4 Retail Discount Stocks With Potential to Beat Industry Blues

With the decline of stimulus-driven spending and persistently high interest rates, the Retail – Discount Stores industry finds itself at a pivotal juncture. Inflationary pressures are causing consumers to be more judicious with their disposable income, affecting various merchandise categories and creating hurdles for retailers. The drop in U.S. consumer sentiment in June signals further potential challenges as decreased consumer confidence could lead to reduced spending, exacerbating the industry's struggle.

That said, industry participants have been focusing on deepening engagements with consumers, adding more compelling products and enhancing digital and data analytics capabilities. Inventory management, supply-chain enhancement, cost-structure realignment and investments to accelerate digitization have been working in favor of companies like Costco Wholesale Corporation COST, Target Corporation TGT, Dollar General Corporation DG and Burlington Stores, Inc. BURL.

About the Industry

The Retail – Discount Stores industry is a significant segment within the retail sector that caters to price-conscious consumers seeking value-for-money products. These stores specialize in offering a wide range of merchandise, including groceries, household items, apparel, electronics, cleaning products, pet supplies and more, at discounted prices compared to traditional retail outlets. Discount stores operate on a low-cost business model, focusing on cost-efficient operations, bulk purchasing and streamlined supply chains to offer competitive pricing. These stores often carry both national and private-label brands, providing a mix of products to cater to a diverse customer base. The Retail – Discount Stores industry has shown resilience, even during economic downturns, as consumers tend to prioritize value-oriented shopping.

4 Key Industry Trends to Watch

Soft Demand May Hit Revenues: Elevated interest rates, underlying inflationary pressure and geopolitical concerns continue to pose a threat to consumer spending activity. The industry's outlook heavily relies on consumer purchasing power, which has been strained by higher prices, putting pressure on family budgets and dampening demand. In June, U.S. consumer sentiment continued its decline for the third consecutive month, reflecting increasing pessimism among Americans about their personal financial situations. According to the University of Michigan's preliminary report, the consumer sentiment index dropped to 65.6 this month, down from May's final reading of 69.1.

Pressure on Margins to Linger: Companies in the industry are vying for a bigger share on attributes such as price, products and speed to market. Further, the increasing dominance of e-commerce players has made the retail discount space highly competitive. This has compelled many players to strengthen their digital ecosystem and boost shipping and delivery capabilities. While these endeavors drive sales, they entail high costs. Apart from these, higher marketing, advertising and other store-related expenses might compress margins. However, companies have been focusing on undertaking initiatives to mitigate cost-related challenges. These include streamlining operational structures, optimizing supply networks and adopting effective pricing policies.

Consumers Seek Better Bargains: The strategy to sell products at discounted prices has helped industry players draw customers in low-to-middle-income groups who have been seeking both value and convenience, particularly in the face of rising prices. Industry participants have been focusing on creating innovative and compelling products and enhancing digital and data analytics capabilities to attract price-sensitive consumers.

Digitization Is the Key to Growth: With the change in consumer shopping patterns, industry participants have been evolving to play dual in-store and online roles. Initiatives, such as building omnichannel, coming up with loyalty and marketing programs, enhancing the supply chain and providing faster delivery options, be it doorstep delivery, curbside pickup or buy online and pick up at the store, are worth mentioning. Simultaneously, companies are investing in renovation, improved checkouts and mobile point-of-sale capabilities to keep stores relevant. Keeping in mind consumers’ product preferences and growing inclination toward online shopping, retailers have been replenishing shelves with in-demand merchandise and ramping up investments in digitization.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Retail – Discount Stores industry is housed within the broader Zacks Retail – Wholesale sector. The industry currently carries a Zacks Industry Rank #163, which places it in the bottom 35% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates drab near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. Since the beginning of January 2024, the industry’s earnings estimate has declined 2.4%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry vs. Broader Market

The Zacks Retail – Discount Stores industry has outperformed the broader Retail – Wholesale sector and the Zacks S&P 500 composite over the past year.

Stocks in this industry have collectively advanced 39.8%. Meanwhile, the Zacks Retail – Wholesale sector has risen 22.3%, and the S&P 500 has rallied 24.1% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of a forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing retail stocks, the industry is currently trading at 31.18 compared with the S&P 500’s 21.56 and the sector’s 22.61.

Over the last five years, the industry has traded as high as 31.18X and as low as 20.97X, with the median being 24.73X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

4 Retail Discount Store Stocks to Keep a Close Eye On

Burlington Stores: Burlington Stores has adeptly responded to the challenges in the retail landscape by strategically emphasizing recognizable brands, implementing the best pricing strategy and targeting trade-down shoppers. The implementation of strategic initiatives aimed at enhancing merchandising capabilities, operational efficiency and store optimization is likely to support revenue growth. By focusing on initiatives such as store relocations and downsizing, Burlington Stores aims to improve store productivity. The ability to quickly respond to evolving market dynamics and adjust inventory levels based on real-time data insights has enabled the company to seize opportunities.

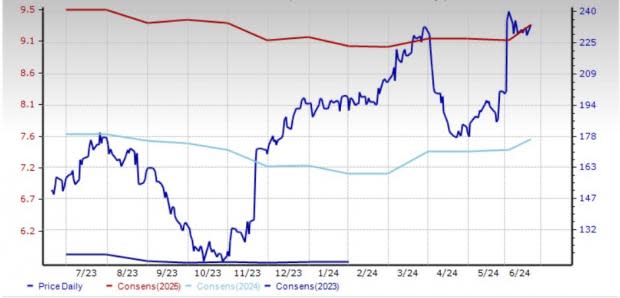

The Zacks Consensus Estimate for Burlington Stores’ current financial-year revenues and EPS suggests growth of 9.5% and 25.4%, respectively, from the year-ago reported figure. Impressively, Burlington Stores has a trailing four-quarter earnings surprise of 21.7%, on average. Shares of this Zacks Rank #2 (Buy) company have rallied 54% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: BURL

Costco: The discount retailer’s growth strategies, better price management and decent membership trends have been contributing to its performance. Cumulatively, these factors have been aiding this Issaquah, WA-based company in registering decent sales numbers. The company's distinctive membership business model and pricing power set it apart from traditional players. We believe a favorable product mix, steady store traffic, pricing strength and strong liquidity should benefit Costco.

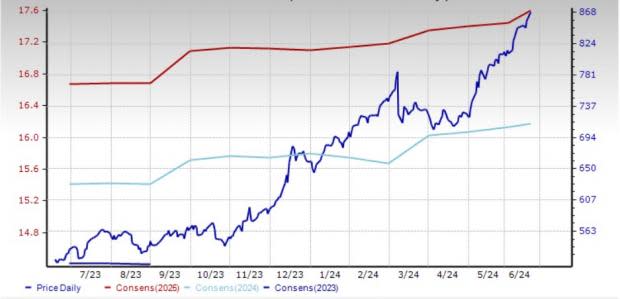

Costco has a trailing four-quarter earnings surprise of 2.3%, on average. The Zacks Consensus Estimate for current financial-year revenues and EPS suggests growth of 4.9% and 9.9%, respectively, from the year-ago reported figure. Shares of this Zacks Rank #3 (Hold) company have surged 65.7% in the past year.

Price and Consensus: COST

Target: This Minneapolis, MN-based company has been making multiple changes to its business model to adapt and stay relevant in the dynamic retail landscape. Target has been deploying resources to enhance omnichannel capabilities, come up with new brands, refurbish stores and expand same-day delivery options to provide customers with a seamless shopping experience. These have been contributing to the top line.

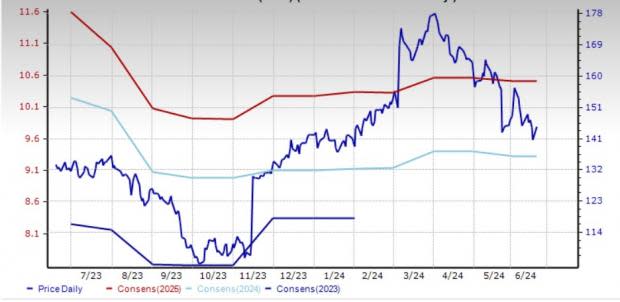

The Zacks Consensus Estimate for Target’s current financial-year EPS suggests growth of 4.3% from the year-ago reported figure. TGT has a trailing four-quarter earnings surprise of 22.4%, on average. We note that shares of this Zacks Rank #3 company have risen 8.3% in the past year.

Price and Consensus: TGT

Dollar General: Thanks to its value-creating initiatives, defensive product mix and real estate growth strategy, Dollar General has the capabilities to gain market share. Its commitment to better pricing, private label offerings, effective inventory management and merchandise initiative should drive sales. We remain encouraged by the host of initiatives such as DG Fresh, SKU rationalization, digitization and the expansion of the private fleet that should yield same-store sales improvements and margin expansion.

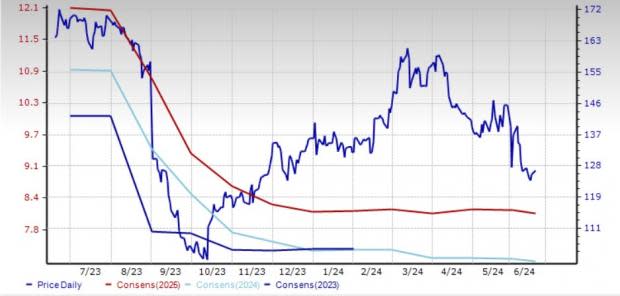

The Zacks Consensus Estimate for Dollar General’s current financial-year sales implies growth of 6.1% from the year-ago reported figure. DG has a trailing four-quarter earnings surprise of 0.4%, on average. We note that shares of this Zacks Rank #3 company have declined 22.8% in the past year.

Price and Consensus: DG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance