These 4 Measures Indicate That Louisiana-Pacific (NYSE:LPX) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Louisiana-Pacific Corporation (NYSE:LPX) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Louisiana-Pacific

How Much Debt Does Louisiana-Pacific Carry?

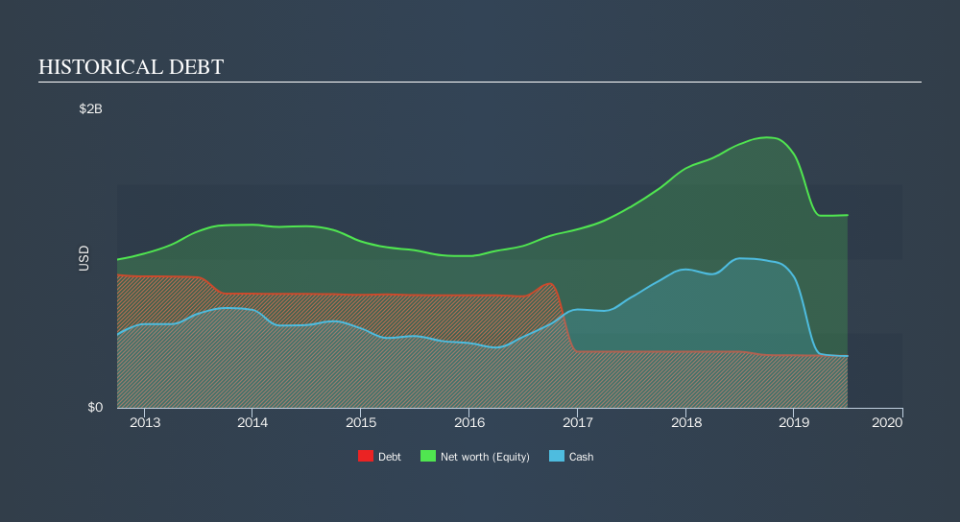

You can click the graphic below for the historical numbers, but it shows that Louisiana-Pacific had US$349.0m of debt in June 2019, down from US$375.7m, one year before. However, it does have US$348.0m in cash offsetting this, leading to net debt of about US$1.00m.

How Healthy Is Louisiana-Pacific's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Louisiana-Pacific had liabilities of US$229.0m due within 12 months and liabilities of US$570.0m due beyond that. On the other hand, it had cash of US$348.0m and US$177.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$274.0m.

Of course, Louisiana-Pacific has a market capitalization of US$3.00b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. But either way, Louisiana-Pacific has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Louisiana-Pacific has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.0027 and EBIT of 1k times the interest expense. Indeed relative to its earnings its debt load seems light as a feather. The modesty of its debt load may become crucial for Louisiana-Pacific if management cannot prevent a repeat of the 63% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Louisiana-Pacific's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Louisiana-Pacific produced sturdy free cash flow equating to 57% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Based on what we've seen Louisiana-Pacific is not finding it easy EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to cover its interest expense with its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Louisiana-Pacific is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Louisiana-Pacific's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance