3 UK Growth Companies With Up To 38% Insider Ownership

Amidst a backdrop of fluctuating global markets and particular challenges in the UK, such as declining car production and ongoing financial regulatory debates, investors are keenly watching for resilient opportunities. In this context, growth companies with high insider ownership in the UK stand out as potentially strong contenders due to their leaders' commitment and deep-rooted stake in their businesses' success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

LSL Property Services (LSE:LSL) | 10.7% | 33.3% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Here we highlight a subset of our preferred stocks from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

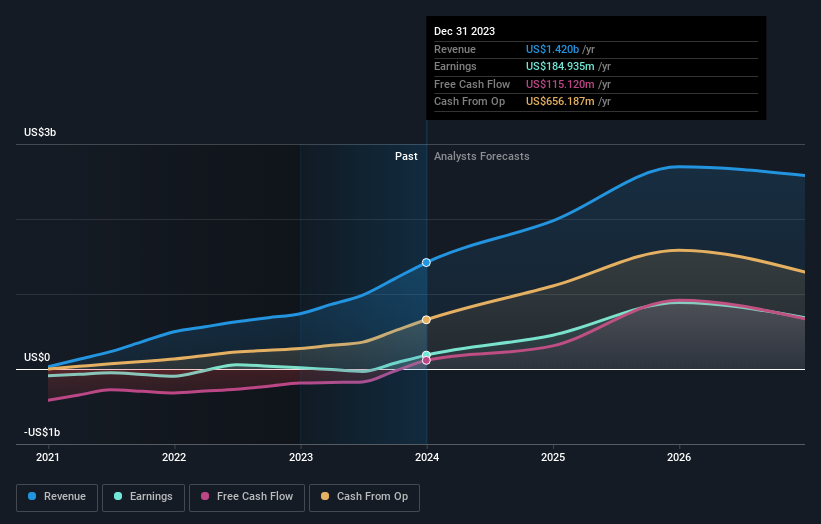

Overview: Craneware plc operates in the healthcare industry in the United States, focusing on developing, licensing, and supporting computer software, with a market capitalization of approximately £800.43 million.

Operations: The company generates its revenue primarily through its healthcare software segment, which brought in $180.56 million.

Insider Ownership: 17%

Craneware, a UK-based company, demonstrates robust growth potential with its earnings forecast to increase by 28.5% annually, outpacing the UK market's average of 13.2%. Despite a modest Return on Equity projection of 11.2%, the firm's revenue is expected to grow at 7.3% per year, again exceeding the national market forecast of 3.7%. Recent activities include extending their buyback plan and active participation in significant industry conferences, signaling ongoing operational momentum and management confidence in its financial health.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

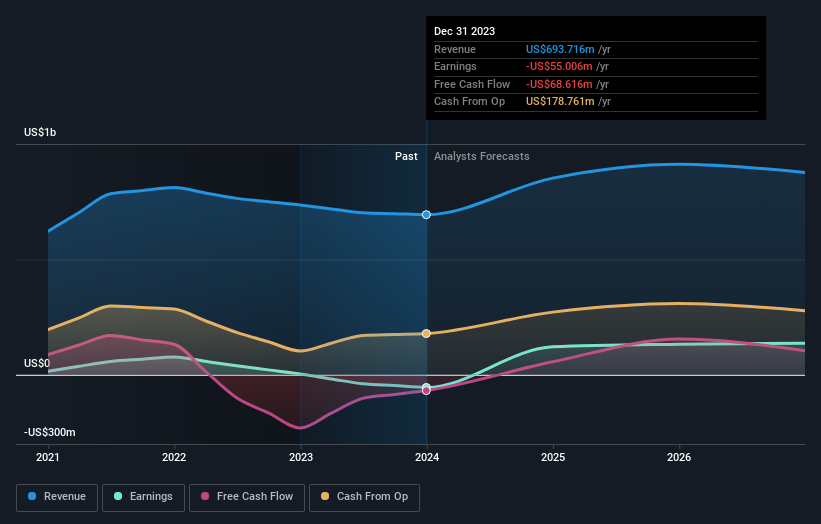

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of resources, with a market capitalization of approximately £2.16 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $1.42 billion.

Insider Ownership: 10.7%

Energean, a UK-based energy firm, has shown substantial growth with a 970.8% increase in earnings over the past year and is forecasted to grow earnings by 19.42% annually. Despite trading at 20.5% below its estimated fair value and having high insider ownership, challenges include high debt levels and dividends that are not well-covered by earnings or cash flows. Recent production increases and positive financial results underscore its operational success, supporting a potentially optimistic outlook for growth-focused investors.

Delve into the full analysis future growth report here for a deeper understanding of Energean.

Our valuation report here indicates Energean may be undervalued.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company that specializes in the exploration, mining, processing, and sale of gold and silver in countries including Peru, Argentina, the United States, Canada, Brazil, and Chile, with a market capitalization of approximately £0.92 billion.

Operations: Hochschild Mining's revenue is primarily derived from its operations at Inmaculada generating $396.64 million, San Jose at $242.46 million, and Pallancata contributing $54.05 million.

Insider Ownership: 38.4%

Hochschild Mining, a UK-based precious metals miner, is navigating a challenging landscape with significant insider buying in the past three months, signaling confidence from management. Despite a net loss reported for 2023, the company forecasts robust revenue growth at 8.4% per year, outpacing the UK market average. Looking ahead to 2024, Hochschild anticipates producing between 343,000 and 360,000 gold equivalent ounces. The firm is actively pursuing value-accretive mergers and acquisitions focused on Latin America to bolster future growth.

Make It Happen

Investigate our full lineup of 66 Fast Growing UK Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW LSE:ENOG and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance