3 US Stocks That May Be Trading Below Their Estimated Value

As major U.S. stock indexes experience a downturn ahead of the anticipated jobs report and amid rising oil prices due to Middle East tensions, investors are keenly observing market fluctuations for signs of economic stability. In this environment, identifying stocks that may be trading below their estimated value can provide opportunities for investors seeking potential growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Peoples Financial Services (NasdaqGS:PFIS) | $44.73 | $87.09 | 48.6% |

First Internet Bancorp (NasdaqGS:INBK) | $30.50 | $60.91 | 49.9% |

Pinnacle Financial Partners (NasdaqGS:PNFP) | $92.95 | $180.20 | 48.4% |

California Resources (NYSE:CRC) | $53.64 | $104.42 | 48.6% |

Tenable Holdings (NasdaqGS:TENB) | $40.20 | $78.97 | 49.1% |

EverQuote (NasdaqGM:EVER) | $20.32 | $39.77 | 48.9% |

EVERTEC (NYSE:EVTC) | $33.57 | $66.28 | 49.4% |

Dingdong (Cayman) (NYSE:DDL) | $3.69 | $7.25 | 49.1% |

Vasta Platform (NasdaqGS:VSTA) | $2.63 | $5.11 | 48.5% |

SunOpta (NasdaqGS:STKL) | $6.35 | $12.65 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

AppLovin

Overview: AppLovin Corporation develops a software-based platform that aids advertisers in optimizing the marketing and monetization of their content both in the United States and globally, with a market cap of approximately $43.91 billion.

Operations: The company generates revenue through its Apps segment, which contributes $1.49 billion, and its Software Platform segment, which brings in $2.47 billion.

Estimated Discount To Fair Value: 40.5%

AppLovin is trading at US$135.25, significantly below its estimated fair value of US$227.15, suggesting undervaluation based on discounted cash flow analysis. Recent earnings growth was substantial, with net income rising to US$309.97 million in Q2 2024 from US$80.36 million a year earlier. Despite high debt levels and significant insider selling in the past quarter, AppLovin's forecasted annual profit growth of 24.7% exceeds market expectations, bolstered by its inclusion in the FTSE All-World Index.

CrowdStrike Holdings

Overview: CrowdStrike Holdings, Inc. provides cybersecurity solutions both in the United States and internationally, with a market cap of approximately $68.69 billion.

Operations: The company's revenue is primarily generated from its Security Software & Services segment, amounting to $3.52 billion.

Estimated Discount To Fair Value: 32.7%

CrowdStrike Holdings is trading at US$283.75, below its estimated fair value of US$421.81, highlighting potential undervaluation based on discounted cash flow analysis. Recent revenue growth to US$963.87 million in Q2 2024 from US$731.63 million a year ago signals robust performance despite insider selling and shareholder dilution over the past year. Forecasted earnings growth of 35.4% annually surpasses market averages, supported by innovative product expansions like AI Security Posture Management and Falcon Cloud Security enhancements.

SharkNinja

Overview: SharkNinja, Inc. is a product design and technology company that offers a range of consumer solutions globally, with a market cap of approximately $15.05 billion.

Operations: The company's revenue primarily comes from its Appliance & Tool segment, which generated $4.76 billion.

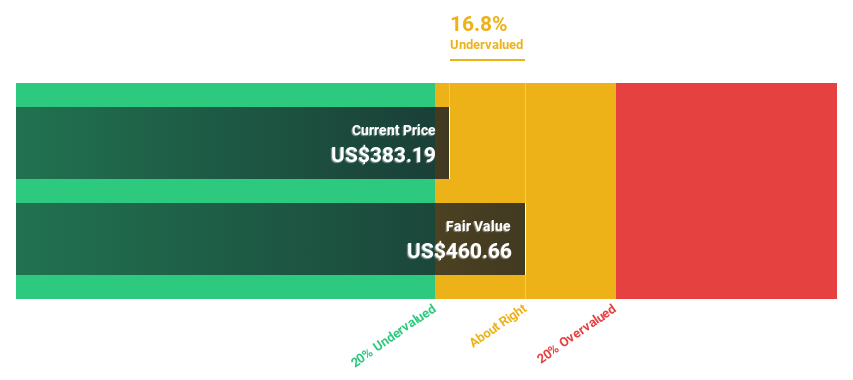

Estimated Discount To Fair Value: 27.9%

SharkNinja trades at US$109.05, significantly below its fair value estimate of US$151.31, indicating potential undervaluation based on discounted cash flow analysis. With earnings projected to grow at 26.08% annually, surpassing market averages, and recent revenue growth from US$950.31 million to US$1.25 billion in Q2 2024, the company shows strong financial performance despite concerns about debt coverage by operating cash flow and slower revenue growth compared to earnings expansion forecasts.

The growth report we've compiled suggests that SharkNinja's future prospects could be on the up.

Navigate through the intricacies of SharkNinja with our comprehensive financial health report here.

Where To Now?

Gain an insight into the universe of 191 Undervalued US Stocks Based On Cash Flows by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:APP NasdaqGS:CRWD and NYSE:SN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance