3 Top-Rated Stocks That Look Attractive After Earnings

Optimistically, more and more stocks are starting to stand out this earnings season. Even better, there are a variety of stocks from different sectors that look attractive after reporting quarterly results this week.

Here are three diverse top-rated stocks that investors may want to consider after beating earnings expectations.

MakeMyTrip Limited (MMYT)

Starting with a tech stock, MakeMy Trip Limited lands a Zacks Rank #2 (Buy) after beating its fiscal fourth-quarter earnings expectations on Tuesday.

The Internet-Delivery Services Industry is also in the top 16% of over 250 Zacks industries. To that point, MakeMy Trip’s stock can offer solid exposure to its strong business industry as an online travel service that offers travel products and solutions in India and the United States.

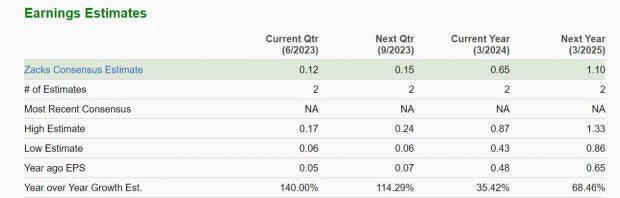

This is especially true with travel demand expected to be higher in 2023. Indicative of such, MakeMy Trip’s Q4 earnings of $0.21 per share came in 110% above EPS expectations of $0.10. More intriguing, MakeMy Trip’s annual outlook has become more attractive. With shares of MMYT trading at $25, annual earnings are now forecasted to climb 35% in its current fiscal 2024 and soar another 68% in FY25 at $1.10 per share.

Image Source: Zacks Investment Research

Paysafe Limited (PSFE)

Among the Zacks Business Services sector Paysafe Limited’s stock looks attractive sporting a Zacks Rank #2 (Buy) with the company crushing first-quarter earnings estimates on Tuesday.

Notably, Paysafe’s Financial Transaction Services Industry is in the top 44% of all Zacks industries. Paysafe appears to be benefiting as a specialized payment platform that enables businesses and consumers to connect and transact seamlessly through payment processing, digital wallets, and online cash solutions.

First-quarter earnings of $0.54 per share crushed expectations by 575% with Q1 EPS estimates at $0.08. Paysafe was able to reconfirm its full-year outlook following its strong Q1 results, and sales of $387.85 million were the highest quarterly total since the company went public in 2021.

Image Source: Zacks Investment Research

Attractively, Paysafe is staying above the profitability line although earnings are projected to drop to $0.65 per share in fiscal 2023 after an extremely tough year to follow that saw EPS at $2.25 in 2022. Still, fiscal 2024 earnings are expected to stabilize and rebound 106% at $1.34 per share.

Furthermore, with Paysafe stock still near its 52-week lows at around $11 a share much of the risk to reward appears to be already priced in.

Suzuki Motor (SZKMY)

Automaker Suzuki Motor rounds out the list and also sports a Zacks Rank #2 (Buy) after impressively surpassing its fiscal-fourth quarter earnings expectations on Monday.

As a global branded auto company, Suzuki stock is attractive at the moment with its Automotive-Foreign Industry in the top 14% of all Zacks industries.

The iconic motorcycle and automobile manufacturer was able to top its Q4 EPS estimates by 9% at $2.50 per share compared to expectations of $2.30 a share. This was despite a very slight miss on the top line.

Image Source: Zacks Investment Research

Suzuki’s earnings are forecasted to jump 10% in its current fiscal 2024 and rise another 3% in FY25 at $15.41 per share. Furthermore, Suzuki stock trades attractively from a price-to-earnings valuation perspective. Trading at $135 a share, Suzuki stock trades at 9.1X forward earnings which is above the industry average of 6.8X but nicely beneath the S&P 500’s 19.3X.

Plus, Suzuki is an industry leader and trades 71% below its decade-long high of 32X and offers a 29% discount to the median of 12.9X.

Image Source: Zacks Investment Research

Takeaway

Strong quarterly results have made these companies look more attractive at their current levels. More importantly, MakeMy Trip, Paysafe, and Suzuki are starting to look like viable investments for 2023 and beyond.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

Suzuki Motor (SZKMY) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance