3 Top Dividend Stocks With Yields Ranging From 4% To 6.6%

Amidst a backdrop of notable performances in sectors like gold and technology, the U.S. stock market continues to present varied investment opportunities. In this environment, dividend stocks remain a compelling option for investors seeking steady income streams, particularly when considering current economic dynamics and market trends.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.26% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.37% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.08% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.02% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.78% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.14% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.21% | ★★★★★☆ |

Helmerich & Payne (NYSE:HP) | 4.89% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.58% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Sierra Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sierra Bancorp, operating through its subsidiary Bank of the Sierra, offers retail and commercial banking services primarily in California, with a market capitalization of approximately $318.77 million.

Operations: Sierra Bancorp generates its revenue primarily through banking services, totaling approximately $141.85 million.

Dividend Yield: 4.1%

Sierra Bancorp offers a steady dividend yield of 4.08%, although it falls below the top quartile of US dividend stocks. The company’s dividends are well-supported by a modest payout ratio of 37.9%. Despite a slight earnings growth last year, projections indicate an average annual decline of 0.1% over the next three years, raising concerns about long-term sustainability. Recent financials show increased net income and interest income, alongside higher charge-offs and continued share buybacks, reflecting mixed financial health signals.

Get an in-depth perspective on Sierra Bancorp's performance by reading our dividend report here.

Our valuation report here indicates Sierra Bancorp may be undervalued.

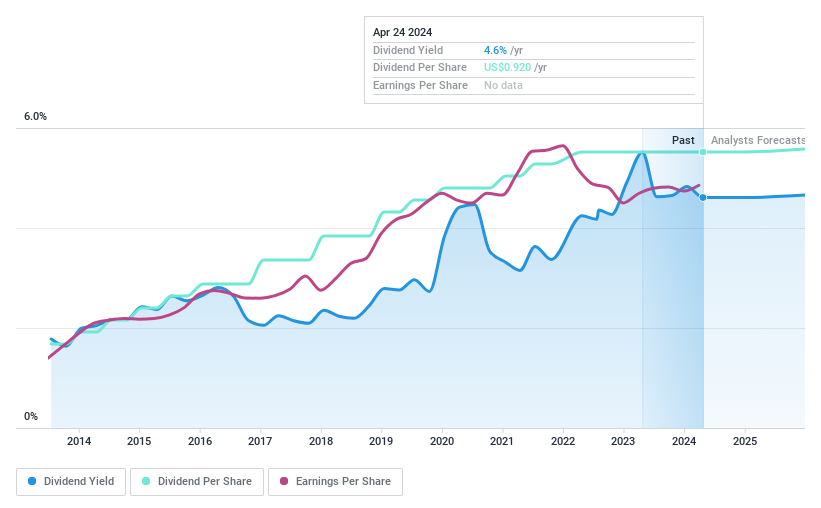

First Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Bancorp, Inc., serving as the holding company for First National Bank, offers various banking products and services to individuals and businesses, with a market capitalization of approximately $274.85 million.

Operations: First Bancorp, Inc. generates its revenue primarily through banking operations, which amounted to $78 million.

Dividend Yield: 5.6%

First Bancorp has demonstrated a consistent dividend history, with payments increasing over the last decade and a recent uptick to US$0.36 per share for Q2 2024. The stock offers a competitive yield of 5.58%, placing it in the top quartile of US dividend payers. Despite trading at 63.3% below estimated fair value, recent financials reveal a dip in net interest income and net income year-over-year, which could raise concerns about future earnings support for dividends.

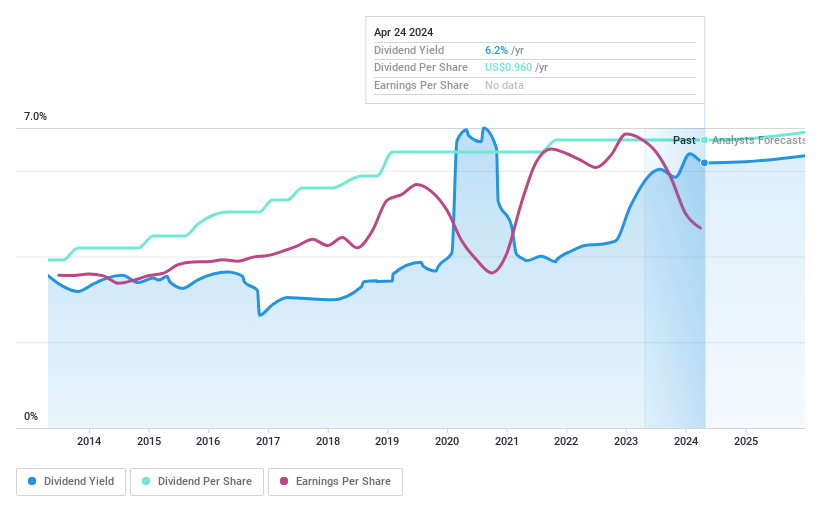

Provident Financial Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc., functioning as the bank holding company for Provident Bank, offers a range of banking products and services to individuals, families, and businesses in the United States, with a market capitalization of approximately $1.09 billion.

Operations: Provident Financial Services, Inc. generates its revenue primarily through traditional banking and other financial services, totaling approximately $441.20 million.

Dividend Yield: 6.6%

Provident Financial Services maintains a strong dividend appeal with a 6.6% yield, ranking in the top 25% of US dividend payers. The company's dividends are well-supported by earnings with a reasonable payout ratio of 60%. Despite recent operational changes, including board reshuffles and executive shifts, Provident continues to show commitment to shareholder returns through stable dividends and share repurchases totaling US$66.34 million since 2021. Trading at 39.3% below its estimated fair value suggests potential undervaluation relative to peers.

Summing It All Up

Access the full spectrum of 202 Top Dividend Stocks by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BSRR NasdaqGS:FNLC and NYSE:PFS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance