4 Top Electronics Stocks to Beat Macroeconomic Headwinds

The Zacks Electronics - Miscellaneous Components industry has been suffering from macroeconomic uncertainties and end-market volatility. Moreover, geo-political tensions, unfavorable forex and high inflation weigh heavily on the industry’s prospects.

Nevertheless, Novanta NOVT, OSI Systems OSIS, Rogers ROG and American Superconductor AMSC are well-poised to benefit from the solid adoption of AI and the democratization of IoT techniques, which are transforming robotics, transportation systems, retail and healthcare. The ongoing automation drive, and increased spending by semiconductors, automobiles, machinery and mobile phone manufacturers are other positives for the industry players. Easing supply-chain constraints are also benefiting the industry participants.

Industry Description

The Zacks Electronics - Miscellaneous Components industry primarily comprises companies providing various accessories and parts used in electronic products. The industry participants’ offerings include power control and sensor technologies to mitigate equipment damage, testing products for safety, and advanced medical solutions. They cater to varied end markets, such as telecommunications, automotive electronics, medical devices, industrial, transportation, energy harvesting, defense and aerospace electronic systems, and consumer electronics. The industry’s customers are mainly original equipment manufacturers, independent electronic component distributors and electronic manufacturing service providers.

3 Trends Shaping the Future of Electronics - Miscellaneous Components Industry

Macroeconomic Headwinds Pose Concerns: Fears of global recession and high inflation have negatively impacted the rate of deal wins. Due to the challenging macroeconomic scenario, enterprises are reluctant to sign multi-year deals worldwide. These trends do not bode well for the industry participants.

Geo-political Tensions Are Worrisome: The ongoing Russia-Ukraine war and, most importantly, the souring relationship between the United States and China are headwinds. Increasing dependency on AI-backed electronic devices on semiconductors and current restrictions ordered by the U.S. on trading with China, which remains the main hub for chip production, is a significant negative for the underlined industry.

Automation Boom Acts as a Tailwind: The requirements for faster, more powerful and energy-efficient electronics lead to increased automation. Control systems such as computers and robots, and information technologies for handling different processes and machinery are driving the industry. The growing installation of collaborative robots, which add efficiency to production processes by working with production workers, will benefit the industry participants. IoT-supported factory automation solutions are other contributing factors. The evolution of smart cars and autonomous vehicles is expected to drive growth for the industry.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Electronics – Miscellaneous Components industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #164, placing it in the bottom 34% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bearish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries results from the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are pessimistic about this group’s earnings growth potential. Since Feb 29, 2024, the industry’s earnings estimates for the current year have moved 2.3% down.

Despite the gloomy industry outlook, a few stocks have the potential to outperform the market, based on a strong earnings outlook. But before we present the top industry picks, it is worth looking at the industry’s shareholder returns and current valuation first.

Industry Underperforms S&P 500 & Sector

The Zacks Electronics - Semiconductors industry has underperformed the Zacks S&P 500 composite and the broader Zacks Computer and Technology sector in the past year.

The industry has returned 23.5% over this period compared with the S&P 500’s growth of 24.3% and the broader sector’s rally of 39.9%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month price to earnings, a commonly-used multiple for valuing electronics - miscellaneous components stocks, the industry is currently trading at 23.83X compared with the S&P 500’s 21.59X and the sector’s 28.52X.

In the past five years, the industry has traded as high as 27.05X and as low as 16.22X, and recorded a median of 21.31X, depicted in the charts below.

Price/Earnings Ratio (F12M)

4 Electronics - Miscellaneous Components Stocks to Buy

American Superconductor: The Ayer, MA-based company is a leading energy technologies company, which develops and sells a wide range of products based on power electronic systems and high-temperature superconductor wires. American Superconductor is riding on solid momentum in its new energy power systems and ship protection systems, which is driving its Grid revenues. The growing shipment of 3-megawatt electrical control systems is benefiting its Wind business.

This Zacks Rank #1 (Strong Buy) company remains well-poised to gain substantial traction across military and navy markets on the back of its robust Grid business. Its new energy product lineup in the power grid is a positive.

You can see the complete list of today’s Zacks #1 Rank stocks here.

American Superconductor has gained 298.4% in the past year. The Zacks Consensus Estimate for AMSC’s fiscal 2024 earnings has been revised upward by 66.7% to 10 cents per share in the past 30 days.

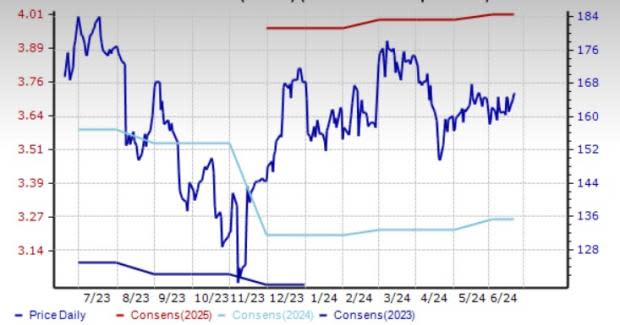

Price and Consensus: AMSC

OSI Systems: This Hawthorne, CA-headquartered company is a vertically integrated designer and manufacturer of specialized electronic systems and components. Its products are primarily utilized for critical homeland security, healthcare, defense and aerospace applications. The company is riding on its strong portfolio of security screening solutions. Its strong contract wins for mobile cargo, vehicle inspection, and advanced security inspection technology and services remain a major positive.

The Zacks Rank #2 (Buy) player also benefits from its strengthening optoelectronics business. Its growing customer base across multiple industries is bringing higher-margin opportunities to the business.

OSI Systems has gained 11% in the past year. The Zacks Consensus Estimate for OSIS’ fiscal 2024 earnings has been unchanged at $8.09 per share in the past 30 days.

Price and Consensus: OSIS

Novanta: The Bedford, MA-based company designs, develops, manufactures, and sells precision photonic and motion-control components and subsystems to original equipment manufacturers (OEM) in the medical equipment and advanced industrial technology markets. The company is benefiting from strong momentum across medical applications, thanks to which it is experiencing solid relationships with leading OEMs.

The Zacks Rank #2 player is well-poised to capitalize on the growing demand for robotics and automation, minimally invasive and robotic surgery, and precision medicine on the back of its robust portfolio. The company’s sticky business model is a plus.

Novanta has lost 3.5% in the past year. The Zacks Consensus Estimate for 2024 earnings has been unchanged at $3.26 per share in the past 30 days.

Price and Consensus: NOVT

Rogers: The Chandler, AZ-based company is riding on solid momentum across ADAS, general industrial and renewable energy markets. Its focus on bolstering customer engagement, and developing and commercializing unique material solutions for leading-edge applications is constantly driving business growth.

The Zacks Rank #2 company, which offers electronic and elastomeric materials that are used in applications for automotive safety and radar systems, EV/HEV, renewable energy, mobile devices, wireless infrastructure, and energy-efficient motor drives, among others, is well-poised to witness strong momentum among converters, fabricators, distributors and original equipment manufacturers on the back of its robust Advanced Electronics and Elastomeric Material solutions.

Rogers has lost 21.4% in the past year. The Zacks Consensus Estimate for ROG’s 2024 earnings has been unchanged at $3.07 per share in the past 30 days.

Price and Consensus: ROG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Superconductor Corporation (AMSC) : Free Stock Analysis Report

Rogers Corporation (ROG) : Free Stock Analysis Report

OSI Systems, Inc. (OSIS) : Free Stock Analysis Report

Novanta Inc. (NOVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance