralization of host rocks through which gold veins run—so in a historical first in Canada, they can mine gold in open pits. That means lower productions costs, reduced risks, and improved ability to scale.

And the Goldenville property is phenomenal from this respect. It's unlike any other place in the world because rocks from nearly every age are already exposed so Osprey's got the fast-track to gold here, and right across the street, another company has make a $250-million project doing the same.

At the end of the day, this is the key entry point because it's a small-cap company (only $7.5 million) sitting on what could be $560 million in gold.

#3 Wheaton Precious Metals (NYSE:WPM)

Wheaton is another good dividend play, paying out 20 percent of the cash it generates from operations racked up in the previous four quarters. The last quarterly dividend paid to shareholders was $0.07, but this one fluctuates, so we've seen it dip as low as $0.03 and soar as high as $0.14.

But beyond this, Wheaton is a great stock to own. Formerly Silver Wheaton, this company has seen shares rise more than 500 percent since 2005, and from most perspectives, it's going to continue on the upwards climb.

The reason for this is its unique business structure—and it's resulting high margins. Wheaton is unique because it doesn't just dive into mining. Instead, it looks for other major miners who need capital to expand existing projects. It seals its percentage of production at cut rates in this way, with long-term contracts that guarantee consistent cash flow. And it doesn't have to pay direct day-to-day mining costs, while at the same time it's incredibly savvy with its own overhead—it pays a minimum due to brilliant management.

With its multiple streams and diversity in combination with unique structure and stellar management, this stock is a smart choice on any given day.

#4 Newmont Mining (NYSE:NEM)

This is the only gold mining stock listed on the S&P. Newmont is another favorite because of its strong balance sheet and asset value growth, but what you should be looking at here is how its restructured its portfolio to reduce risk and improve operational performance. With Newmont now you'll get exposure to stable gold and a nice, continuous cash flow. And it's expected to outperform.

Newmont's Q1 results impressed. Revenue soared 13 percent to $1.7 billion on higher pricing and volumes.

Attributable gold production jumped 9 percent to 1.23 million ounces for the three-month period as new production from Long Canyon and Merian nicely offset geotechnical concerns at Carlin. Exceptional weather affected operations in South America and Australia. GAAP net income from continuing operations came at $69 million while adjusted net income stood at $133 million.

#5 Franco-Nevada (NYSE:FNV)

FNV is also set to outperform this quarter, and this is a great play for the dividend-focused. This is the precious metals/royalty streaming business, so it's different than putting your money into direct mining. FNV provides cash up front to precious metals miners in return for the right to buy those metals at reduced rates in the future.

This is a high-margin business—over 70 percent. So, when gold prices have been weak, FNV is still increasing dividends. And we love the conservative operating strategy. You won't see yields as high as the direct miners, but you will see a very nice dividend consistency.

And while FNV has traditionally been all about gold and silver (or metals, in general), it's now moving quickly into oil and gas, which represented some 6 percent of its revenues in the first quarter of this year—and it's moving more in this direction.

Honorable Mentions in this space:

Pretium Resources (TSX:PVG): The project to keep an eye on here is the British-Colombia-based Brucejack gold project, with its Valley of Kings deposit of over 8 million ounces of gold in proven/probable reserves. Pretium is advancing this toward construction and commercial production is expected this year, so there should be plenty of news flow catalysts in the coming weeks and months.

Detour Gold Corp. (TSX:DGC): There's been a lot of movement on these shares lately, and Q1 has seen them outperform. The company owns and operates the Detour Lake Mine in northern Ontario, and this is one of the biggest mines in Canada (reserves of over 16 million ounces of gold). This stock is expected to outperform this quarter.

Alamos Gold (TSE:AGI) (NYSE:AGI): We might be in for an earnings surprise with this one, so this could be a good buy right now. A number of equities research analysts have raised their price objectives on this stock. With Desjardins estimating from C$13.25 to C$13.50.

Eldorado Gold (TSX:ELD): ELD did not benefit from the late-2016 rally because of concerns about production and performance of its operations; but it's on track and the price is nice. A new catalyst will be its agreement to acquire the remaining shares of Integra Gold Corp to expand mining operations in Canada.

B2 Gold (TSX:BTO): This is the one of the most actively traded companies on the TSX, and its stocks are climbing. The stock is trading 8.25 percent above its 50-day moving average and 2.97 percent above its 200-day moving average.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Yahoo Finance

Yahoo Finance