4 Stocks to Watch in a Promising Consumer Products-Discretionary Industry

The Consumer Products-Discretionary industry looks promising amid gradually easing inflation and evolving consumer preferences. Higher disposable incomes and improved consumer confidence are likely to drive demand. Technological advancements, particularly in e-commerce and artificial intelligence, are enhancing consumer experiences and expanding market reach. Additionally, the growing emphasis on sustainability and ethical consumerism is pushing brands to innovate and appeal to a more conscious consumer base.

While challenges persist, companies that leverage digital transformation, embrace sustainability and focus on delivering unique customer experiences are well-positioned to thrive in this burgeoning sector. Reynolds Consumer Products Inc. REYN, Central Garden & Pet Company CENT, The Honest Company, Inc. HNST and Lifetime Brands, Inc. LCUT are well-placed to seize opportunities that may arise in this changed marketplace.

About the Industry

The Consumer Products-Discretionary industry has a direct correlation with the economy, thus making it cyclical. Discretionary products command high prices, with middle-to-higher-income groups being targeted customers. The industry comprises companies that offer product categories, including fashion, jewelry and watches, and other home and art products. Quite a few players develop, manufacture, market and sell over-the-counter health and personal care products. Some even manufacture and distribute party goods. There are companies that design, source and distribute licensed pop culture products, too. Some industry participants also produce and distribute various products for the lawn and garden and pet supplies markets. Companies sell products to specialty retailers, mass-market retailers and e-commerce sites.

3 Key Trends to Watch in the Industry

Consumers’ Willingness to Spend: The performance of the consumer discretionary industry is closely tied to consumers’ purchasing power. Despite a challenging economic environment, consumer spending — an essential driver of the economy — has shown resilience due to robust hiring and wage growth. In May, the U.S. economy added 272,000 jobs, contributing to this positive trend. Average hourly earnings increased by 4.1% compared to the same period last year. Additionally, a slight easing of inflation provided further relief, as the consumer price index remained flat month over month in May, according to the Bureau of Labor Statistics. This combination of strong employment, rising wages and stabilized inflation supports continued growth in the consumer discretionary sector.

Brand Enhancement, Capital Discipline: Industry participants have been focusing on deepening engagements with consumers, creating innovative and compelling products and enhancing digital and data analytics capabilities. The launch of newer styles, customization options, unique packaging, point-of-sale displays, automation and high-end customer service enables them to woo consumers. Efforts to enhance the brand portfolio via marketing strategies, buyouts, innovations and alliances are likely to keep supporting players in the space. The companies have been taking steps to strengthen their financial position. They have been making every move, from managing the inventory to optimizing capital expenditures and enhancing operational efficiency.

Margins, an Area to Watch: The industry is quite fragmented, with companies vying for a bigger slice of the pie on attributes such as price, products and speed to market. To address these, a significant number of players in the industry have been investing in strengthening their digital ecosystem. While these endeavors provide an edge, they entail high costs. Apart from these, higher marketing, advertising and other operational expenses might compress margins. Of late, the industry participants have been dealing with product cost inflation. Nonetheless, companies have been focusing on undertaking initiatives to mitigate cost-related challenges. These include streamlining operational structures, optimizing supply networks and adopting effective pricing policies.

Zacks Industry Rank Indicates Robust Prospects

The Zacks Consumer Products-Discretionary industry is a group within the broader Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #81, which places it in the top 33% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence in this group’s earnings growth potential. Since the beginning of March 2024, the industry’s earnings estimate has risen roughly by 1%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Versus Broader Market

The Zacks Consumer Products-Discretionary industry has underperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

The industry has declined 2.8% over this period against the S&P 500’s rise of 16.3%. Meanwhile, the broader sector has advanced 2.5%.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward 12-month price-to-sales (P/S), which is commonly used for valuing consumer discretionary stocks, the industry is currently trading at 1.74X compared with the S&P 500’s 3.95X and the sector’s 1.68X.

Over the last three years, the industry has traded as high as 4.29X and as low as 1.35X, with the median being at 1.76X, as the chart below shows.

Price-to-Sales Ratio (Past 3 Years)

4 Stocks to Watch

Reynolds Consumer Products: The company's meaningful investments in omnichannel and multi-product advertising campaigns are set to enhance brand visibility and drive sales volume. Ongoing productivity improvements and cost-saving measures in procurement, manufacturing and supply chain operations are expected to bolster earnings and support reinvestment into the business. The impressive performance of the Reynolds Cooking & Baking business underscores the company’s operational and financial strengths, providing a solid foundation for future growth. Additionally, the company's proactive engagement with retail partners helps meet consumer needs effectively.

The Zacks Consensus Estimate for Reynolds Consumer Products’ current fiscal EPS suggests growth of 17.6% from the year-ago reported figure. REYN delivered a trailing four-quarter earnings surprise of 6.6%, on average. Shares of this Zacks Rank #2 (Buy) company have declined 0.2% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: REYN

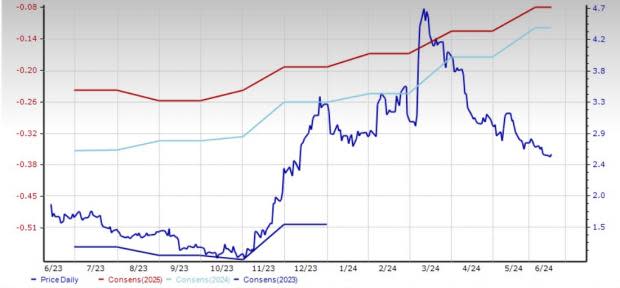

The Honest Company: The Honest Company's brand continues to expand its reach, with notable growth in household penetration and product innovation, particularly in the baby care segment, which has become a leading category in major retail outlets. Additionally, the company’s commitment to its transformation pillars — brand maximization, margin enhancement and operating discipline — underpins a robust strategic plan aimed at sustaining long-term growth. Significant advancements in the gross margin in the first quarter of 2024, driven by cost savings in product and logistics, alongside pricing and trade promotion efficiencies, highlight the company's focus on margin enhancement.

This manufacturer and seller of diapers and wipes, skin and personal care, and household and wellness products delivered a trailing four-quarter earnings surprise of 56.3%, on average. The Zacks Consensus Estimate for The Honest Company’s current financial-year sales and earnings suggests growth of 5.1% and 70.7% from the year-ago period. Shares of this Zacks Rank #2 company have surged 53.3% in the past year.

Price and Consensus: HNST

Lifetime Brands: Lifetime Brands' focus on new product introductions and a favorable product mix has been contributing to margin improvement, reflecting the company's ability to manage costs effectively. The stability in supply chain operations and strategic investments in growth areas, such as the foodservice business and international markets, underscore the potential for future revenue and margin expansion. Additionally, the company’s disciplined expense management and strong cash flow generation have strengthened its balance sheet, providing flexibility for further strategic investments and acquisitions.

This leading global designer, developer and marketer of a broad range of branded consumer products used in the home delivered a trailing four-quarter earnings surprise of 12.1%, on average. The Zacks Consensus Estimate for Lifetime Brands’ current financial-year sales and earnings suggests growth of 1.9% and 40.4% from the year-ago period. Shares of this Zacks Rank #2 company have advanced 103% in the past year.

Price and Consensus: LCUT

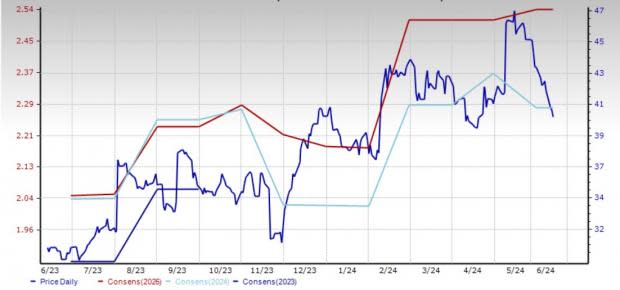

Central Garden & Pet Company: The company is positioning itself as a frontrunner in the U.S. pet supplies and lawn and garden supplies industry, bolstering its competitive edge through a range of strategic endeavors. These include unique packaging, impactful point-of-sale displays, logistics capabilities and a steadfast commitment to delivering exceptional customer service. Central Garden & Pet Company is focusing on brand building, containing costs, lowering complexity and improving margins. The company has been expanding its manufacturing capacity and simplifying its portfolio.

The Zacks Consensus Estimate for Central Garden & Pet Company’s current fiscal EPS suggests growth of 10.1% from the year-ago reported figure. CENT delivered a trailing four-quarter earnings surprise of 42.6%, on average. Shares of this Zacks Rank #3 (Hold) company have rallied 30.1% in the past year.

Price and Consensus: CENT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reynolds Consumer Products Inc. (REYN) : Free Stock Analysis Report

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Lifetime Brands, Inc. (LCUT) : Free Stock Analysis Report

The Honest Company, Inc. (HNST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance