3 Top Ranked Stocks for a Year End Rally

It’s no secret that the last two weeks of the year are one of the seasonally strongest periods of the year, that’s why its deemed the Santa Claus rally.

What better way to take advantage of the bullish drift than to pick up some top Zacks Rank stocks. Here I will share three such stocks that enjoy upward trending earnings revisions and strong relative price momentum.

Image Source: Zacks Investment Research

Duolingo

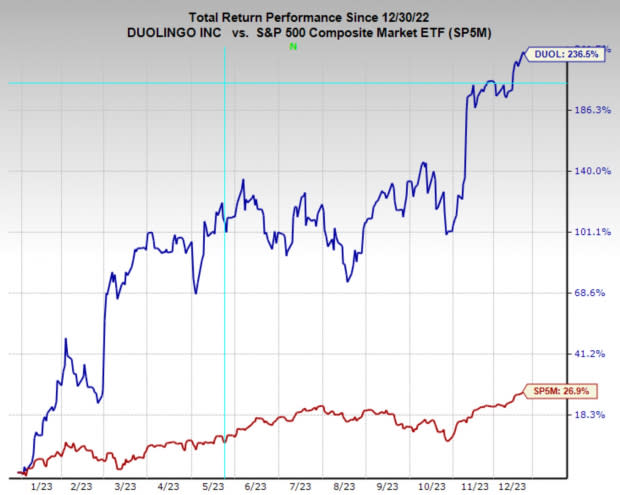

If you have sought out language education of any sort, you have probably heard of Duolingo DUOL. Duolingo went public in mid-2021, and after a challenging initial 12 months has gone on an incredible run in 2023. Since the start of the year DUOL has rallied 236% and currently hovers at its all-time high.

Image Source: Zacks Investment Research

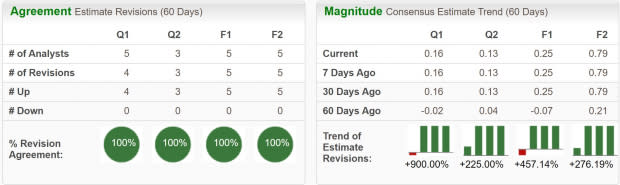

Analysts have revised earnings estimates considerably higher over the last two months, giving Duolingo a Zacks Rank #1 (Strong Buy) rating. In addition to seeing earnings flip to a net positive in the coming quarters and years, sales growth is forecast to grow at an impressive pace.

In FY23 sales are projected to grow 42.6% YoY to $527 million, and FY24 is expected to see growth of 29.3% to $681.5 million. With next year’s sales expected to be $681.5 million and a total market capitalization of $10 billion the company is trading at a forward sales multiple of 14.7x, which is an admittedly loft valuation.

Image Source: Zacks Investment Research

Sunoco

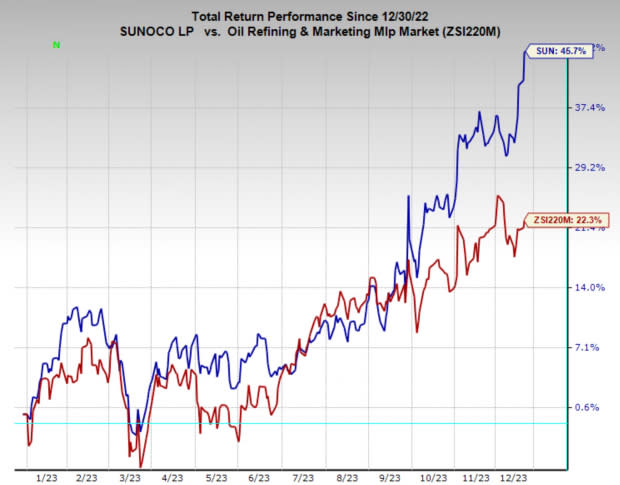

Sunoco SUN is a master limited partnership (MLP) based in the United States. The company is primarily engaged in the wholesale distribution and retail sale of motor fuels, operating convenience stores and fueling stations across the country. Sunoco’s business activities include the acquisition, distribution, and marketing of fuel products, as well as operating convenience stores under various brand names.

In what has been a more challenging year for oil stocks Sunoco stock has managed in impressive performance. With the stock up 45% YTD it has doubled the performance of the industry and well outperformed the market.

As part of the Oil and Gas - Refining and Marketing - Master Limited Partnerships it sits in the Top 1% (3 out of 252) of the Zacks Industry Rank.

In addition to a Zacks Rank #1 (Strong Buy) reflecting upward trending earnings revisions, Sunoco also pays a hefty dividend of 5.8%.

Image Source: Zacks Investment Research

Amazon

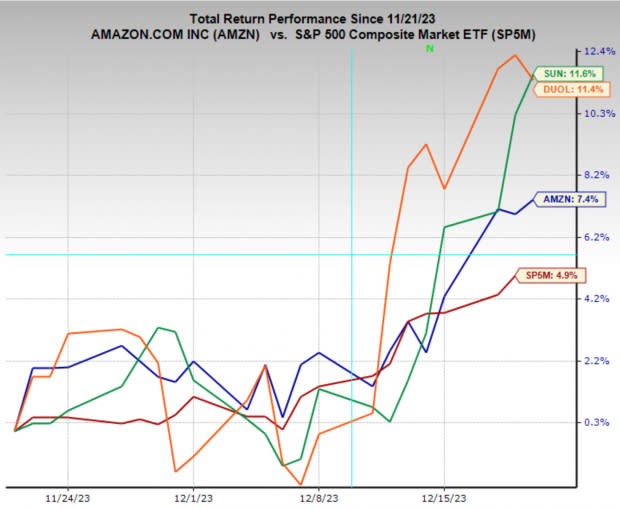

After a very challenging 2022, Amazon AMZN has made an impressive comeback this year, rallying 81% YTD. Over the last 20 years, Amazon has compounded at an annual rate of 22.2%.

As seen in the technical chart below, AMZN stock has been forming, and breaking out of some prototypical momentum trading patterns. Just this week, the stock broke out from a very clean sideways bull consolidation. Because of the year end bullish tendencies in stocks, I wouldn’t be surprised to see AMZN stock rally right into the year end.

Image Source: TradingView

Amazon has also experienced earnings estimates upgrades over the last two months, giving it a Zacks Rank #1 (Strong Buy) rating. Earnings over the next quarters and years are expected to grow at the fastest pace among the magnificent seven stocks.

Current quarter earnings are projected to climb 271% YoY, FY23 earnings are expected to increase 276%, and over the next 3-5 years, EPS are forecasted to grow 28.5% annually.

Image Source: Zacks Investment Research

Bottom Line

For investors looking to make trades benefitting from the year end rally, Sunoco, Duolingo and Amazon all make worthy considerations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance