4 Stocks to Watch From a Challenging Entertainment Industry

The Zacks Film and Television Production and Distribution industry is benefiting from a spike in demand for digital entertainment, fueled by limited capacity and operational limitations in movie theaters, theme parks and cruise lines. Increased consumption of media, music and news over the web, triggered by the work-and-learn-at-home wave, has been a key catalyst for industry participants like World Wrestling Entertainment WWE, iQIYI IQ, Lions Gate Entertainment (LGF.A) and IMAX Corporation IMAX. Companies have been focusing on a superior product strategy and prudent capital investments. Steady recovery in the advertising spending environment and resumption of production pipelines bode well for film and television production companies.

Industry Description

The Zacks Film and Television Production and Distribution industry comprises companies involved in film and TV production, distribution and exhibition. The main activities of the industry participants include the production and distribution of entertainment content to theaters, TV networks, video-on-demand platforms, streaming services and other exhibitors. Imax offers entertainment technology and specializes in motion picture technologies and presentations. Industry participants produce and distribute motion pictures for theatrical and straight-to-video releases besides TV programming. These players are heavily dependent on the box-office performance of their films, both domestically and internationally, the number of film releases, and the ratings of TV shows.

3 Film and Television Production Industry Trends in Focus

Over-the-Top Services Gaining Prominence: Companies involved in content creation are looking to distribute content through over-the-top services to leverage the popularity of their franchises. With this, they are looking to provide exclusive content and a differentiated experience. However, streaming companies are increasingly producing original and award-winning feeds to reduce licensing costs and excessive dependence on third-party content providers. This is likely to hurt industry participants’ content distribution strategy.

Binge-Watching Driving Consumption: Factors such as binge-watching, deepening Internet penetration and advancement in mobile, video, and wireless technologies have got viewers glued to small screens. In order to keep pace with new consumption patterns, industry participants are turning to digital content distribution. The emergence of digital capabilities is making consumer data easily available to companies. With the use of AI tools, production houses are gaining a better understanding of user preferences. This helps them produce content that strikes a chord with viewers. However, increasing spending on content and sales & marketing is hurting profitability due to stiff competition from streaming players.

Technological Advancement Aids Prospects: Exhibitors are turning to highly efficient and cost-effective technologies like laser-based projection systems to enhance image quality and the entire movie experience. Additionally, the use of technologies like motion seating, immersive audio systems and interactive movies among others is expected to enhance the viewing experience. The increasing adoption of AR and VR technologies bodes well for industry participants. However, the evolution of alternative motion picture distribution channels such as home video, pay-per-view, streaming services, video-on-demand, Internet and syndicated and broadcast television is hurting exhibitors.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Film and Television Production and Distribution industry is housed within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #231, which places it in the bottom 7% of more than 249 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic on this group’s earnings growth potential. Since Apr 30, 2022, estimates for the current year have moved 26.1% south.

Despite the gloomy industry outlook, a few stocks are worth watching based on a strong earnings outlook. Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

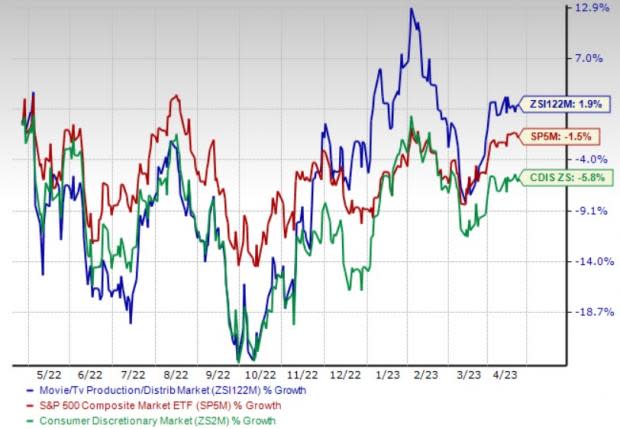

Industry Beats S&P 500, Sector

The Zacks Film and Television Production and Distribution industry has outperformed the Zacks S&P 500 and its own sector in the past year.

The stocks in this industry have collectively gained 1.9% against the S&P 500’s decline of 1.5% and the Zacks Consumer Discretionary sector’s decline of 5.8% over the same time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month price-to-sales (P/S), a commonly used multiple for valuing Film and Television Production and Distribution stocks, the industry is currently trading at 1.57X compared with the S&P 500’s 3.62X and the sector’s 1.94X.

Over the past five years, the industry has traded as high as 2.48X and as low as 0.92X, recording a median of 1.52X as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

4 Film & Television Stocks to Watch Right Now

World Wrestling Entertainment: WWE anticipates generating record revenues in 2023. This suggests a likely increase in media rights fees from flagship weekly programming and premium live events, as well as a full live event touring schedule, and higher advertising and sponsorship revenues. WWE projects adjusted OIBDA in the range of $395-$410 million for 2023.

The company’s focus on expanding original content and creating new content, driving subscriber count, raising content rights fees and monetization of video content across digital and DTC platforms bodes well.

In latest developments, the company together with Endeavor Group Holdings, Inc. has agreed to establish a new, publicly listed company comprising two complementary, global sports and entertainment brands – UFC and WWE. On the closure of this deal, Endeavor will hold a 51% controlling stake in the new company while the existing WWE shareholders will own a 49% interest. This move reflects the successful conclusion of World Wrestling’s strategic options review process. On a combined basis, the new company will be a $21 billion live sports and entertainment powerhouse with a collective fanbase of more than a billion people.

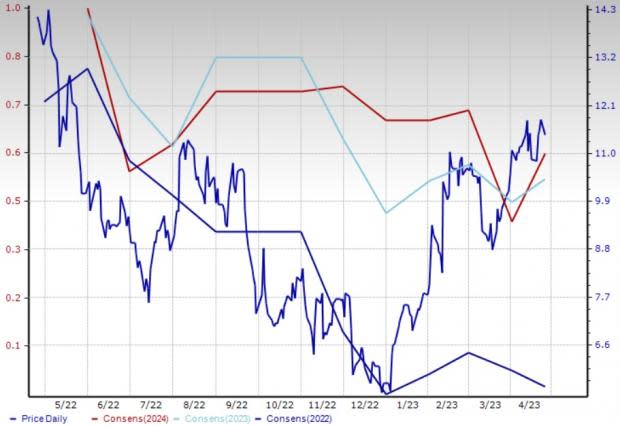

Shares of this Zacks Rank #2 (Buy) company have risen 59.4% year to date. The Zacks Consensus Estimate for World Wrestling’s 2023 earnings has moved south by 0.7% to $2.77 per share over the past 30 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: WWE

iQIYI: The company offers movies, television dramas, variety shows and other video content. Recently, the company entered into a definitive agreement with Douyin, pursuant to which it will license select content to the latter for editing and distribution as short-form videos in the formats agreed on by the two companies.

The company already has a huge subscriber base in China, which is one of the biggest consumer markets in the world. Strong demand for company-produced drama series, original movies and variety shows in international markets is a key top-line growth driver for the near term.

iQIYI’s shares have returned 16.6% year to date. The Zacks Consensus Estimate for this Zacks Rank #3 (Hold) company’s 2023 earnings has remained steady at 27 cents per share over the past 30 days.

Price and Consensus: IQ

Lionsgate Holdings: Lionsgate is benefiting from a strong pipeline of content on Starz’s platforms that boosts viewership and increases the subscriber base of its OTT platforms. Management has been planning to spend cautiously on content and not chase subscribers, therefore focusing on profitability. It would now also look for bundling and packaging opportunities.

In February, the company announced its partnership with Amazon to offer the Starz and MGM+ bundle to Prime members in the United States at a 20% discount to boost subscribers. Amid the ongoing fight for share in the streaming market, Starz and MGM+ are teaming up to have a larger market share.

Lions Gate and Starz will be separated by September 2023 as planned. This will help the two core businesses to pursue separate strategic and financial paths, which would ensure better results. Strategies are being made so that both entities have a strong balance sheet by the end of the year.

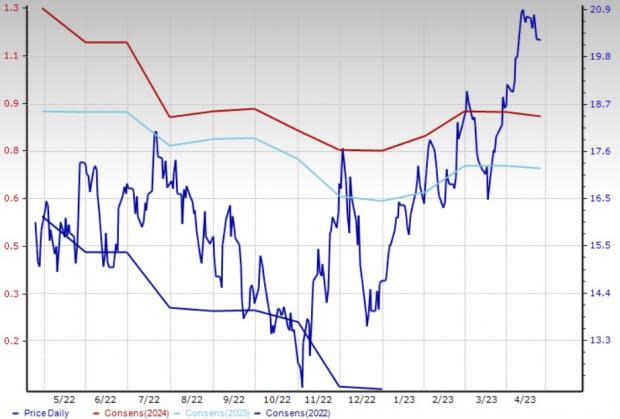

Lionsgate’s shares have returned 100% year to date. The Zacks Consensus Estimate for this Zacks Rank #3 company’s fiscal 2023 loss has widened by 2 cents to 4 cents per share over the past 30 days.

Price and Consensus: LGF.A

IMAX: It is riding on the continued reopening of theaters, particularly in the United States. The impressive performances of Avatar: The Way of Water, Thor: Love and Thunder and Top Gun: Maverick have benefited IMAX. Recovery in the pace of theater system installations and higher IMAX maintenance sales are major positives. The company has 29 titles to be released in 2023, which is expected to aid top-line growth.

Earlier this month, IMAX collected $21.6 million on the opening weekend of The Super Mario Bros. Movie. This created an all-time record for an animated movie. With big movies like Fast X, The Little Mermaid and Guardians of the Galaxy Vol.3 slated to release in the coming quarter, all the entertainment companies are expected to boost their revenues. These highly anticipated movies encourage viewers to come to cinema halls in the age of online-streaming platforms.

IMAX recently signed an agreement with Galaxy Cinema for two new, state-of-the-art IMAX with Laser systems in Vietnam. The deal will bring the first-ever premium IMAX with Laser systems to the country, marking a significant milestone for the market.

The Zacks Consensus Estimate for IMAX’s 2023 earnings has moved south by 1.4% to 73 cents per share over the past 30 days. IMAX’s shares have increased 38% year to date.

Price and Consensus: IMAX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

World Wrestling Entertainment, Inc. (WWE) : Free Stock Analysis Report

IMAX Corporation (IMAX) : Free Stock Analysis Report

Lions Gate Entertainment Corp. (LGF.A) : Free Stock Analysis Report

iQIYI, Inc. Sponsored ADR (IQ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance