33% Gains in 10 Days! Is This Top Dividend Stock Still a Screaming Buy?

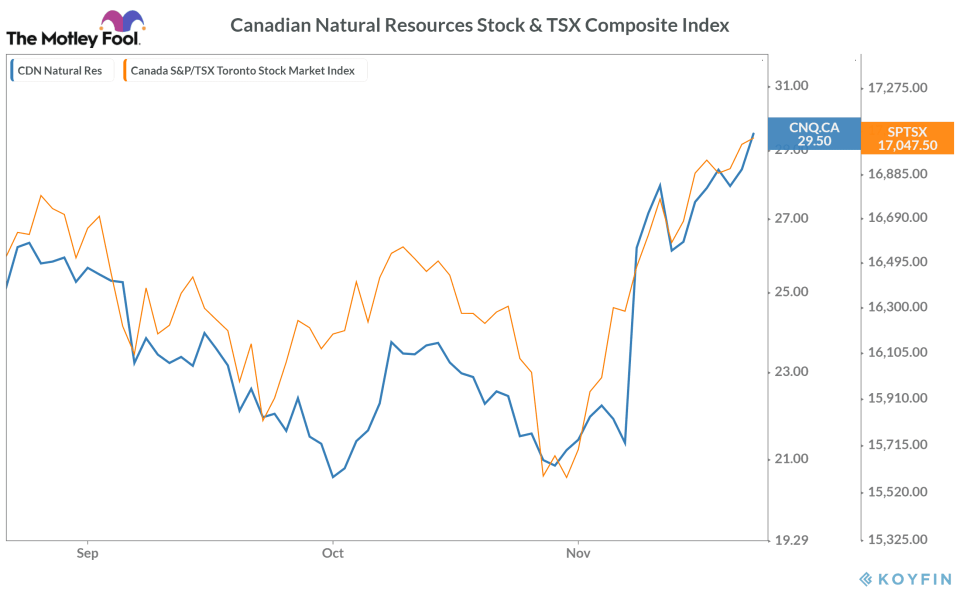

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) — the Calgary-based crude oil and natural gas exploration company — has emerged as the top-performing S&P/TSX60 company in the last 10 days. During this period, its stock has risen by a 33.1% — much higher as compared to 5.2% gains in the TSX60 Index.

Let’s take a closer look at what drove these solid gains in Canadian Natural Resources stock and find out if it’s still a good buy.

What drove massive gains in Canadian Natural Resources stock?

A sharp rally in Canadian Natural Resources stock started earlier this month after the company reported its better-than-expected third-quarter results on November 6.

In the quarter ended September 30, it reported an adjusted net profit of $135 million. While this figure reflected a 90% YoY (year-over-year) decline in its profits, it was much better than analysts’ consensus expectation of a $165 million net loss.

These profits translated into adjusted earnings of $0.11 per share for the quarter. More importantly, the company’s Q3 earnings showed a massive improvement compared to its net loss of $0.65 per share in the previous quarter.

Other key positive factors

In Q3 2020, Canadian Natural’s management focused on increasing liquids production from its North American exploration and production assets. As a result, its production from these assets rose 20% sequentially to about 495 thousand barrels per day. At the same time, CNQ managed to minimize its operating costs — boosting its bottom line for the quarter.

These factors demonstrated strength in Canadian Natural Resources’ business model — helping it regain investors’ confidence.

Analysts are turning positive on CNQ

Following its upbeat third-quarter results, analysts at Canadian Imperial Bank of Commerce raised their price target on CNQ stock to $31 per share.

Most other notable Bay Street analysts are already favouring a “buy” on the stock. Currently, 22 out of 24 analysts covering it suggest a “buy.” Only one analyst each is recommending a “sell” and a “hold.”

Is CNQ stock worth buying right now?

After sliding by nearly 22% in the first quarter, the shares of Canadian Natural Resources recovered sharply in the next couple of quarters. It rose by 16% in the second quarter and added another 4% gains in the third quarter. On a quarter-to-date basis, CNQ stock is trading with 6% gains in the fourth quarter.

Interestingly, Canadian Natural Resources is one of the very few TSX companies that didn’t cut or discontinued its dividends amid the COVID-19 crisis. In fact, it has paid 13.3% higher dividends in the first three quarters of 2020 compared to the same period of 2019. The company’s strong dividend yield of about 6% makes its stock look attractive — especially when its financials are showcasing a rapid recovery.

Foolish takeaway

Despite a sharp recent rally, Canadian Natural Resources is still trading within the negative territory on a year-to-date basis. As of Friday’s closing price, its stock has lost 32.3% in 2020 so far.

If the company manages to maintain a robust financial recovery in the fourth quarter, its stock is very likely to outperform the broader market by a wide margin. That’s why if you’re looking to buy a good dividend stock with a reliable business model, you should definitely consider buying Canadian Natural Resources stock.

The post 33% Gains in 10 Days! Is This Top Dividend Stock Still a Screaming Buy? appeared first on The Motley Fool Canada.

More reading

Fool contributor Jitendra Parashar has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance