4 Things to Know About TMX Group Stock in January 2023

Written by Kay Ng at The Motley Fool Canada

TMX Group (TSX:X) stock has outperformed the Canadian stock market returns in the last decade. It grew investors’ money roughly three-fold in that period.

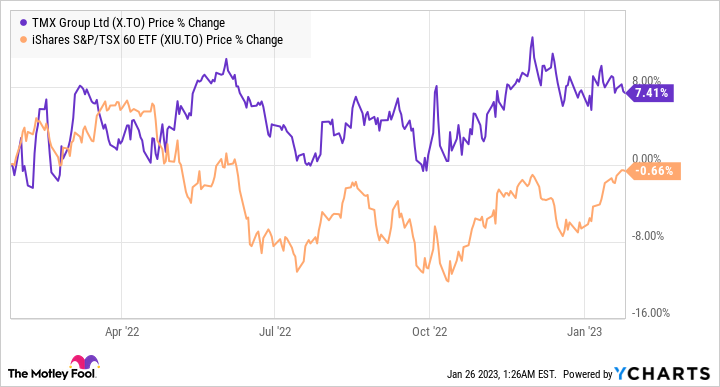

X and XIU Total Return Level data by YCharts

Is it a good buy today? First, here’s an overview of the business. It consists of four key business segments:

Capital Formation includes the TSX and TSX Venture Exchange listing and issuer services

Equities and Fixed Income Trading and Clearing

Derivatives Trading and Clearing

Global Solutions, Insights, and Analytics: Delivers equity and index data, and integrated data sets that feeds into proprietary and third-party analytics, helping clients make better trading and investment decisions

What are TMX Group’s recent results?

TMX Group last reported the first nine months of its 2022 results, during which revenue rose 16% to $842.5 million. However, operating expenses jumped 24%. Ultimately, this resulted in adjusted earnings-per-share growth of about 1% to $5.38. Cash flow from operating activities also increased by roughly 1% to $343.2 million.

Zooming into the third quarter, the company witnessed operating expenses rising 18% year over year to $144.2 million. Investors should note that much of the increase were due to acquisition-related costs with regards to BOX and AST Canada. Excluding these costs, its operating expenses would have increased 5% instead for the quarter.

Resilient and low-volatility stock

The dividend stock has been more resilient versus the Canadian stock market in the last 12 months. The graph below compares their price returns. Adding returns from cash distributions, the stock delivered a return of approximately 10% versus the market’s 2%.

X and XIU data by YCharts

The stock also has a lower beta than the market. The resilient and low-volatility attribute may appeal to conservative investors.

Valuation

At $135.18 per share at writing, the Canadian Dividend Aristocrat yields 2.5%. This is a price-to-earnings ratio of approximately 18.9, which seems a bit high for the near-term slow growth that’s expected. That said, the analyst consensus 12-month price target across seven analysts suggests it trades at a discount of 12%.

Dividend track record

TMX Group has a long history of paying dividends since 2003. However, it has only started increasing its dividend every year since 2016. Its trailing 12-month payout ratio is less than 35% of earnings and less than 46% of free cash flow. So, its dividend remains sustainable.

Should you buy TMX Group stock today?

TMX Group’s Global Solutions, Insights, and Analytics segment should provide fairly stable revenues through economic cycles. However, its other three key segments would be more sensitive to the health of the capital markets and how well or poorly stocks and bonds are doing. As economic growth is expected to be slow this year, the company is likely to experience slower earnings growth as well.

That said, it is a durable business with a resilient stock. So, it may be suitable for conservative investors to hold in a diversified investment portfolio. It would just be safer for interested investors to buy on meaningful dips of at least 7% to benefit from a bigger margin of safety. It’ll serve you better to explore other best Canadian stocks to buy in 2023.

The post 4 Things to Know About TMX Group Stock in January 2023 appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Tmx Group?

Before you consider Tmx Group, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in January 2023... and Tmx Group wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 16 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 1/9/23

More reading

Brookfield Asset Management Spin-Off: What Investors Need to Know

Passive Income: 4 Safe Dividend Stocks to Own for the Next 10 Years

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends TMX Group. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance