4 Stocks to Track Despite Consumer Products-Discretionary Industry Woes

Consumer spending activity, which is one of the pivotal factors driving the economy, has somewhat slowed down. This is because inflation and recession-wary shoppers have curtailed spending. Underlying price pressure, a slowing labor market and a higher interest rate environment have cooled demand. Of late, players in the Zacks Consumer Products-Discretionary industry have been encountering these headwinds.

To navigate troubled waters, industry participants have been directing resources toward digital platforms and augmenting the supply chain. Companies have been focusing on a superior product strategy, the advancement of omnichannel capabilities and prudent capital investments. Backed by these initiatives, companies like Prestige Consumer Healthcare Inc. PBH, Traeger, Inc. COOK, The RealReal, Inc. REAL and Genius Brands International, Inc. GNUS are set to cash in on the opportunities.

About the Industry

The Consumer Products-Discretionary industry has a direct correlation with the economy, thus making it cyclical. Discretionary products generally command high prices, with middle-to-higher-income groups being the targeted customers. The industry comprises companies that offer product categories, including fashion, jewelry and watches, and other home and art products. Quite a few players develop, manufacture, market and sell over-the-counter health and personal care products. Some even manufacture and distribute party goods. There are companies that design, source and distribute licensed pop culture products too. Some industry participants also produce and distribute various products for the lawn and garden and pet supplies markets. Companies sell products to specialty retailers, mass-market retailers and e-commerce sites.

3 Key Trends to Watch in the Industry

Soft Demand May Hit Revenues: Elevating prices and geopolitical concerns continue to pose a threat to consumer spending activity. Undoubtedly, the industry’s prospects are correlated with the purchasing power of consumers. However, rising prices have been discomforting family budgets. The Fed’s aggressive rate hikes to tame inflation also made things tough for consumers by squeezing disposable income. Consequently, the demand for discretionary products has softened. Per the Commerce Department, U.S. retail and food service sales in March declined 1% sequentially to $691.7 billion. March retail sales data marked the second straight month of a decline in spending. The decline was steeper than expected, with spending on categories such as automobiles, home furnishing, electronic stores and building supplies taking a hit.

Margins an Area to Watch: The industry is quite fragmented, with companies vying for a bigger slice of the pie on attributes such as price, products and speed to market. To address these, a significant number of players in the industry have been investing in strengthening their digital ecosystem. While these endeavors provide an edge, they entail high costs. Apart from these, higher marketing, advertising and other operational expenses might compress margins. Of late, the industry participants have been dealing with product cost inflation. Nonetheless, companies have been focusing on undertaking initiatives to mitigate cost-related challenges. These include streamlining operational structures, optimizing supply networks and adopting effective pricing policies.

Brand Enhancement, Capital Discipline: Industry participants have been focusing on deepening engagements with consumers, creating innovative and compelling products and enhancing digital and data analytics capabilities. The launch of newer styles, customization options, unique packaging, point-of-sale displays, automation and high-end customer service enables them to woo consumers. Efforts to enhance the brand portfolio via marketing strategies, buyouts, innovations and alliances are likely to keep supporting players in the space. The companies have been taking steps to strengthen their financial position. They have been making every move, from managing the inventory to optimizing capital expenditures and enhancing operational efficiency.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Consumer Products-Discretionary industry is a group within the broader Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #227, which places it in the bottom 9% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates drab near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. The industry’s bottom-line estimate has declined to a loss of 15 cents a share from a loss of 3 cents at the beginning of January 2023.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Versus Broader Market

The Zacks Consumer Products-Discretionary industry has underperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

The industry has declined 12% over this period compared with the S&P 500’s decline of 6%. Meanwhile, the broader sector has slumped 10.6%.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward 12-month price-to-sales (P/S), which is commonly used for valuing consumer discretionary stocks, the industry is currently trading at 0.30X compared with the S&P 500’s 3.60X and the sector’s 1.59X.

Over the last three years, the industry has traded as high as 12.02X and as low as 0.30X, with the median being at 3.64X, as the chart below shows.

Price-to-Sales Ratio (Past 3 Years)

4 Stocks to Watch

Prestige Consumer Healthcare: This leading consumer healthcare product company’s proven business strategy and strong portfolio of brands have been contributing to the top line. Apart from this, the company is gaining on e-commerce strength and focusing on areas with high growth potential. Management anticipates organic revenue growth of about 3% in fiscal 2023.

Impressively, Prestige Consumer Healthcare has an estimated long-term earnings growth rate of 8%. The Zacks Consensus Estimate for current financial-year revenues and EPS suggests growth of 3.1% and 3%, respectively, from the year-ago reported figure. We note that shares of this Zacks Rank #3 (Hold) company have increased 12.6% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: PBH

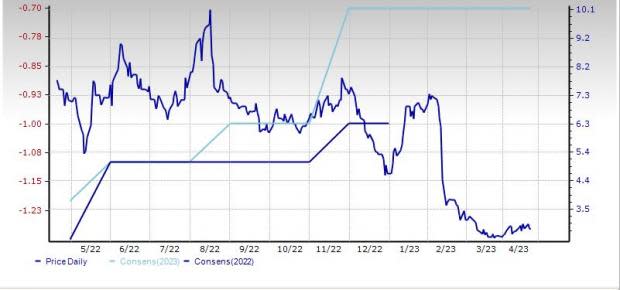

Traeger: This creator and category leader of wood pellet grills has been benefiting from proactive measures undertaken to drive profitability and financial flexibility amid tough macroeconomic conditions. These include cost-containment initiatives and inventory rationalization. Management foresees a gross margin between 36% and 37% for fiscal 2023.

Traeger has a trailing four-quarter earnings surprise of 32.5%, on average. The Zacks Consensus Estimate for the bottom line for the current fiscal has been stable over the past 30 days. Shares of this Zacks Rank #3 company have declined 48.9% in the past year.

Price and Consensus: COOK

The RealReal: This San Francisco, CA-based company is the world’s largest online marketplace for authenticated, resale luxury goods. The RealReal is focusing on enhancing profitability through price optimization, cost containment, the tapping of potential revenue streams and the overhauling of the consignor commission structure.

The RealReal has a trailing four-quarter earnings surprise of 9.8%, on average. It has an estimated long-term earnings growth rate of 33.8%. The Zacks Consensus Estimate for the current financial-year top and bottom lines suggests growth of 4.7% and 26.8%, respectively, from the year-ago reported figure. Shares of this Zacks Rank #3 company have decreased 81% in the past year.

Price and Consensus: REAL

Genius Brands: This global brand management company, which creates, produces, broadcasts and licenses entertainment content for children, is witnessing higher revenues. The addition of new content, markets and distribution partners to its portfolio is supporting top-line growth. Strategic buyouts and investments have aided Genius Brands in strengthening its position in the children's entertainment industry.

The company attained significant revenue growth in 2022 due to synergies and efficiencies from recent acquisitions. The Zacks Consensus Estimate for Genius Brands’ current financial-year revenues suggests growth of 38.5% from the year-ago reported figure. Shares of this Zacks Rank #3 company have dropped 63% in the past year.

Price and Consensus: GNUS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prestige Consumer Healthcare Inc. (PBH) : Free Stock Analysis Report

Genius Brands International, Inc. (GNUS) : Free Stock Analysis Report

The RealReal, Inc. (REAL) : Free Stock Analysis Report

Traeger, Inc. (COOK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance