4 Electronics Semiconductor Stocks to Escape Macro Headwinds

The challenging global macroeconomic environment and end-market volatility have affected the Zacks Electronics - Semiconductors industry. Geo-political tensions, unfavorable forex, inventory corrections and high inflationary pressure have been taking a toll on the industry.

Nevertheless, industry players like Amkor Technology AMKR, Impinj PI, Silicon Motion Technology SIMO and Alpha and Omega Semiconductor AOSL have been benefiting from the increasing demand for high-volume consumer electronic devices, such as digital media players, smartphones and tablets, and the strong uptake of efficient packaging, machine vision solutions and robotics. Additionally, the growing proliferation of AI, Machine Learning, Blockchain, Internet of Things, Augmented Reality/Virtual Reality (AR/VR) and industrial revolution 4.0 (which focuses on interconnectivity and automation) should continue to drive the industry’s growth. Easing supply-chain constraints are also benefiting the industry participants.

Industry Description

The Zacks Electronics – Semiconductors industry comprises firms that provide a wide range of semiconductor technologies. Their offerings include packaging and test services, wafer cleaning, factory automation, face detection, and image-recognition capabilities to develop intelligent and connected products. The participants primarily cater to end-markets constituting consumer electronics, communications, computing, industrial and automotive. These companies are raising their spending on research and development to stay afloat in an era of technological advancements and changing industry standards. The underlined industry is experiencing solid demand for advanced electronic equipment, helping these firms increase their investments in cost-effective process technologies.

What's Shaping the Future of the Electronics - Semiconductors Industry?

Macroeconomic Headwinds Pose Concerns: Fears of global recession and high inflation have negatively impacted the rate of deal wins. Due to the challenging macroeconomic scenario, enterprises are reluctant to sign multi-year deals worldwide. These trends do not bode well for industry participants.

Geo-political Tensions Are Worrisome: The ongoing Russia-Ukraine war, and most importantly, the souring relationship between the United States and China, remain headwinds. Increasing dependency on AI-backed electronic devices on semiconductors and current restrictions ordered by the United States on trading with China, which remains the main hub for chip production, is a significant negative for the underlined industry.

Smart Devices Aid Computing Demand: Smart devices need computing and learning capabilities to perform face detection, image recognition, and video analytics capabilities. These require high processing power, speed and memory, low power consumption, and better graphic processors and solutions, which bode well for the industry. Graphic solutions help increase the image rendering rate, and improve image resolution and color definition.

Complex Process Drives Demand: The requirement for faster, more powerful and energy-efficient semiconductors is expected to increase rapidly with the robust adoption of cloud computing, IoT and AI. Semiconductor manufacturers are primarily looking to maximize manufacturing yields at lower costs. This is making semiconductor manufacturing processes more complex and driving the demand for solutions offered by industry participants. The rapid adoption of IoT-supported factory automation solutions is another contributing factor. The increasing deployment of 5G is a key catalyst.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Electronics - Semiconductors industry is housed within the broader Zacks Computer and Technology sector. It currently carries a Zacks Industry Rank #155, which places it in the bottom 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Since Feb 29, 2024, the industry’s earnings estimates for the current year have moved 11.8% down.

Despite the gloomy industry outlook, a few stocks have the potential to outperform the market based on a strong earnings outlook. But before we present the top industry choices, it is worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Outperforms S&P 500 & Sector

The Zacks Electronics - Semiconductors industry has outperformed the Zacks S&P 500 composite and surpassed the broader Zacks Computer and Technology sector in the past year.

The companies in the industry have collectively surged 67.3% compared with the S&P 500 and the broader sector’s rallies of 16% and 22.3%, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is a commonly used multiple for valuing electronics semiconductors stocks, the industry is currently trading at 37.9X versus the S&P 500 and the sector’s 20.7X and 27.71X, respectively.

Over the past five years, the industry has traded as high as 44.41X, as low as 10.13X and recorded a median of 17.47X, as the chart below shows.

Price/Earnings Ratio (F12M)

4 Electronics Semiconductor Stocks to Buy

Amkor Technology: The Tempe, AZ-based company is riding on its technology leadership in advanced packaging, expanding its global footprint, and strong relationships with lead customers in the secular growth market. Amkor is witnessing solid momentum across fast-growing markets like automotive electronics, 5G, Internet of Things and artificial intelligence, which is a positive.

The Zacks Rank #1 (Strong Buy) company, which is the world's largest independent provider of semiconductor packaging and test services, is expected to benefit from increasing semiconductor content per car due to the proliferation of ADAS, electrification, infotainment and telematics, which are boosting advanced packaging technology demand. The company’s strengthening R&D efforts to innovate next-generation advanced packaging technologies for high-performance computing are positives.

You can see the complete list of today’s Zacks #1 Rank stocks here.

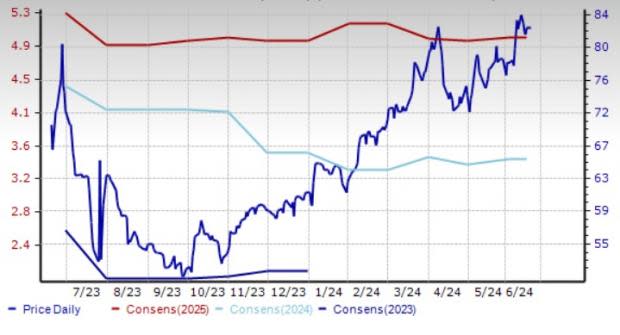

Amkor Technology has gained 33.5% in the past year. The Zacks Consensus Estimate for AMKR’s 2024 earnings moved north by 9.2% to $1.78 per share over the last 60 days.

Price and Consensus: AMKR

Silicon Motion Technology: The Hong Kong, China-based company is a developer of microcontroller ICs for NAND flash storage devices, and high-performance, low-power semiconductor solutions for original equipment manufacturers (“OEM”) and other customers. The company is known as the leading merchant supplier of client SSD controllers to module makers, including most market leaders in the United States, Taiwan and China.

The Zacks Rank #1 company is benefiting from a strong product portfolio. The launch of an ultra-fast, single-chip controller, SM2322, is helping SIMO in addressing the growing demand for high-density, external portable SSDs. The Introduction of Universal Flash Storage 4.0 controller is bolstering Silicon Motion’s prospects in automotive and edge computing. The company’s expanding SSD controller program engagements with PC OEMs and eMMC/UFS controllers for smartphones, automotive applications and IoT/smart devices is a plus.

Silicon Motion Technology has gained 20.8% in the past year. The Zacks Consensus Estimate for SIMO’s 2024 earnings moved 2.1% north to $3.47 per share over the last 60 days.

Price and Consensus: SIMO

Alpha and Omega Semiconductor: The Sunnyvale, CA-based company is known for its wide array of power semiconductor products, such as Power MOSFET, SiC, IGBT, IPM, TVS, HV Gate Drivers, Power IC and Digital Power products. Its diversified portfolio makes it well-poised to capitalize on the ongoing trend of AI, digitalization, connectivity, and electrification. It enjoys strong momentum in battery, motor and power supply applications.

Alpha and Omega Semiconductor’s ongoing transition from a component supplier to a comprehensive solution provider in order to capitalize on the increasing bill-of-materials content across various end markets is a positive. The Zacks Rank #1 company’s core competencies of high-performance silicon, advanced packaging and intelligent ICs are creating other tailwinds.

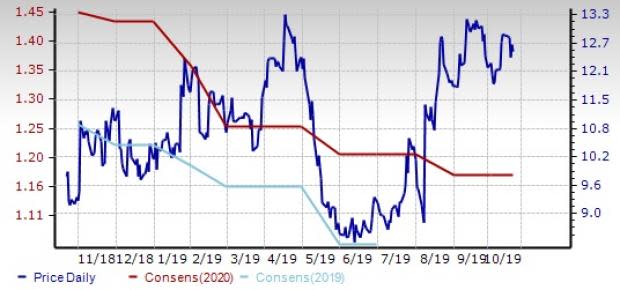

Alpha and Omega Semiconductor has gained 2.8% in the past year. The Zacks Consensus Estimate for AOSL’s fiscal 2024 earnings moved 38.1% north to 58 cents per share over the last 60 days.

Price and Consensus: AOSL

Impinj: The Seattle, WA-based company is a provider of referral and information network radio frequency identification solutions to the retail, pharmaceutical, healthcare, food and beverage, and other industries.

The Zacks Rank #2 (Buy) company is benefiting from strength in the end-point IC product line, which is driving its momentum in retail apparel and general merchandise applications. Strength in Impinj’s self-checkout and loss prevention solutions is a positive. The growing penetration of RAIN products in the apparel category is a plus.

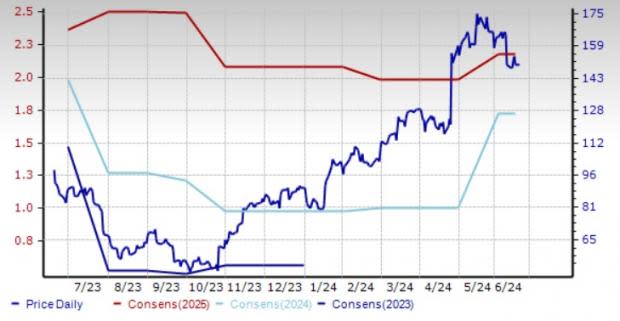

Impinj has gained 51.5% in the past year. The Zacks Consensus Estimate for PI’s 2024 earnings moved 83.2% north to $1.74 per share over the last 60 days.

Price and Consensus: PI

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Alpha and Omega Semiconductor Limited (AOSL) : Free Stock Analysis Report

Impinj, Inc. (PI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance