3M's (MMM) Sales Fall Y/Y in May on Lower Business Days

3M Company MMM yesterday provided an update on its sales performance in May 2020. Results declined 20% on a year-over-year basis despite the pandemic spurring the demand for certain products — including personal safety, food safety products and other products. Notably, the decline is worse than the 11% fall recorded for April.

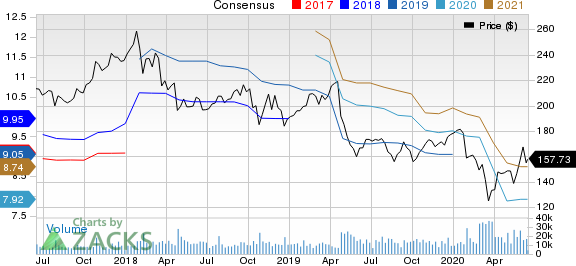

Despite weak results, the company’s shares gained 1.9% yesterday, closing the trading session at $157.73.

Inside the Headlines

As noted, the monthly sales totaled $2.2 billion. Organic sales in May were down 21% year over year, while forex woes had an adverse impact of 1%. However, acquisitions/divestitures had a positive impact of 2%. The company further pointed out that fewer business days in May on a year-over-year basis adversely impacted sales performance to the tune of 9%.

On a geographical basis, sales in the Americas decreased 21% year over year, with organic sales declining 24%. Notably, sales (organically) were down 22% in the United States. Further, Europe, Middle East and Africa’s sales declined 26%, with a dip in organic sales of 25%. Also, sales in the Asia Pacific declined 15%. Notably, organic sales (local currency) in China decreased 6% and fell 18% in Japan.

On a segmental basis, sales decreased 17% year over year in Safety and Industrial, while plummeted 30% in Transportation & Electronics, and 12% in Consumer. Further, Health Care sales decreased 11% year over year. On an organic basis, sales were down 15% in Safety and Industrial, 28% in Transportation & Electronics, 11% in Consumer and 22% in Health Care.

The company is scheduled to release second-quarter results on July 28, before the market opens. It predicts that the impacts of two lower business days in May are likely to offset gain from two extra business days in June, thus, making the impact nil for the quarter.

For the second quarter of 2020, the Zacks Consensus Estimate for earnings is pegged at $1.71, reflecting a decline of 5.5% from the 60-day-ago figure. The consensus estimate for revenues is pegged at $7 billion, suggesting a decline of 14.4% from the year-ago reported figure.

Zacks Rank, Earnings Estimates, Price Performance and Peers

3M, with a market capitalization of $89.1 billion, currently carries a Zacks Rank #3 (Hold). The company is poised to gain from its cost-saving measures, the pandemic-induced demand for certain products, buyouts and shareholder-friendly policies. However, weakness in end-markets caused by the coronavirus outbreak, high debts and forex woes are concerning.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past three months, 3M’s shares have gained 17.3% compared with the industry’s growth of 14.4%.

The Zacks Consensus Estimate for the company’s earnings is pegged at $7.92 for 2020 and $8.74 for 2021, reflecting declines of 2.9% and 3.1% from the respective 60-day-ago figures.

3M Company Price and Consensus

3M Company price-consensus-chart | 3M Company Quote

Three companies from the industry that competes with 3M are Carlisle Companies Incorporated CSL, Honeywell International Inc. HON and Danaher Corporation DHR.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance