3 Top TSX Passive-Income Stocks That Pay Out Every Month

Written by Kay Ng at The Motley Fool Canada

Higher interest rates have more or less triggered lower stock valuations, which provides a good opportunity for investors to buy income stocks for more passive income. Here are a few top TSX passive-income stocks that conveniently pay out cash every month!

Exchange Income Corporation

Exchange Income Corporation (TSX:EIF) consists of a diversified portfolio of operating subsidiaries in the aviation and industrial manufacturing industries. It aims to acquire profitable companies that generate quality, durable cash flows and have the potential for organic growth. Its 18 subsidiaries deliver essential products and services to niche markets.

At $45.78 per share at writing, the stock offers a nice dividend yield of almost 5.8%. Despite the sensitivity of the aviation and industrial manufacturing industries to the economic cycle, the company has maintained or increased its monthly dividend since its inception in 2004.

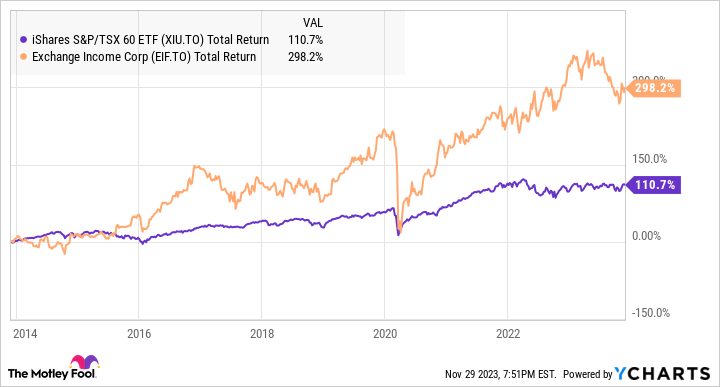

At the recent quotation, analysts believe the undervalued stock is discounted by about 27%. For your reference, the stock last increased its dividend this month by 4.8%. It has also outperformed the Canadian stock market benchmark over the last three, five, and 10 years. Its underperformance over the last 12 months represents a buy-the-dip opportunity.

XIU and EIF 10-Year Total Return Level data by YCharts

CT REIT

Higher interest rates have weighed on CT REIT (TSX:CRT.UN), which as a Canadian real estate investment trust (REIT), naturally has sizeable debt on its balance sheet. That said, CT REIT’s key tenant is Canadian Tire. Both companies maintain an investment-grade S&P credit rating of BBB. Importantly, CT REIT maintains a high occupancy rate of north of 99%.

CT REIT’s fundamentals remain defensive. Year to date, it witnessed net operating income growth of 4.6% year over year, while the funds from operations per unit rose by 3.8%. The REIT is a Canadian Dividend Aristocrat with a five-year cash-distribution growth rate of roughly 4%.

At $13.55 per unit, its cash distribution yield is attractive at 6.6% for a juicy monthly payout. Analysts also believe the stock is discounted by approximately 18%.

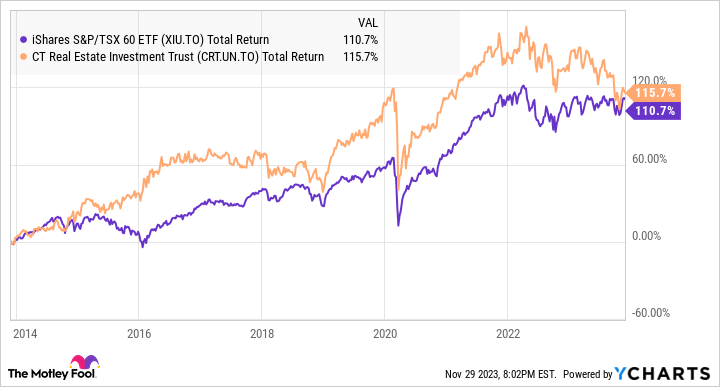

XIU and CRT.UN 10-Year Total Return Level data by YCharts

Although barely, the stock has outperformed the Canadian stock market benchmark over the last decade while paying outsized monthly income.

Dream Industrial REIT

Dream Industrial REIT (TSX:DIR.UN) is in a good space. The industrial real estate industry continues to grow, while the stock valuation has come down. The REIT is comprised of 322 industrial assets and generates rental income from Canada, Europe, and the United States.

It also maintains a high occupancy rate of approximately 97%. A positive sign is that the REIT has a relatively low net debt-to-asset ratio of 35%. Additionally, it has strong mark-to-market potential to increase its rental income in Canada and Europe.

At $12.49 per unit, it yields 5.6%. Furthermore, analysts believe the stock is discounted by approximately 22%.

Income tax on Canadian REIT distributions

Canadian REITs pay out cash distributions that are like dividends but are taxed differently. In non-registered accounts, the return-of-capital portion of the distribution reduces the cost base. The return of capital is tax deferred until unitholders sell or their adjusted cost base turns negative.

REIT distributions can also contain other income, capital gains, and foreign non-business income. Other income and foreign non-business income are taxed at your marginal tax rate, while half of your capital gains are taxed at your marginal tax rate.

If you hold Canadian REITs inside tax-advantaged accounts like a Tax-Free Savings Account, Registered Retirement Savings Plan, Registered Disability Savings Plan, Registered Education Savings Plan, or First Home Savings Account, you won’t need to worry about the source of income other than foreign income which may have foreign withholding tax. When unsure of where best to hold REIT units, seek advice from a tax professional.

The post 3 Top TSX Passive-Income Stocks That Pay Out Every Month appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Ct Real Estate Investment Trust?

Before you consider Ct Real Estate Investment Trust, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2023... and Ct Real Estate Investment Trust wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 24 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/14/23

More reading

Fool contributor Kay Ng has positions in Exchange Income. The Motley Fool recommends Dream Industrial Real Estate Investment Trust. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance