4 Security & Safety Stocks Poised to Gain on Prospering Industry Trends

The Zacks Security and Safety Services industry is poised for growth on the back of robust demand for products and solutions with growing awareness about the security and safety of people and infrastructure. Higher research and development activities supported by governments and improving supply chains augur well for the industry’s near-term prospects.

The increase in demand for cybersecurity products is supporting several industry participants as well. Companies like Allegion plc ALLE, MSA Safety Incorporated MSA, Brady Corporation BRC and Napco Security Technologies, Inc. NSSC are a few industry participants that might capitalize on these opportunities.

About the Industry

The Zacks Security and Safety Services industry comprises firms that provide sophisticated and interactive security solutions and related services, which are meant to be used for residential, commercial and institutional purposes. A few industry players develop electrical weapons for personal defense and military, federal, law enforcement and private security. Some of them provide solutions for the recovery of stolen vehicles, wireless communication devices, equipment for the safety of facility infrastructure and employees and products for detecting hazards. A few players provide a variety of services to automobile owners and insurance companies. The industry serves customers from various end markets, including manufacturing, electronics, hospitality, education, construction, telecommunications, aerospace and medical.

Major Trends Shaping the Future of the Security and Safety Services Industry

Strong Demand for Security and Safety Services: Growing instances of terrorism and criminal activities with concerns related to the ever-increasing fraudulent activities are promoting demand for security and safety services. For example, with the goal of enhancing the safety and surveillance of people or assets, governments, commercial operations, communities and other establishments across the world are rapidly deploying IP-based cameras. This is acting as a key growth driver for the industry. With growing urbanization, the increasing requirement to ensure the safety and security of infrastructure at offices, factories and residential buildings is aiding industry participants. With rising instances of hacking, the industry is seeing higher demand for Internet security products and services like firewalls, intrusion detection system (IDS) and intrusion prevention system (IPS). People’s preference for purchasing products through e-commerce platforms also opened up opportunities for industry players.

Other Favorable Trends: Increases in budgets and funds from governments have invited several big players to make significant investments in the research and development of advanced products and services. For instance, government and law enforcement agencies in the United States and Canada are directly working with industry participants to strengthen the security infrastructure of smart cities. Also, an anticipated reduction in raw material costs with the improvement of supply chain conditions should support the industry’s growth in 2024.

High Debt Levels: Industry participants constantly focus on innovation, product upgrades and the development of new products to cater to the changing customer needs and stay competitive, making steady investments necessary. While this augurs well for the industry’s long-term growth, hefty investments in research and development often leave companies with highly leveraged balance sheets.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Security and Safety Services industry, housed within the broader Industrial Products sector, currently carries a Zacks Industry Rank #30. This rank places it in the top 12% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of the positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are keeping more faith in this group's earnings growth potential. The industry’s earnings estimates for the current year have increased 3% in the year-to-date period.

Given the bullish near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it is worth taking a look at the industry’s shareholder returns and its current valuation first.

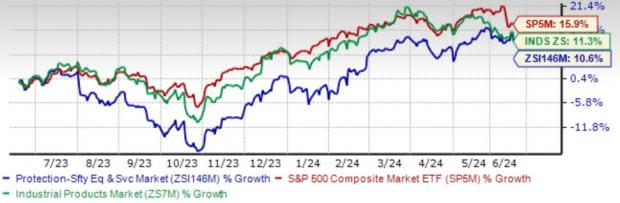

Industry Underperforms Sector & S&P 500

The Zacks Security and Safety Services industry has underperformed both the broader sector and the Zacks S&P 500 composite index in the past year.

Over this period, the industry has moved up 10.6% compared with the sector’s and the S&P 500 Index’s increase of 11.3% and 15.9%, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward P/E (F12M), which is a commonly used multiple for valuing security and safety services stocks, the industry is currently trading at 19.58X compared with the S&P 500’s 20.70X. However, it exceeds the sector’s P/E (F12M) ratio of 17.39X.

Over the past five years, the industry has traded as high as 27.04X, as low as 12.65X and at the median of 19.57X, as the chart below shows:

Price-to-Earnings Ratio

Price-to-Earnings Ratio

4 Security and Safety Services Stocks Leading the Pack

Allegion: The company is a leading provider of mechanical and electronic security products, including doors and door systems, electronic security products and biometric and mobile access control systems. It is well-positioned to benefit from strength in its International segment, driven by an increase in demand for electronic security products. Higher adoption of advanced technologies and solutions in the electronics security products market is expected to drive ALLE’s performance in the quarters ahead.

In the past 60 days, the Zacks Rank #2 (Buy) stock’s earnings estimates have increased 1.1% for 2024. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: ALLE

MSA Safety: The company is engaged in the development, manufacture and supply of safety products that protect people and facility infrastructures. The company's core products include self-contained breathing apparatus, fixed gas and flame detection systems, air-purifying respirators and gas masks, among others. Strengthening the demand for its firefighter safety products and industrial PPE technologies and solid operational execution have been driving the company’s performance of late. A favorable product mix and improved supply chain conditions are likely to be beneficial moving ahead.

In the past 60 days, the Zacks Rank #2 stock’s earnings estimates have inched up 0.3% for 2024. Its shares have increased 10% in the past year.

Price and Consensus: MSA

Brady: The company offers complete identification solutions and workplace safety products that help companies improve productivity, performance, safety and security. Brady is gaining from its continued focus on product development, investments in growth opportunities, solid operational execution and cost management actions. Inorganic activities position BRC well for future growth.

The Zacks Consensus Estimate for Brady’s fiscal 2024 (ending July 2024) earnings increased 3% in the past 60 days. Shares of the Zacks Rank #2 company have gained 33.8% in a year.

Price and Consensus: BRC

Napco Security Technologies: The company offers access control systems, door-locking products, intrusion and fire alarm systems, and video surveillance systems for commercial, residential, institutional, industrial and governmental applications. The Zacks Rank #2 company has been gaining from strong recurring service revenues, improvement in the supply chain and product development initiatives. Solid demand for its products in school, healthcare and multi-dwelling commercial and residential applications markets is expected to drive its performance in the quarters ahead.

The Zacks Consensus Estimate for Napco Security’s fiscal 2024 (ending June 2024) earnings has been revised upward by 3.8% in the past 60 days. Shares of NSSC have soared 42.5% in the past year.

Price and Consensus: NSSC

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegion PLC (ALLE) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

NAPCO Security Technologies, Inc. (NSSC) : Free Stock Analysis Report

MSA Safety Incorporporated (MSA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance